TKD Science And TechnologyLtd Alongside 2 Promising Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

In a week marked by record highs for major indices like the S&P 500 and Nasdaq Composite, small-cap stocks, as represented by the Russell 2000 Index, faced a decline following previous outperformance. This divergence highlights the importance of identifying small-cap companies with robust fundamentals that can withstand broader market fluctuations. In this context, uncovering undiscovered gems such as TKD Science And Technology Ltd and other promising small caps becomes crucial for investors seeking stability and potential growth amidst mixed economic signals.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

TKD Science and TechnologyLtd (SHSE:603738)

Simply Wall St Value Rating: ★★★★★★

Overview: TKD Science and Technology Co., Ltd. focuses on the research, development, production, and sale of quartz frequency control components and production equipment primarily in China, with a market cap of CN¥6.30 billion.

Operations: The company generates revenue through the sale of quartz frequency control components and production equipment. It has exhibited a net profit margin trend that is noteworthy for its fluctuations over time.

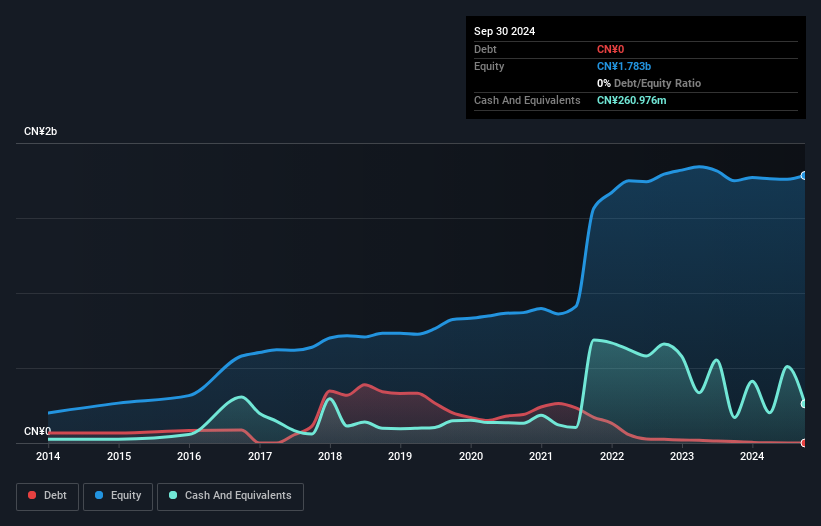

TKD Science and Technology Ltd. stands out with its debt-free status, a significant change from five years ago when its debt to equity ratio was 24.4%. The company's earnings surged by 30% over the past year, outpacing the electrical industry average of 1%. Despite not being free cash flow positive, TKD's profitability ensures that cash runway isn't a concern. A notable one-off gain of CN¥44 million impacted recent financial results, adding complexity to its earnings quality. Recent announcements include plans for a share repurchase program worth up to CN¥100 million, aimed at reducing registered capital.

- Unlock comprehensive insights into our analysis of TKD Science and TechnologyLtd stock in this health report.

Learn about TKD Science and TechnologyLtd's historical performance.

Aoshikang Technology (SZSE:002913)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aoshikang Technology Co., Ltd. focuses on the research, development, production, and sale of printed circuit boards with a market capitalization of CN¥7.86 billion.

Operations: Aoshikang Technology generates revenue primarily from its printed circuit board segment, amounting to CN¥4.41 billion.

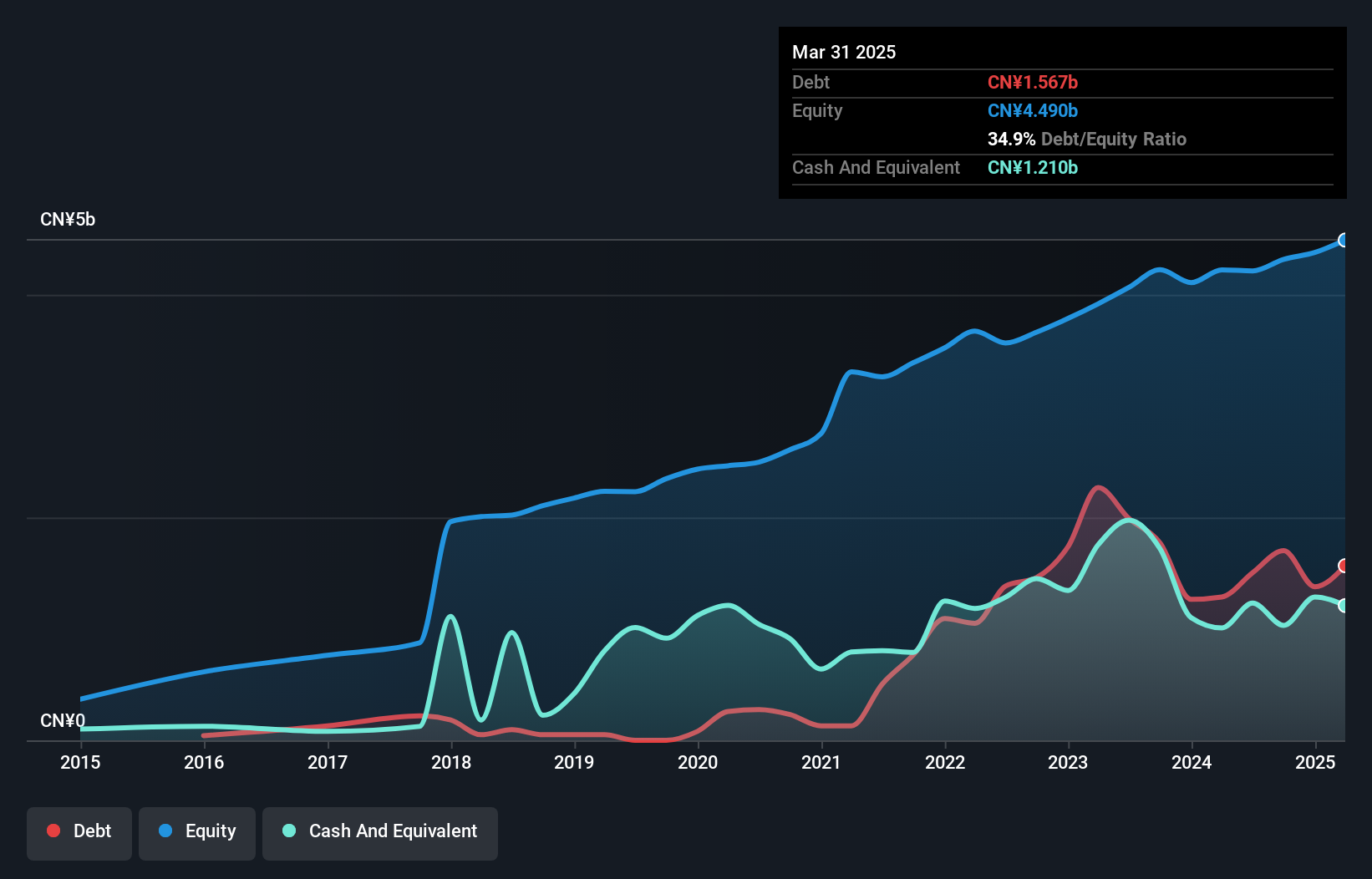

Aoshikang Technology seems to be an intriguing player in the electronics sector, with its earnings growth of 7% over the past year outpacing the industry's 2%. Trading at a significant discount of 61% below estimated fair value, it presents a compelling valuation. Despite an increased debt to equity ratio from 0% to 39% over five years, its net debt to equity remains satisfactory at around 16%. The company's ability to cover interest payments is robust, with EBIT covering interest expenses by over 441 times. Recent board changes and amendments in company bylaws could signal strategic shifts ahead.

Beijing Strong BiotechnologiesInc (SZSE:300406)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Strong Biotechnologies, Inc. engages in the provision of in-vitro diagnostics products and services both within China and internationally, with a market capitalization of CN¥8.63 billion.

Operations: The company's primary revenue stream is from its Biomedicine segment, generating CN¥1.75 billion.

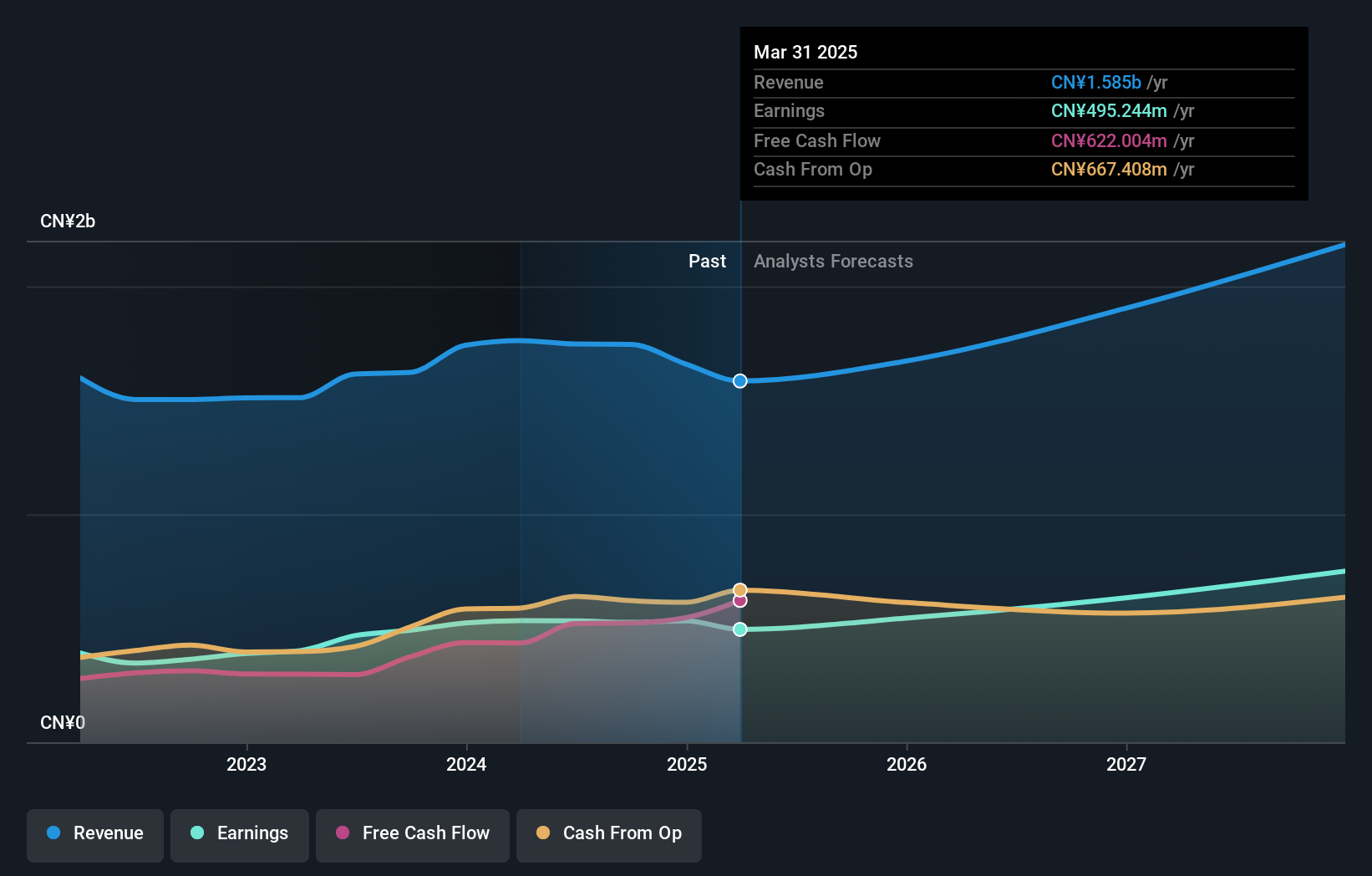

Beijing Strong Biotechnologies, Inc. showcases promising traits as a smaller player in the biotech sector. The company reported CNY 1,237 million in sales for the first nine months of 2024, slightly up from CNY 1,234 million the previous year. Their net income rose to CNY 373 million from CNY 371 million year-on-year. Despite this modest growth, they trade at a notable discount of nearly half their estimated fair value. With high-quality earnings and satisfactory debt levels (net debt to equity ratio at 4.3%), Beijing Strong seems well-positioned for future expansion with an impressive EBIT interest coverage of 28 times.

Next Steps

- Access the full spectrum of 4631 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Strong BiotechnologiesInc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300406

Beijing Strong BiotechnologiesInc

Provides in-vitro diagnostics products and services in the People’s Republic of China and internationally.

Undervalued with excellent balance sheet and pays a dividend.