Longxing Chemical Stock Co., Ltd.'s (SZSE:002442) Prospects Need A Boost To Lift Shares

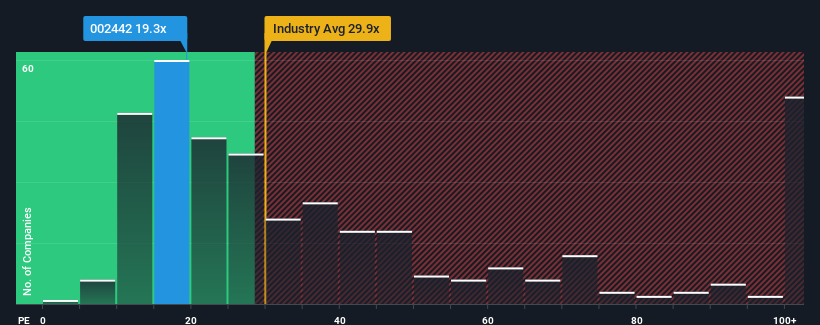

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider Longxing Chemical Stock Co., Ltd. (SZSE:002442) as an attractive investment with its 19.3x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Longxing Chemical Stock recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Longxing Chemical Stock

Is There Any Growth For Longxing Chemical Stock?

There's an inherent assumption that a company should underperform the market for P/E ratios like Longxing Chemical Stock's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 13%. Still, lamentably EPS has fallen 44% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 36% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Longxing Chemical Stock is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Longxing Chemical Stock's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Longxing Chemical Stock maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Longxing Chemical Stock is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002442

Longxing Technology Group

Produces and sells carbon black products under the Longxing brand in China.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives