Guangdong Guanghua Sci-Tech Co., Ltd. (SZSE:002741) Soars 33% But It's A Story Of Risk Vs Reward

Despite an already strong run, Guangdong Guanghua Sci-Tech Co., Ltd. (SZSE:002741) shares have been powering on, with a gain of 33% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

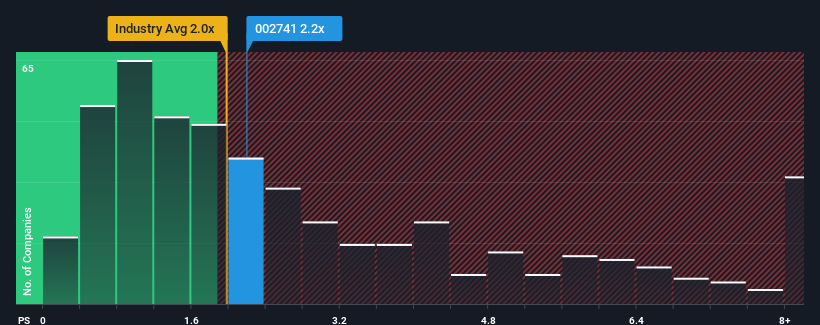

Even after such a large jump in price, there still wouldn't be many who think Guangdong Guanghua Sci-Tech's price-to-sales (or "P/S") ratio of 2.2x is worth a mention when the median P/S in China's Chemicals industry is similar at about 2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Guangdong Guanghua Sci-Tech

What Does Guangdong Guanghua Sci-Tech's P/S Mean For Shareholders?

Guangdong Guanghua Sci-Tech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Guanghua Sci-Tech.How Is Guangdong Guanghua Sci-Tech's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guangdong Guanghua Sci-Tech's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 15% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 59% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

In light of this, it's curious that Guangdong Guanghua Sci-Tech's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Guangdong Guanghua Sci-Tech's P/S Mean For Investors?

Guangdong Guanghua Sci-Tech appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Guangdong Guanghua Sci-Tech's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Guangdong Guanghua Sci-Tech (1 shouldn't be ignored!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002741

Guangdong Guanghua Sci-Tech

Produces and sells electronic chemicals, chemical reagents, and new energy materials in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives