- China

- /

- Semiconductors

- /

- SHSE:688325

Undiscovered Gems With Strong Fundamentals Top Picks For December 2024

Reviewed by Simply Wall St

In a week marked by record highs in major U.S. stock indexes, the Russell 2000 Index, which tracks small-cap stocks, experienced a decline following its recent outperformance against larger-cap peers. This mixed performance highlights the ongoing volatility and sector dispersion within global markets as investors navigate economic indicators like job growth and potential interest rate cuts. In this environment, identifying stocks with strong fundamentals becomes crucial for investors seeking stability and growth opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market capitalization of CN¥8.31 billion.

Operations: The primary revenue stream for EmbedWay Technologies comes from the Computer, Communication, and Other Electronic Equipment Manufacturing segment, generating CN¥1.15 billion.

EmbedWay Technologies, a nimble player in the communications sector, has shown robust growth with earnings jumping 96.7% over the past year and outpacing the industry average of -3%. The company's net debt to equity ratio stands at a satisfactory 5.3%, reflecting prudent financial management. Recent earnings for nine months ending September 2024 revealed sales of CNY 880.94 million, up from CNY 498.37 million last year, with net income rising to CNY 78.28 million from CNY 31.84 million previously reported. Additionally, its inclusion in the S&P Global BMI Index underscores its growing recognition in global markets.

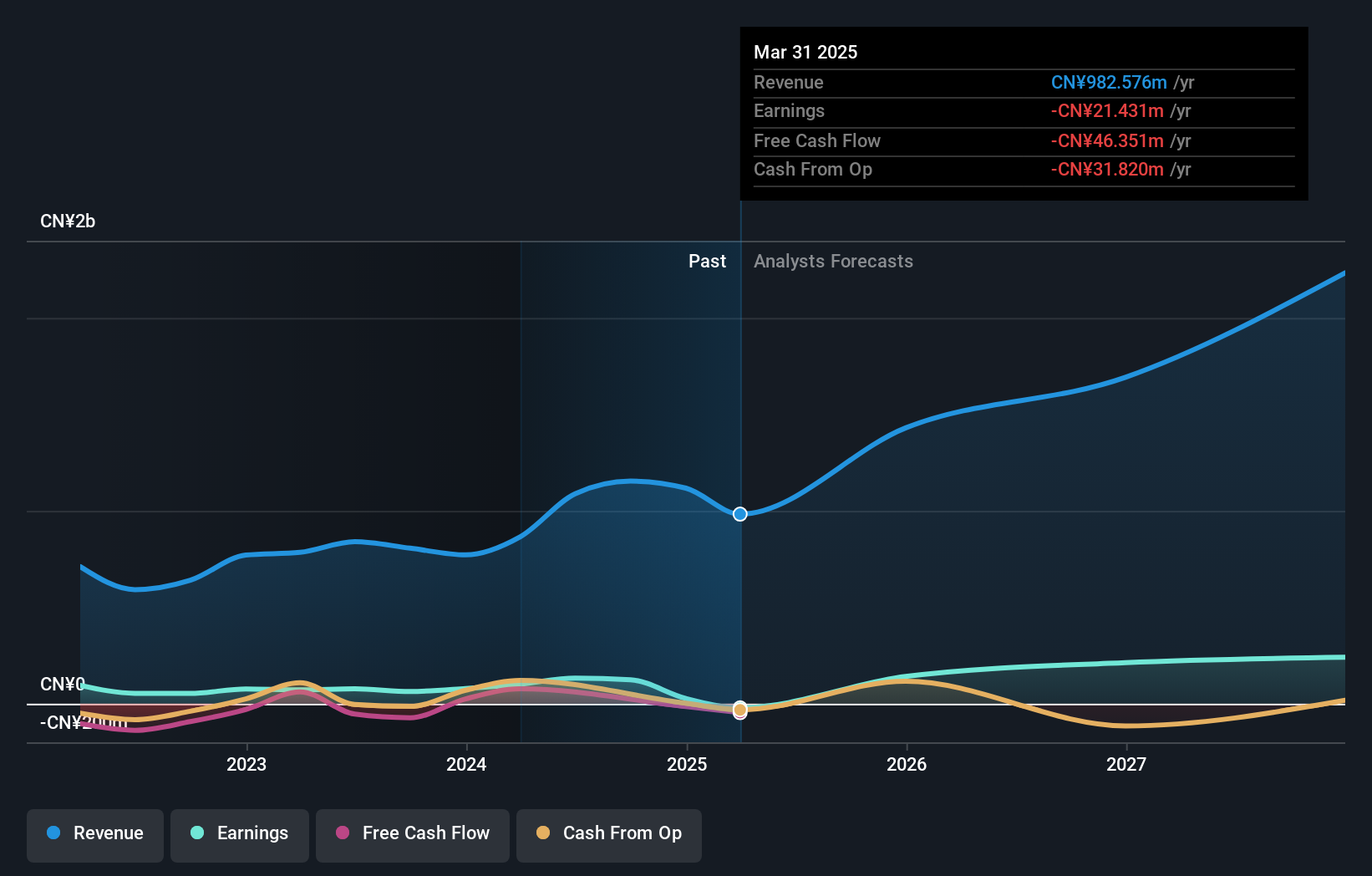

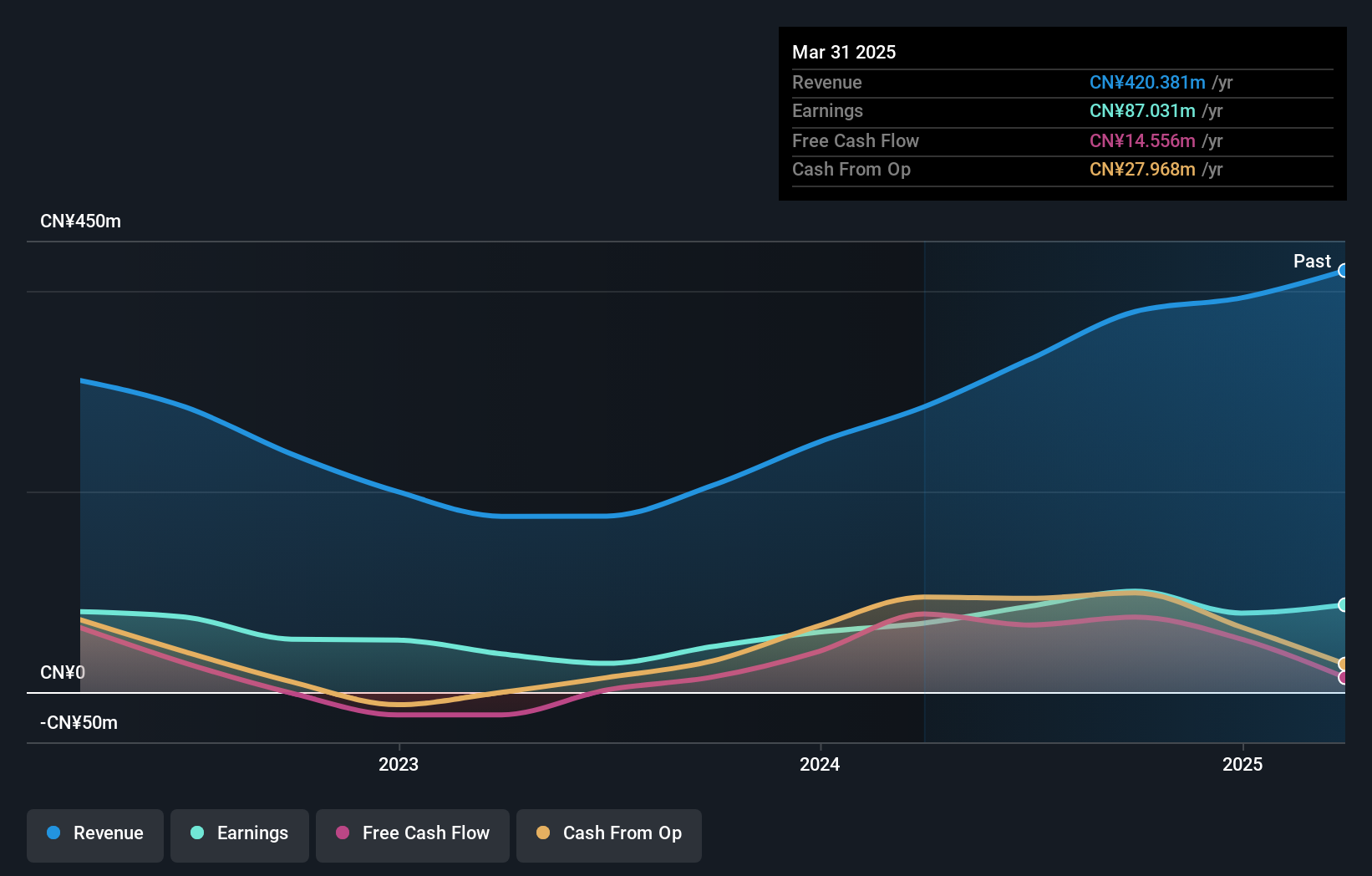

Guangdong Cellwise Microelectronics (SHSE:688325)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Cellwise Microelectronics Co., Ltd. specializes in the design and manufacturing of semiconductor products, with a market cap of CN¥4.31 billion.

Operations: Guangdong Cellwise Microelectronics generates revenue primarily from its semiconductor segment, amounting to CN¥379.37 million.

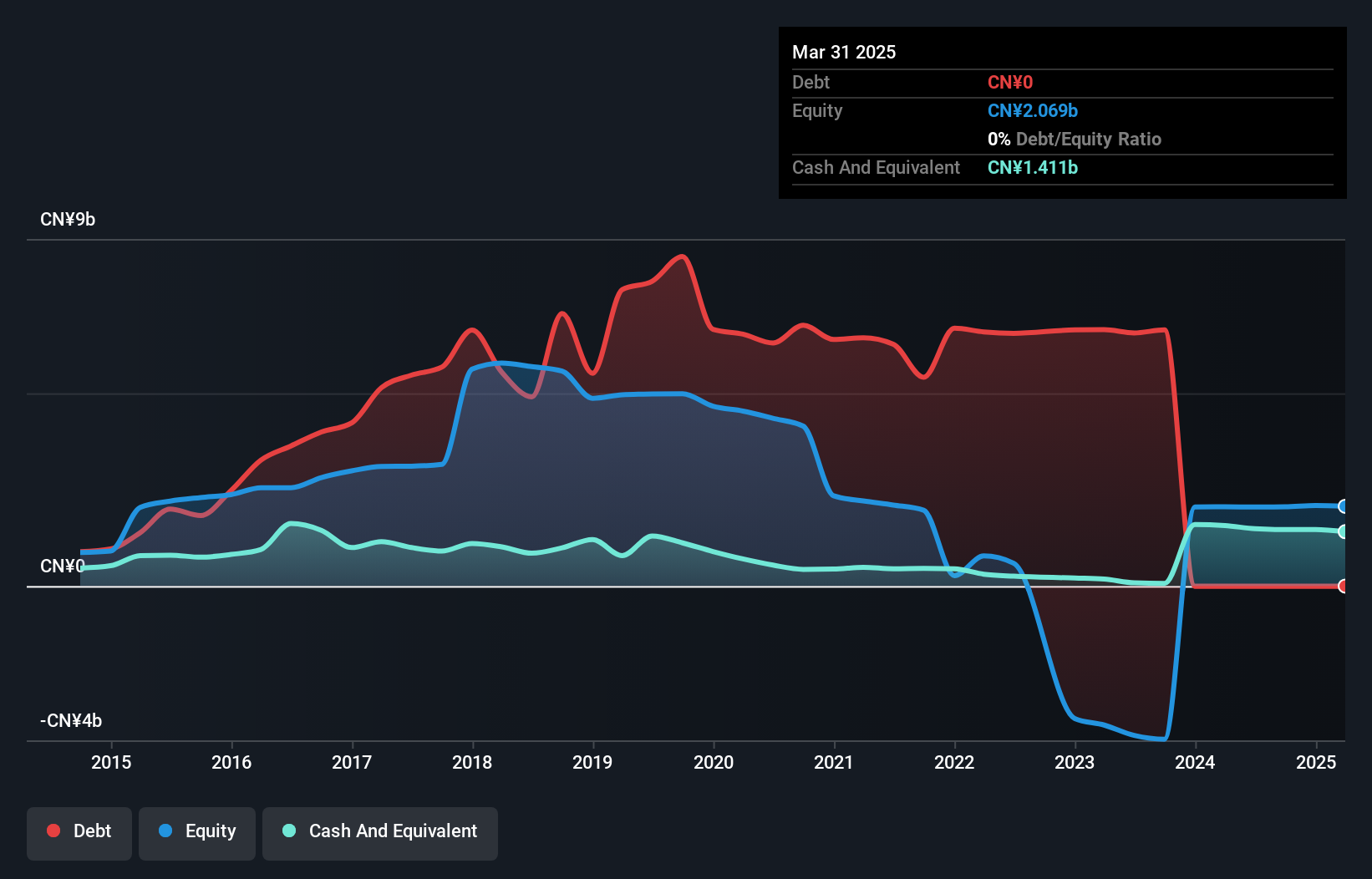

Guangdong Cellwise Microelectronics has shown impressive growth, with earnings climbing 122% over the past year, outpacing the semiconductor industry's 12.1%. The company reported sales of CNY 281.12 million for the first nine months of 2024, nearly doubling from CNY 151.06 million a year earlier. Net income also rose to CNY 60.06 million from CNY 19.11 million previously, reflecting high-quality earnings and strong operational performance. Despite a volatile share price recently, it trades at about 42.8% below estimated fair value and remains debt-free with no interest coverage concerns—highlighting its robust financial health and potential for continued success in its sector.

Beijing Kingee Culture Development (SZSE:002721)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Kingee Culture Development Co., Ltd. operates in the cultural and creative industry, focusing on the design, production, and sale of jewelry and related products, with a market cap of CN¥6.78 billion.

Operations: Kingee Culture's primary revenue streams are derived from the design, production, and sale of jewelry and related products. The company's net profit margin has shown variability over recent periods.

Kingee Culture Development has shown a notable turnaround, posting a net income of CNY 0.61 million for the nine months ending September 2024, compared to a hefty net loss of CNY 521.4 million the previous year. The company is now debt-free, having reduced its debt-to-equity ratio from 171% over five years ago to zero today. Despite sales dropping significantly from CNY 1.31 billion to CNY 276.78 million, Kingee's profitability this year suggests potential stability in its operations moving forward, especially with its price-to-earnings ratio at an attractive 5.7x against the broader CN market's average of 37.3x.

Make It Happen

- Explore the 4632 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688325

Guangdong Cellwise Microelectronics

Guangdong Cellwise Microelectronics Co., Ltd.

Flawless balance sheet with solid track record.