As global markets navigate a week marked by busy earnings reports and mixed economic signals, investors are closely watching for opportunities amid the volatility. With major indices like the S&P 500 and Nasdaq Composite experiencing fluctuations, dividend stocks continue to attract attention as potential sources of steady income in uncertain times. In this environment, selecting dividend stocks with strong fundamentals and reliable payout histories can provide a measure of stability and income generation for investors seeking to weather market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.82% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.16% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

Click here to see the full list of 1991 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

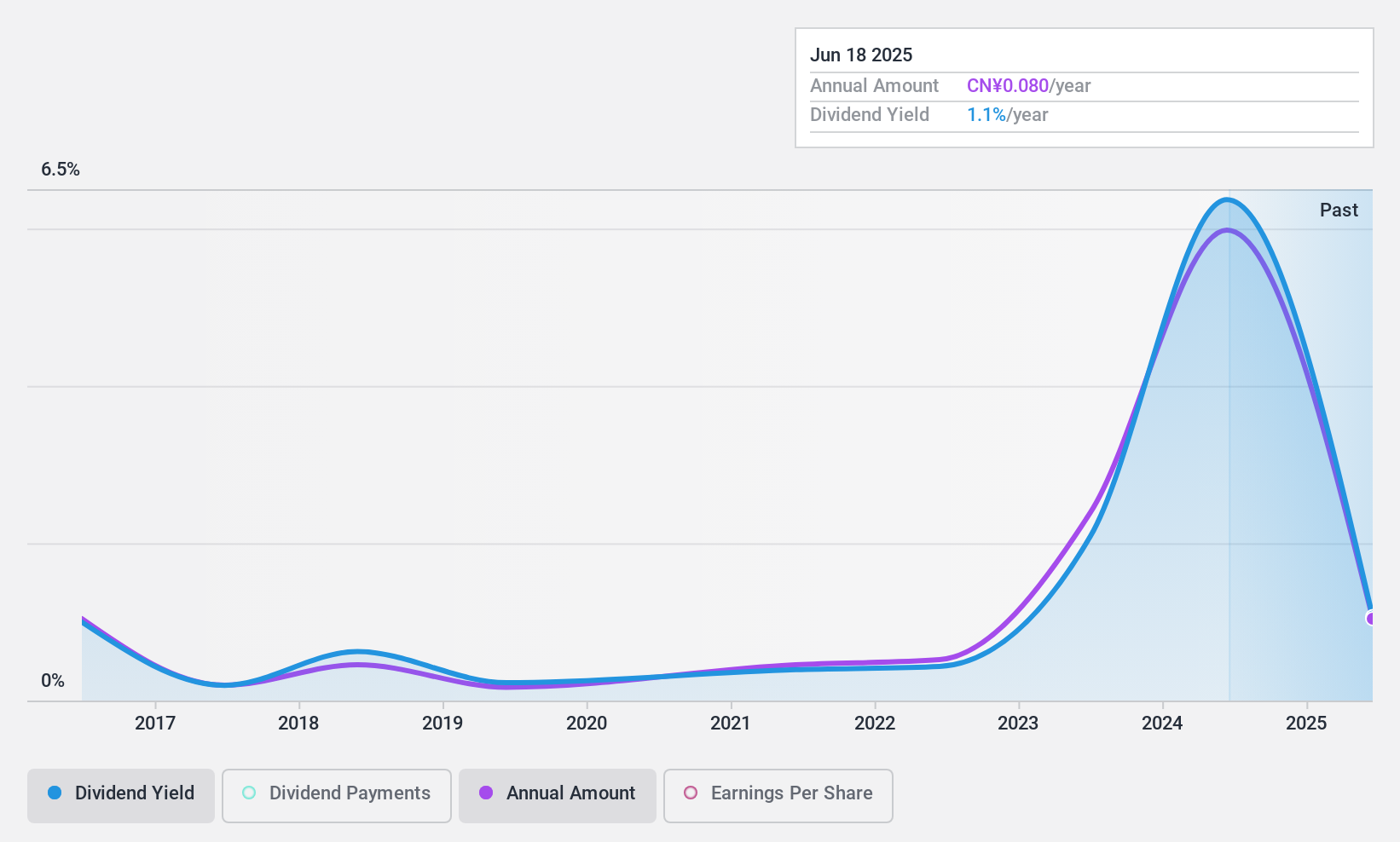

Xinjiang GuannongLtd (SHSE:600251)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang Guannong Co., Ltd. processes and sells agricultural products in China, with a market cap of CN¥5.93 billion.

Operations: Xinjiang Guannong Co., Ltd. generates its revenue primarily through the processing and sale of agricultural products in China.

Dividend Yield: 6%

Xinjiang Guannong Ltd. offers a dividend yield of 6.03%, ranking in the top 25% of CN market payers, yet its sustainability is questionable due to a high cash payout ratio of 577.1%. The company's dividends have been volatile, with unreliable growth over the past decade. Despite trading at 33.9% below estimated fair value, recent earnings show declining net income and profit margins, raising concerns about long-term dividend stability and coverage by free cash flows.

- Navigate through the intricacies of Xinjiang GuannongLtd with our comprehensive dividend report here.

- Our valuation report here indicates Xinjiang GuannongLtd may be undervalued.

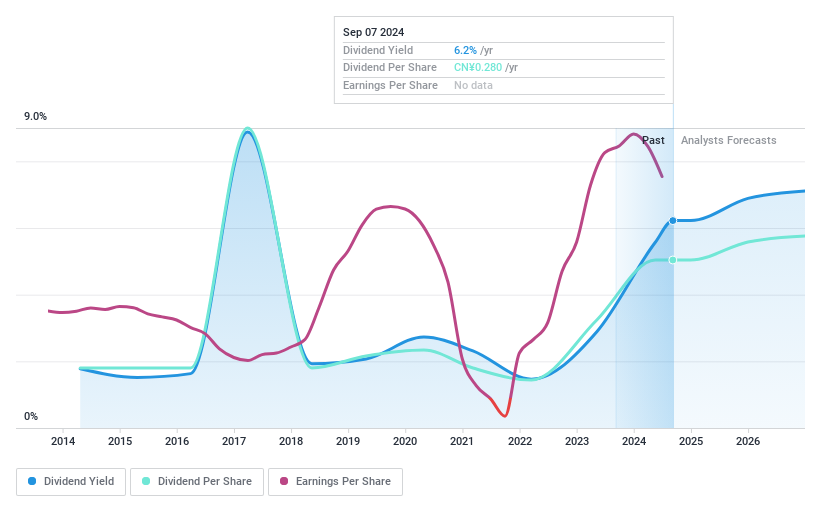

Jiangsu Changbao SteeltubeLtd (SZSE:002478)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Changbao Steeltube Co., Ltd manufactures and sells steel tubes both domestically in the People’s Republic of China and internationally, with a market cap of CN¥4.77 billion.

Operations: The company's revenue primarily comes from the production and sales of seamless steel pipes, amounting to CN¥5.77 billion.

Dividend Yield: 5.3%

Jiangsu Changbao Steeltube Ltd. offers a dividend yield of 5.26%, placing it in the top 25% of CN market payers, but its sustainability is challenged by a high cash payout ratio of 252.6%. Despite earnings being well-covered by a low payout ratio of 43.7%, dividends have been volatile over the past decade. Recent earnings show declining revenue and net income, with sales at CNY 4.22 billion for nine months ending September 2024, impacting long-term dividend reliability.

- Unlock comprehensive insights into our analysis of Jiangsu Changbao SteeltubeLtd stock in this dividend report.

- In light of our recent valuation report, it seems possible that Jiangsu Changbao SteeltubeLtd is trading behind its estimated value.

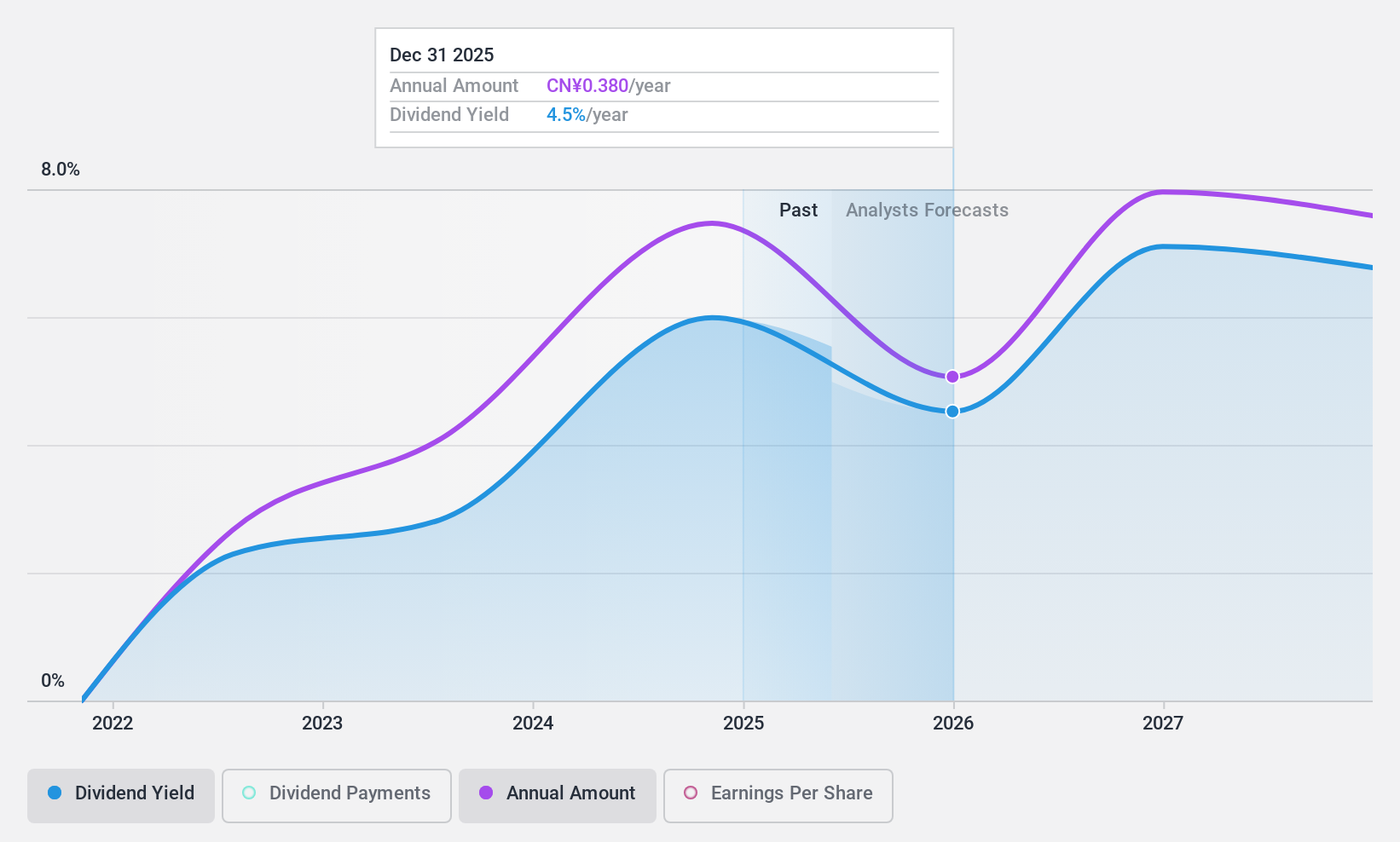

CIMC Vehicles (Group) (SZSE:301039)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Vehicles (Group) Co., Ltd. is engaged in the design, development, production, and sale of specialty vehicles, semi-trailers, spare parts, and related technical services in China with a market cap of CN¥20.02 billion.

Operations: CIMC Vehicles (Group) Co., Ltd. generates revenue through its operations in specialty vehicles, semi-trailers, spare parts, and related technical services within China.

Dividend Yield: 5.2%

CIMC Vehicles (Group) offers a dividend yield of 5.24%, ranking in the top 25% of CN market payers, supported by a payout ratio of 54.1%. However, its dividends have been volatile and unreliable over two years. Recent financials reveal declining revenue and net income, with sales at CNY 15.82 billion for nine months ending September 2024, impacting earnings coverage despite reasonable cash flow support with a cash payout ratio of 69.8%.

- Delve into the full analysis dividend report here for a deeper understanding of CIMC Vehicles (Group).

- The analysis detailed in our CIMC Vehicles (Group) valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Delve into our full catalog of 1991 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301039

CIMC Vehicles (Group)

Designs, develops, produces, and sells specialty vehicles, semi-trailers, spare parts, and related technical services in China.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives