As global markets navigate a landscape marked by easing U.S. inflation and robust banking sector earnings, major indices have experienced a notable rebound, with value stocks outpacing growth shares due to energy sector strength and profit-taking in large-cap technology stocks. Amidst these conditions, identifying growth companies with substantial insider ownership can be particularly appealing for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 35.8% | 110.9% |

Let's explore several standout options from the results in the screener.

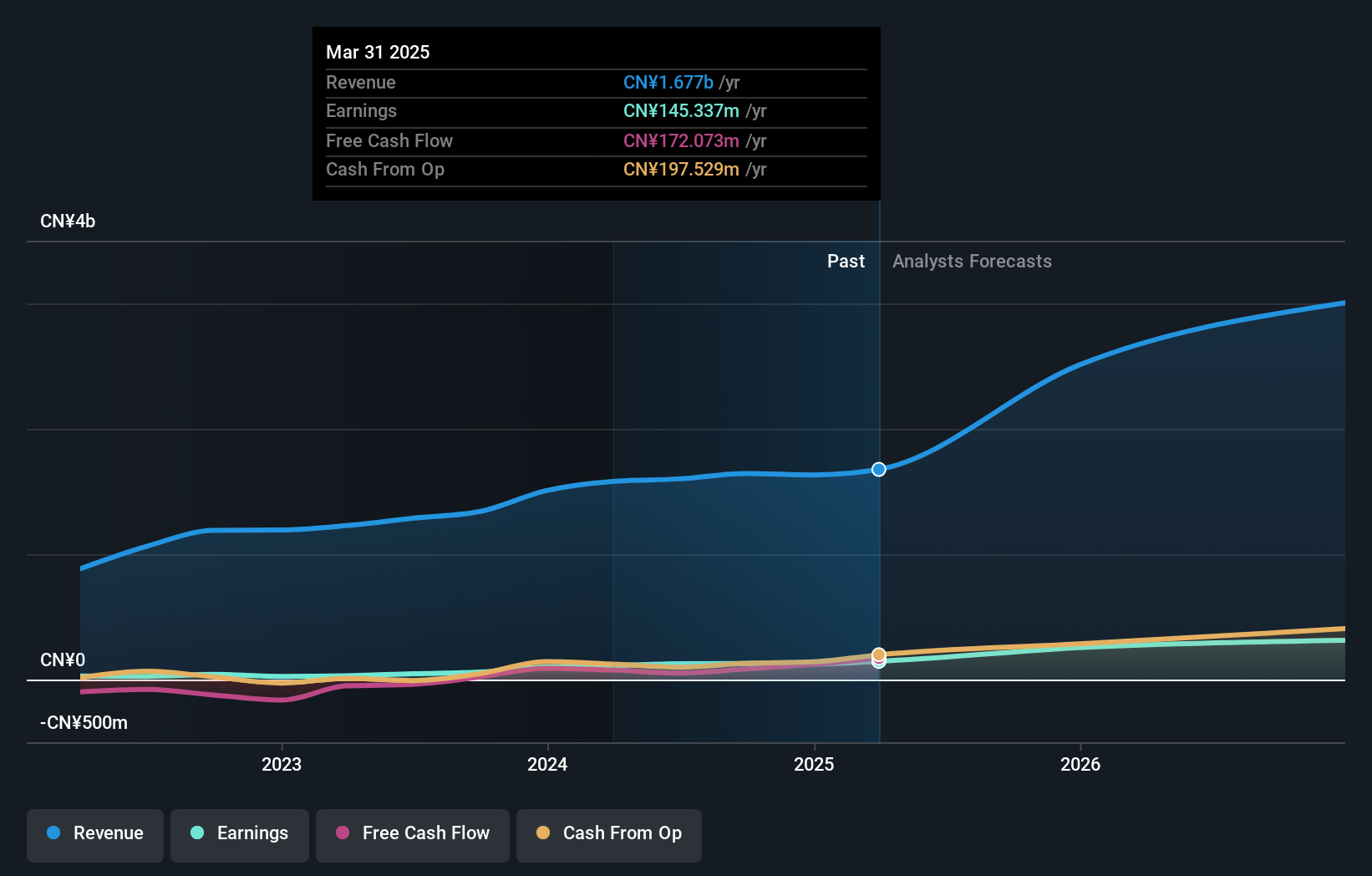

Shenzhen King Explorer Science and Technology (SZSE:002917)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen King Explorer Science and Technology Corporation specializes in researching, designing, developing, manufacturing, and selling intelligent equipment systems for civil explosive production and blasting service companies both in China and internationally, with a market cap of CN¥6.65 billion.

Operations: The company generates revenue through the provision of advanced equipment systems tailored for civil explosive production and blasting services, catering to both domestic and international markets.

Insider Ownership: 33.9%

Shenzhen King Explorer Science and Technology shows promising growth potential, with earnings forecasted to grow significantly at 38.6% annually, outpacing the Chinese market average. Revenue is also expected to rise by 25.1% per year. The company reported substantial profit growth of 117.1% over the past year, with net income reaching CNY 107.67 million for the nine months ending September 2024. Recent buyback activities completed a repurchase of shares worth CNY 25.01 million under its announced plan.

- Click to explore a detailed breakdown of our findings in Shenzhen King Explorer Science and Technology's earnings growth report.

- In light of our recent valuation report, it seems possible that Shenzhen King Explorer Science and Technology is trading beyond its estimated value.

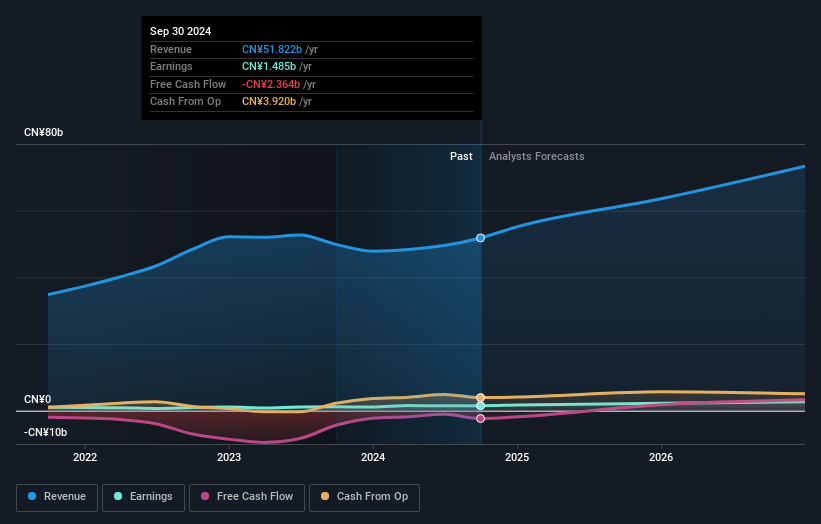

Sunwoda ElectronicLtd (SZSE:300207)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunwoda Electronic Co., Ltd focuses on the research and development, design, production, and sale of lithium-ion battery modules with a market cap of CN¥40.27 billion.

Operations: Sunwoda Electronic Co., Ltd generates revenue through the research, design, production, and sale of lithium-ion battery modules.

Insider Ownership: 29.1%

Sunwoda Electronic Ltd. demonstrates strong growth potential with earnings anticipated to increase significantly at 25.74% annually, surpassing the Chinese market's average growth rate. Recent financial results show a net income rise to CNY 1.21 billion for the nine months ending September 2024, up from CNY 803.67 million the previous year. The company completed a share buyback worth CNY 308.49 million, reflecting confidence in its valuation as it trades below estimated fair value by a substantial margin.

- Get an in-depth perspective on Sunwoda ElectronicLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our Sunwoda ElectronicLtd valuation report hints at an deflated share price compared to its estimated value.

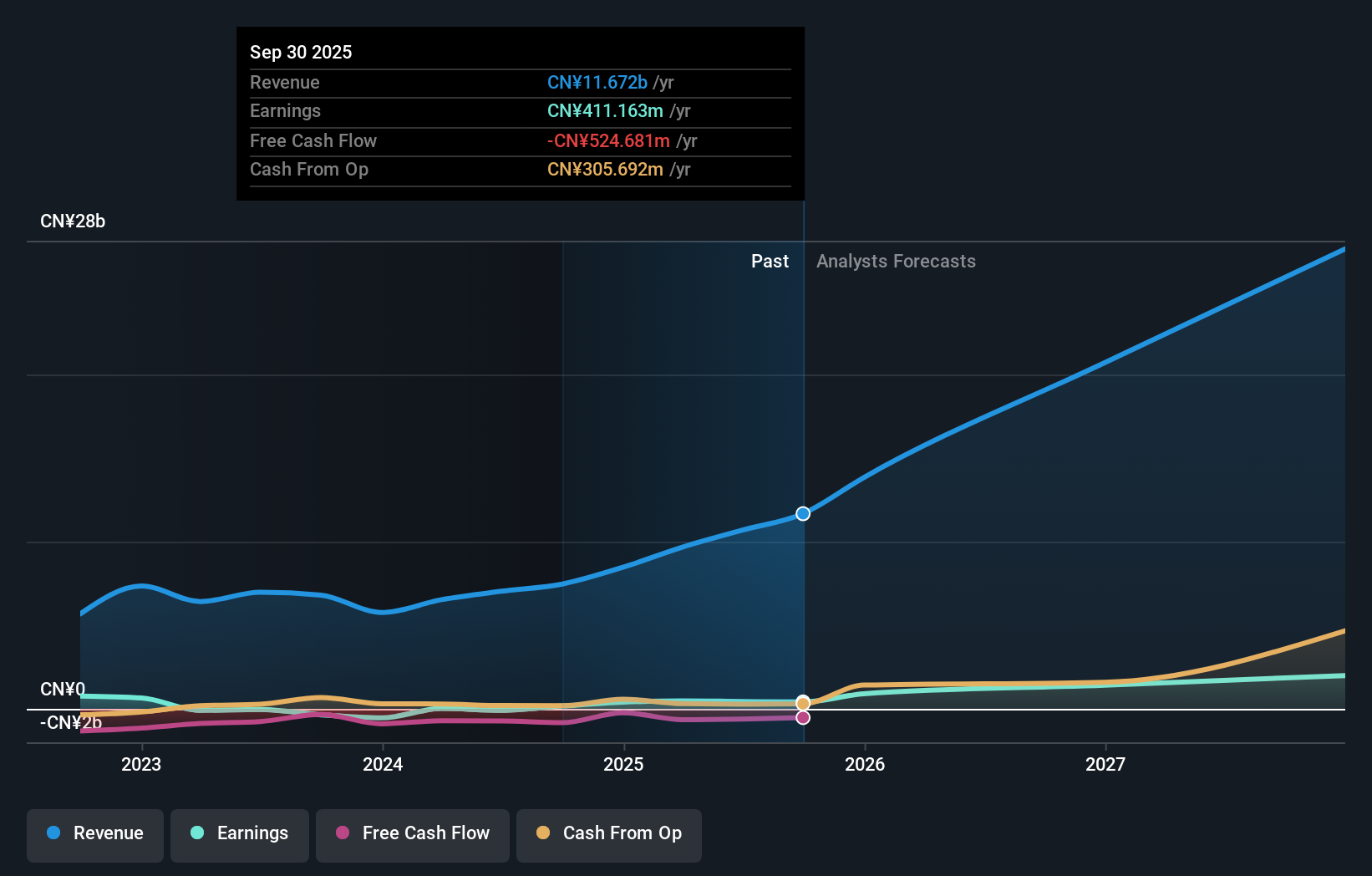

Fulin Precision (SZSE:300432)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fulin Precision Co., Ltd. focuses on the research, development, manufacture, and sale of automotive engine parts in China with a market cap of CN¥21.52 billion.

Operations: Fulin Precision's revenue primarily stems from its activities in the research, development, manufacturing, and sales of automotive engine components within China.

Insider Ownership: 13.6%

Fulin Precision has shown impressive financial recovery, reporting CNY 5.88 billion in revenue for the first nine months of 2024, up from CNY 4.18 billion the previous year, and turning a net loss into a profit of CNY 310.67 million. Earnings are forecast to grow significantly at 66.68% annually, outpacing the Chinese market's average growth rate. The company's insider ownership is high, though recent insider trading activity is unavailable for assessment.

- Click here and access our complete growth analysis report to understand the dynamics of Fulin Precision.

- According our valuation report, there's an indication that Fulin Precision's share price might be on the expensive side.

Key Takeaways

- Click this link to deep-dive into the 1466 companies within our Fast Growing Companies With High Insider Ownership screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002917

Shenzhen King Explorer Science and Technology

Researches, designs, develops, manufactures, and sells intelligent equipment systems to civil explosive production and blasting service companies in China and internationally.

High growth potential with solid track record.