- China

- /

- Infrastructure

- /

- SHSE:601518

Three Top Dividend Stocks For Reliable Income

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances across major indices and geopolitical developments, investors are keenly observing the shifting dynamics between growth and value stocks. Amidst this backdrop, dividend stocks stand out as potential sources of reliable income, offering stability through regular payouts even when market conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

Click here to see the full list of 1929 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong manufactures and sells pharmaceutical raw materials, food, and feed additives under the Star Lake and Yue Bao brand names in China and internationally, with a market cap of CN¥11.53 billion.

Operations: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong generates revenue through the production and distribution of pharmaceutical raw materials, as well as food and feed additives, under its Star Lake and Yue Bao brands both domestically in China and internationally.

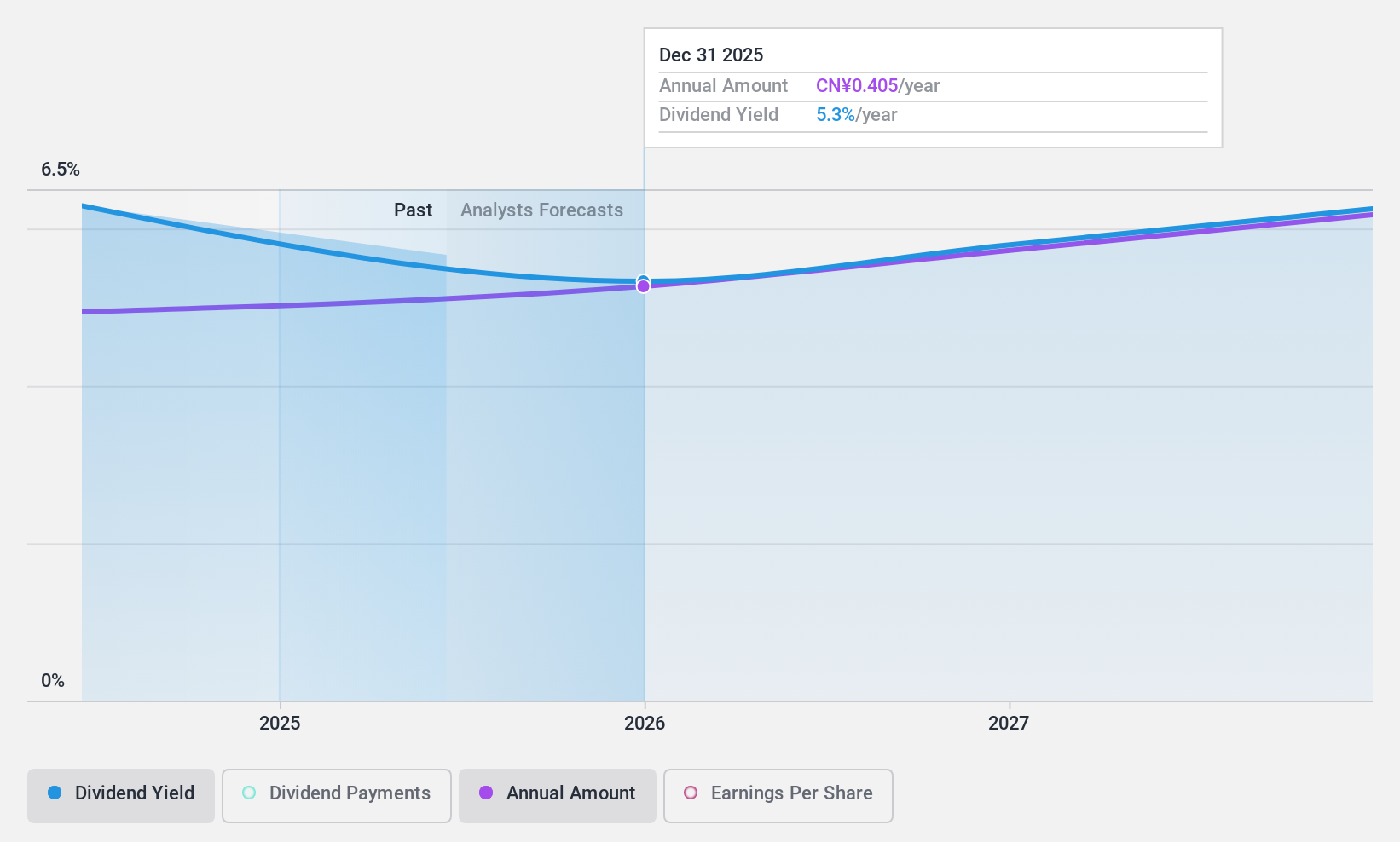

Dividend Yield: 5.3%

Star Lake Bioscience's dividend yield of 5.29% places it in the top 25% of CN market payers, though it's too early to assess stability or growth as dividends have just begun. The payout is sustainable, with a cash payout ratio of 38.3% and earnings coverage at 72.9%. Trading at good value relative to peers and industry, its recent earnings report shows net income growth from CNY 489.4 million to CNY 677.22 million over nine months, supporting dividend sustainability.

- Unlock comprehensive insights into our analysis of Star Lake BioscienceZhaoqing Guangdong stock in this dividend report.

- In light of our recent valuation report, it seems possible that Star Lake BioscienceZhaoqing Guangdong is trading behind its estimated value.

Jilin Expressway (SHSE:601518)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jilin Expressway Co., Ltd. operates in the investment, development, construction, operation, management, and maintenance of toll roads in Jilin Province with a market cap of CN¥5.35 billion.

Operations: Jilin Expressway Co., Ltd. generates revenue primarily from the investment, development, construction, operation, management, and maintenance of toll roads within Jilin Province.

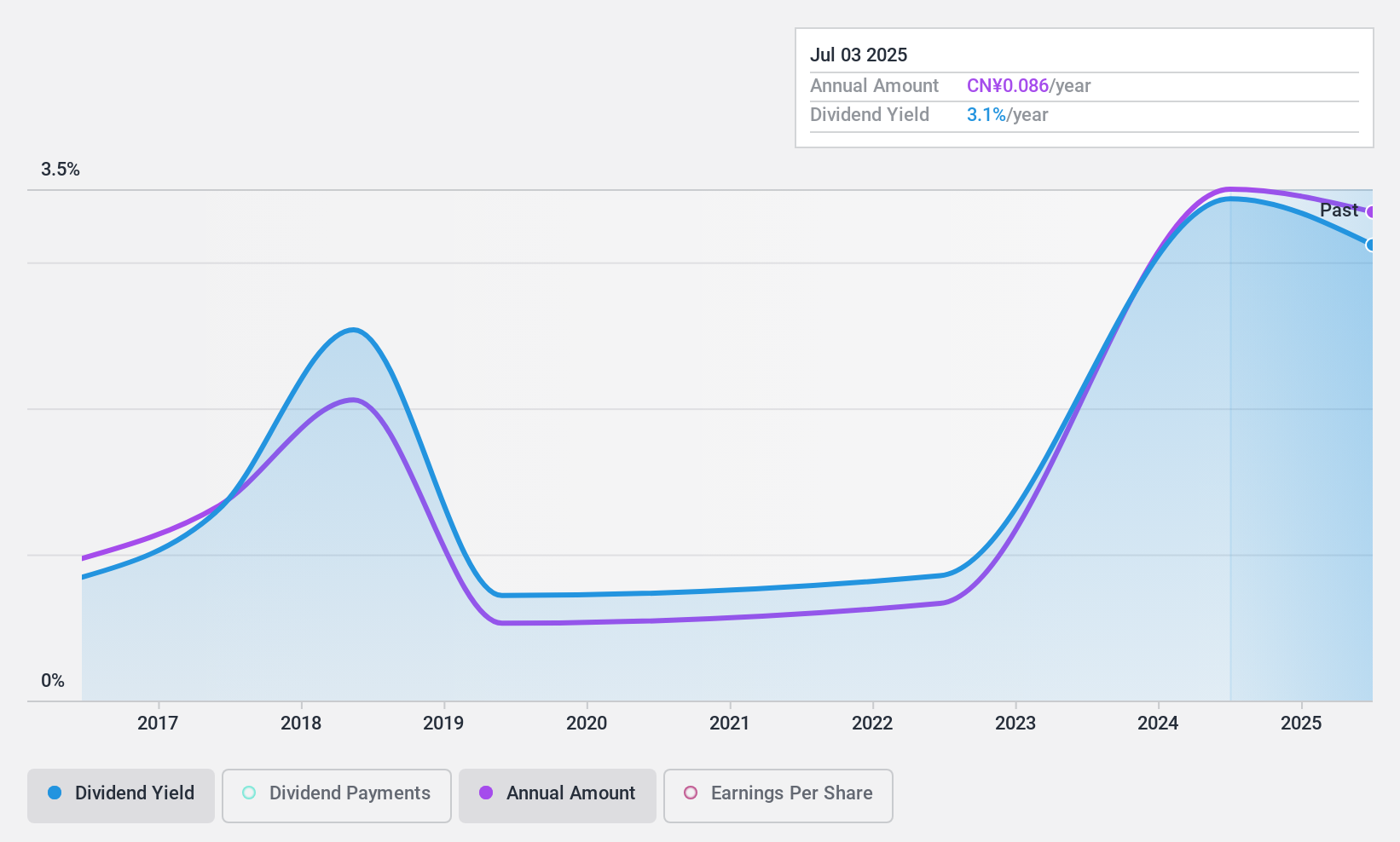

Dividend Yield: 3.1%

Jilin Expressway's dividend yield of 3.08% ranks in the top 25% of CN market payers, supported by a low payout ratio of 31%, indicating sustainability. Despite earnings growth of 16.5% over the past year, its dividend history is marked by volatility and unreliability over the past decade, with annual drops exceeding 20%. Trading at a significant discount to fair value, dividends remain well-covered by both earnings and cash flows, with a cash payout ratio of 29.5%.

- Dive into the specifics of Jilin Expressway here with our thorough dividend report.

- Our valuation report here indicates Jilin Expressway may be undervalued.

Anjoy Foods Group (SHSE:603345)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anjoy Foods Group Co., Ltd. focuses on the research, development, production, and sale of quick-frozen hot pot, noodle rice, and dish products with a market cap of CN¥25.18 billion.

Operations: Anjoy Foods Group Co., Ltd. generates revenue from its food processing segment, amounting to CN¥14.85 billion.

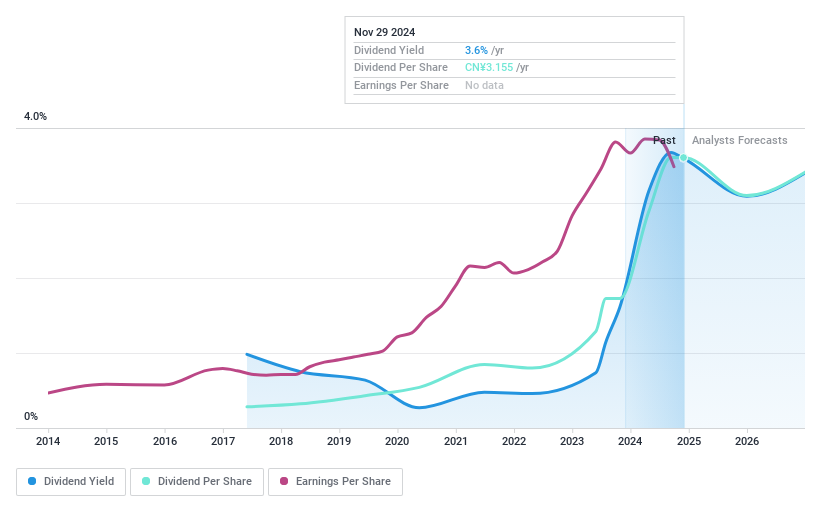

Dividend Yield: 3.5%

Anjoy Foods Group's dividend yield of 3.52% places it in the top 25% of CN market payers, with dividends reliably covered by earnings and cash flows, given payout ratios of 65.9% and 83.2%, respectively. Despite a decline in net income to CNY 1.05 billion for the nine months ended September 2024, sales increased to CNY 11.08 billion from the previous year, supporting its stable yet relatively short dividend history of eight years.

- Take a closer look at Anjoy Foods Group's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Anjoy Foods Group is priced lower than what may be justified by its financials.

Taking Advantage

- Navigate through the entire inventory of 1929 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Jilin Expressway, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601518

Jilin Expressway

Through its subsidiaries, invests in, develops, constructs, operates, manages, and maintains toll roads in the Jilin Province, China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives