As global markets navigate geopolitical tensions and consumer spending concerns, small-cap stocks have been particularly impacted, with indices like the S&P 600 reflecting this volatility. Despite these challenges, the search for promising opportunities continues, as investors look for small-cap companies that demonstrate resilience and potential in a shifting economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Bonny Worldwide | 37.80% | 14.20% | 37.87% | ★★★★★★ |

| CHT Security | NA | 11.75% | 35.75% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| China Container Terminal | 49.96% | 2.83% | 22.37% | ★★★★☆☆ |

| Kinpo Electronics | 126.70% | 5.77% | 32.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Lontium Semiconductor (SHSE:688486)

Simply Wall St Value Rating: ★★★★★★

Overview: Lontium Semiconductor Corporation develops and markets semiconductor products globally, with a market cap of CN¥12.62 billion.

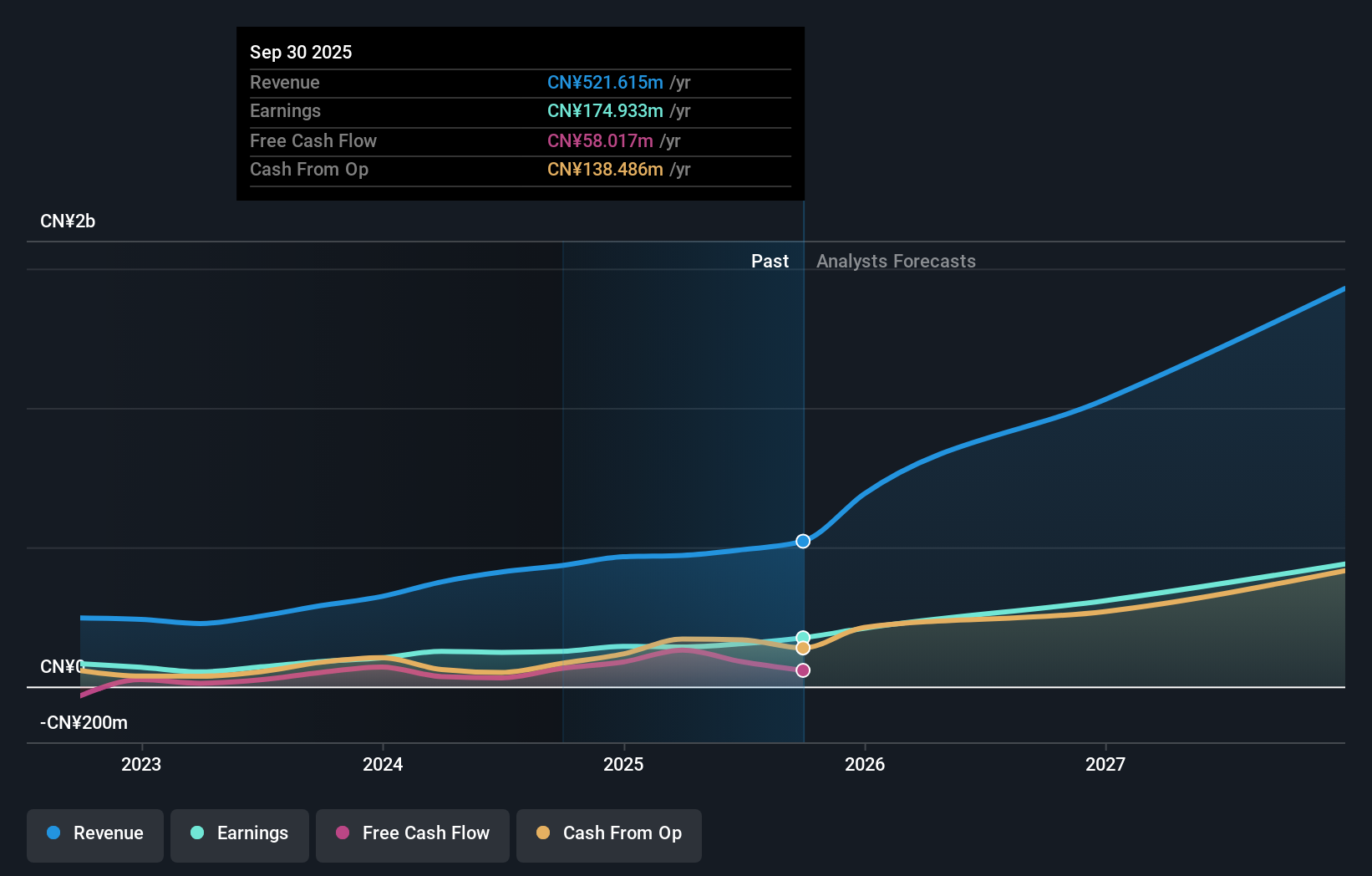

Operations: The company generates revenue primarily through the sale of semiconductor products. It has reported a net profit margin of 15.3%, indicating its profitability relative to total revenue.

Lontium Semiconductor, a nimble player in the semiconductor space, showcases impressive earnings growth of 40.6% over the past year, outpacing the industry’s 13.9%. This debt-free entity has maintained this status for five years, eliminating concerns about interest coverage. Despite its volatile share price recently, Lontium remains free cash flow positive with a notable US$65.67 million as of September 2024 and is forecasted to grow earnings by 39.75% annually. The upcoming shareholders meeting on December 20th might provide further insights into strategic directions and potential opportunities for investors to consider.

- Click to explore a detailed breakdown of our findings in Lontium Semiconductor's health report.

Gain insights into Lontium Semiconductor's past trends and performance with our Past report.

Shandong Dawn PolymerLtd (SZSE:002838)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shandong Dawn Polymer Co., Ltd. engages in the development, production, sale, and servicing of thermoplastic elastomers, modified plastics, master batches, and other products both in China and internationally with a market cap of CN¥6.30 billion.

Operations: Dawn Polymer's revenue is primarily derived from the sale of thermoplastic elastomers, modified plastics, and master batches. The company has a market cap of CN¥6.30 billion.

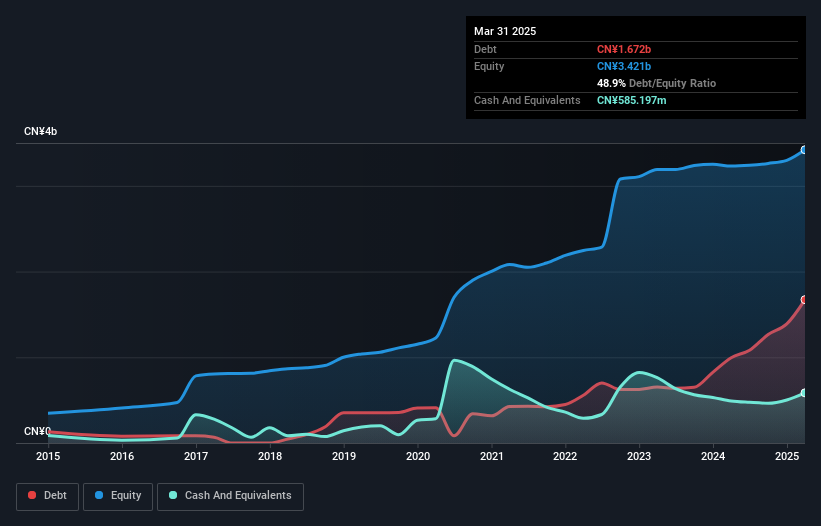

Shandong Dawn Polymer, a smaller player in the chemicals sector, has shown resilience with its earnings growing by 11% over the past year, outpacing the industry average. Despite this growth, its earnings have seen a 27.9% annual decline over five years. The company's interest payments are well-covered by EBIT at 5.6 times coverage, indicating solid financial management. Its net debt to equity ratio stands at a satisfactory 24.6%, though it has risen from 32.1% to 38.8% in five years, suggesting increased leverage over time without compromising quality earnings or profitability concerns related to cash runway issues.

- Navigate through the intricacies of Shandong Dawn PolymerLtd with our comprehensive health report here.

Learn about Shandong Dawn PolymerLtd's historical performance.

Allis ElectricLtd (TWSE:1514)

Simply Wall St Value Rating: ★★★★★★

Overview: Allis Electric Co., Ltd. is engaged in the development, production, and sale of transformers, switching devices, and electronic products globally, with a market capitalization of NT$30.65 billion.

Operations: Allis Electric generates revenue primarily from its Switchboard Department and Electronics Sector, contributing NT$2.93 billion and NT$2.44 billion, respectively. The Construction Division also plays a significant role with NT$1.74 billion in revenue.

Allis Electric Ltd. stands out with robust earnings growth of 51.9% over the past year, significantly outpacing the electrical industry's 7.3%. The company’s debt to equity ratio has improved from 36.6% to a more favorable 33.4% over five years, indicating prudent financial management. With a net debt to equity ratio at a satisfactory 14.2%, Allis Electric seems well-positioned in terms of leverage, and its interest payments are comfortably covered by EBIT at nearly thirty times over, showcasing strong operational efficiency and high-quality earnings that could appeal to investors seeking stability in smaller companies within the sector.

- Click here and access our complete health analysis report to understand the dynamics of Allis ElectricLtd.

Understand Allis ElectricLtd's track record by examining our Past report.

Turning Ideas Into Actions

- Discover the full array of 4760 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002838

Shandong Dawn PolymerLtd

Develops, produces, sells, and services thermoplastic elastomer, modified plastic, master batch, and other products in China and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives