Hainan Airlines Holding (SHSE:600221) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hainan Airlines Holding (SHSE:600221). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Hainan Airlines Holding

How Fast Is Hainan Airlines Holding Growing Its Earnings Per Share?

Hainan Airlines Holding has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In previous twelve months, Hainan Airlines Holding's EPS has risen from CN¥0.036 to CN¥0.037. That's a fair increase of 4.0%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Hainan Airlines Holding's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. The good news is that Hainan Airlines Holding is growing revenues, and EBIT margins improved by 2.1 percentage points to 4.9%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

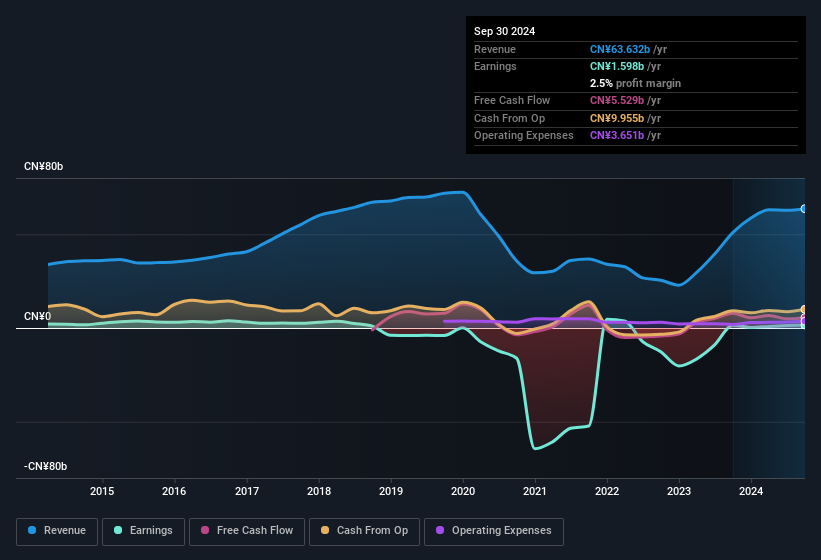

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Hainan Airlines Holding Insiders Aligned With All Shareholders?

Since Hainan Airlines Holding has a market capitalisation of CN¥73b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. With a whopping CN¥559m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Does Hainan Airlines Holding Deserve A Spot On Your Watchlist?

As previously touched on, Hainan Airlines Holding is a growing business, which is encouraging. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. The combination definitely favoured by investors so consider keeping the company on a watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Hainan Airlines Holding you should be aware of, and 1 of them makes us a bit uncomfortable.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Airlines Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600221

Hainan Airlines Holding

Provides passenger and cargo air transportation services in the People’s Republic of China and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives