As global markets navigate a landscape of mixed economic signals and geopolitical developments, small-cap stocks have faced unique challenges with the Russell 2000 Index recently declining after outperforming its larger-cap counterparts. Amidst this backdrop, investors are increasingly on the lookout for undiscovered gems that can offer growth potential in sectors resilient to current market volatility. Identifying such opportunities often involves seeking companies with strong fundamentals and innovative strategies that align well with evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

CNSIG Inner Mongolia Chemical IndustryLtd (SHSE:600328)

Simply Wall St Value Rating: ★★★★★☆

Overview: CNSIG Inner Mongolia Chemical Industry Co., Ltd. operates in the chemical industry with a market cap of CN¥12.33 billion.

Operations: The company generates revenue primarily from its chemical products. It reported a net profit margin of 4.5%, reflecting its profitability after accounting for all expenses.

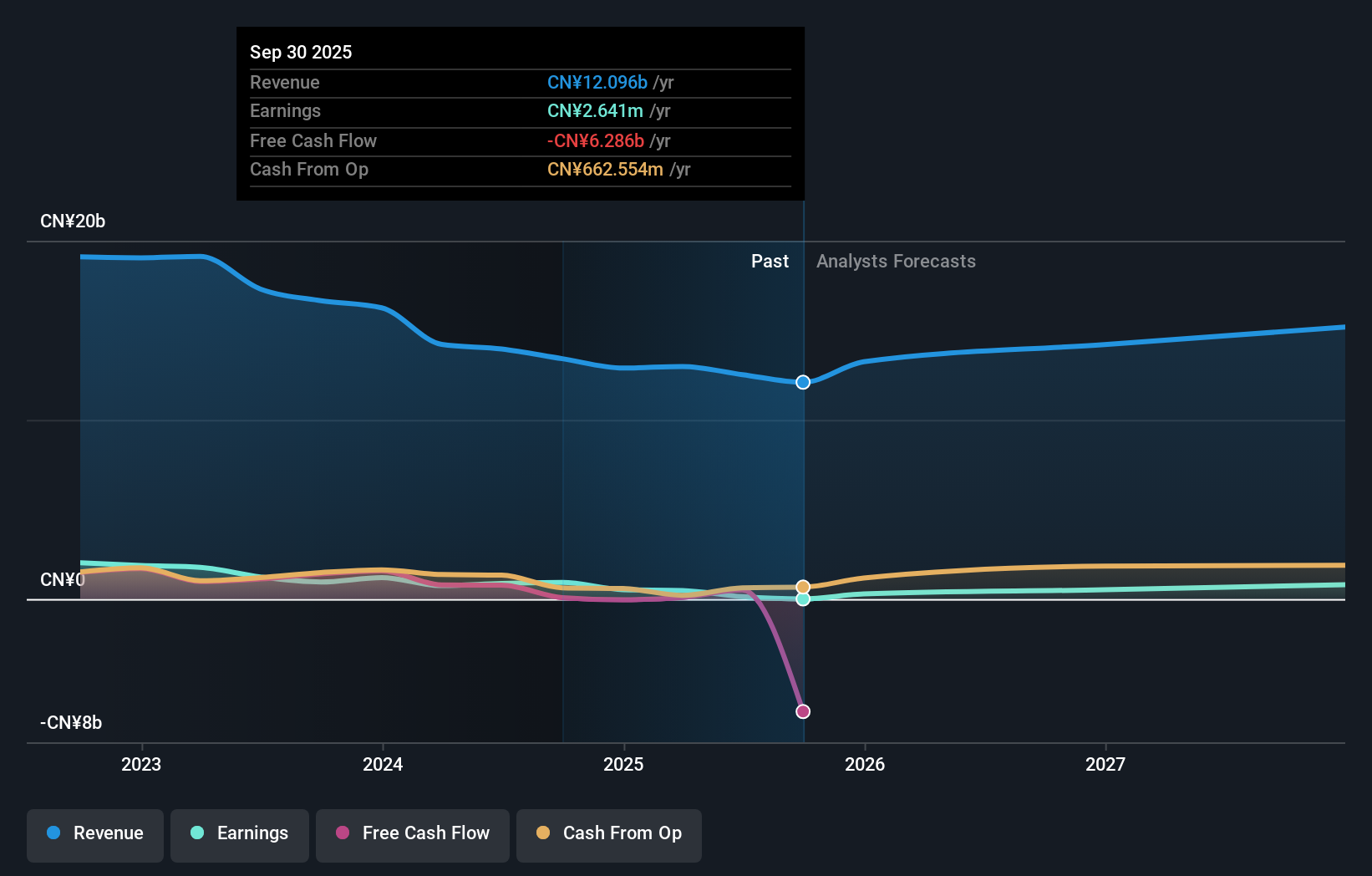

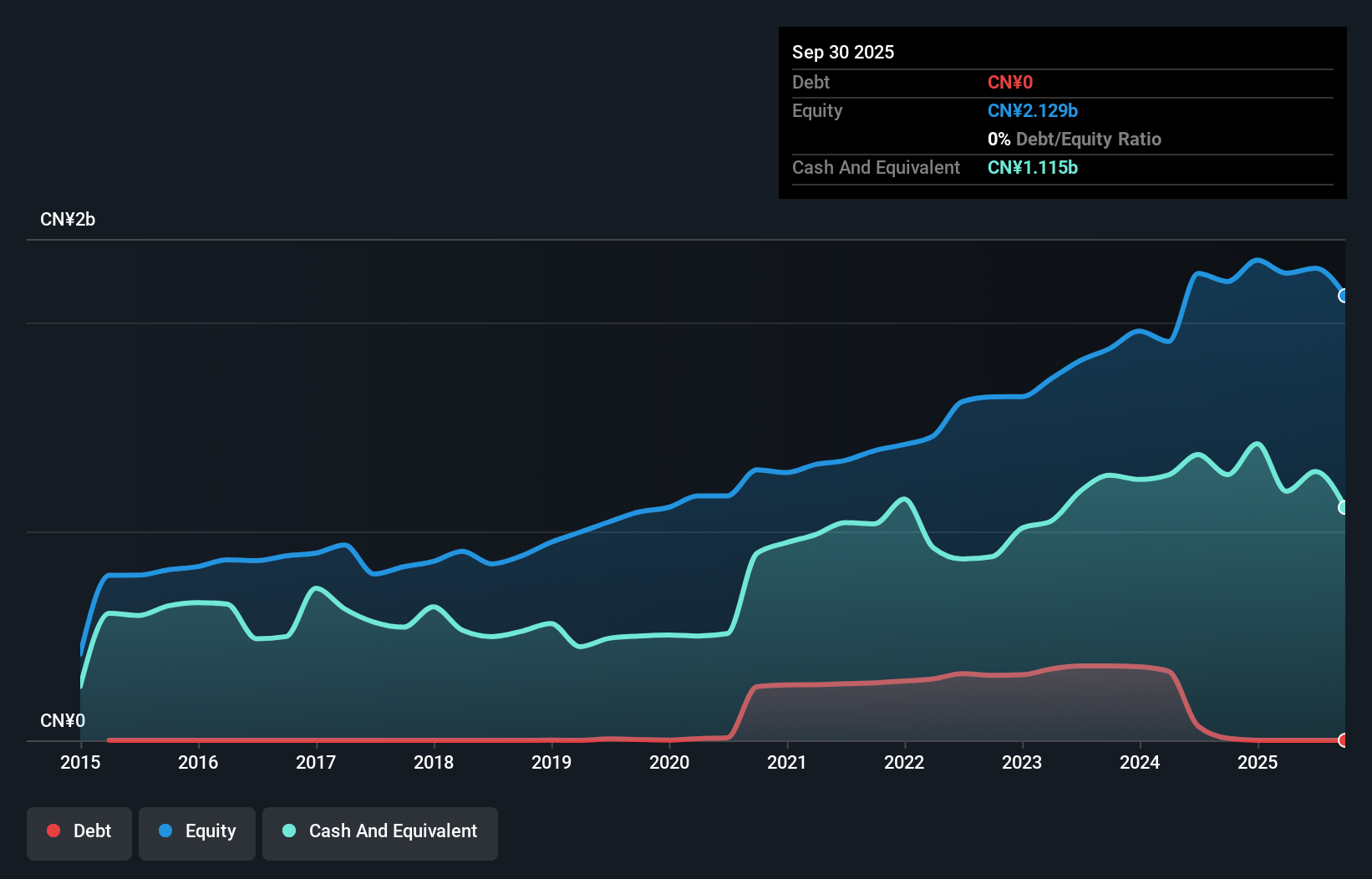

CNSIG Inner Mongolia Chemical Industry, a smaller player in the chemicals sector, presents an intriguing mix of financial metrics and challenges. Over five years, its debt to equity ratio impressively decreased from 53.4% to 6.3%, indicating strong financial management. Despite having more cash than total debt and covering interest payments with EBIT at 49.9x, earnings growth lagged at -7% compared to the industry average of -4.7%. Recent reports show net income dropped from CNY 840 million to CNY 574 million year-over-year, reflecting potential headwinds in revenue generation despite trading at a favorable P/E ratio of 14.1x against the market's 37.3x.

- Take a closer look at CNSIG Inner Mongolia Chemical IndustryLtd's potential here in our health report.

Understand CNSIG Inner Mongolia Chemical IndustryLtd's track record by examining our Past report.

Sichuan Guoguang Agrochemical (SZSE:002749)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sichuan Guoguang Agrochemical Co., Ltd. is involved in the research, development, manufacture, marketing, and distribution of agrochemical products and materials both in China and internationally, with a market cap of CN¥6.64 billion.

Operations: The company's primary revenue streams come from the sale of agrochemical products and materials both domestically and internationally. It is crucial to note that the financial data does not provide specific figures for revenue segments, making detailed analysis challenging.

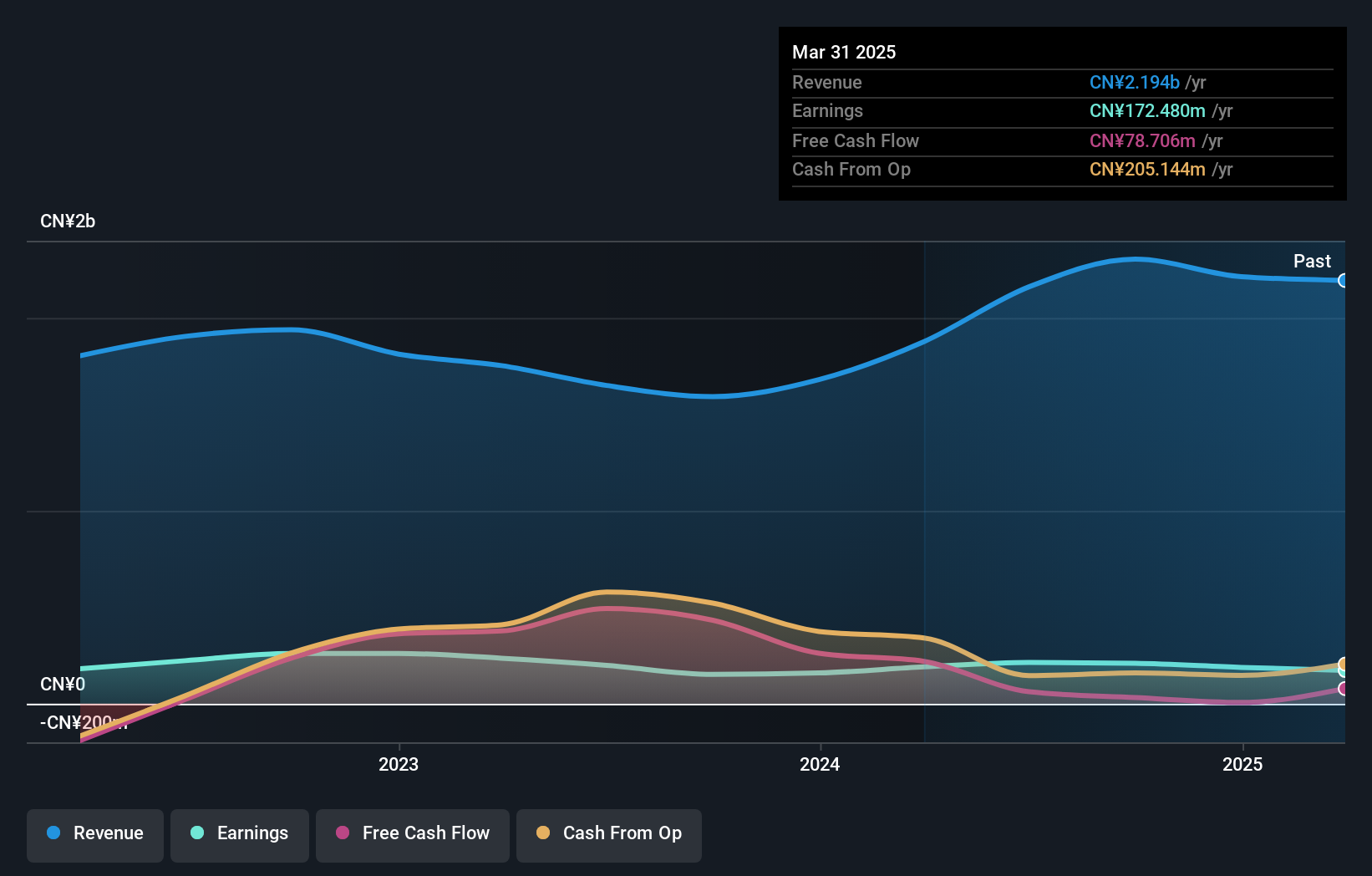

Sichuan Guoguang Agrochemical, a nimble player in the agrochemical sector, has demonstrated robust growth with earnings surging by 102% over the past year, outpacing its industry peers. The company's net income for the nine months ending September 2024 was CNY 270 million, an increase from CNY 223 million in the previous year. Trading at approximately 12.6% below its estimated fair value suggests it offers a good entry point relative to peers. With high-quality earnings and positive free cash flow of CNY 346.9 million as of June 2024, it seems well-positioned for continued financial health and potential growth within its market niche.

TES Touch Embedded Solutions (Xiamen) (SZSE:003019)

Simply Wall St Value Rating: ★★★★★☆

Overview: TES Touch Embedded Solutions (Xiamen) Co., Ltd. is a JDM/ODM company that focuses on the research, development, design, manufacture, and sale of touchscreen products both in Taiwan and internationally, with a market capitalization of CN¥4.41 billion.

Operations: TES Touch Embedded Solutions generates revenue primarily from the Computer, Communications, and Other Electronic Equipment Manufacturing segment, amounting to CN¥1.96 billion. The company's financial performance is influenced by its role in the JDM/ODM market for touchscreen products.

TES Touch Embedded Solutions (Xiamen) has shown promising growth, with earnings climbing 50.2% over the past year, outpacing the electronic industry's average of 1.9%. The company reported sales of CNY 1.87 billion for the first nine months of 2024, a notable increase from CNY 1.24 billion in the previous year. Net income also rose to CNY 163.13 million from CNY 113.19 million a year ago, reflecting its robust performance and high-quality earnings profile. Despite an increased debt-to-equity ratio from 9.4% to 24.8% over five years, TES maintains more cash than total debt, suggesting financial stability and potential for future growth amidst industry challenges.

Where To Now?

- Get an in-depth perspective on all 4631 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002749

Sichuan Guoguang Agrochemical

Engages in the research and development, manufacture, marketing, and distribution of agrochemical products and materials in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives