- China

- /

- Metals and Mining

- /

- SZSE:002379

Optimistic Investors Push Shandong Hontron Aluminum Industry Holding Company Limited (SZSE:002379) Shares Up 27% But Growth Is Lacking

Shandong Hontron Aluminum Industry Holding Company Limited (SZSE:002379) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 51%.

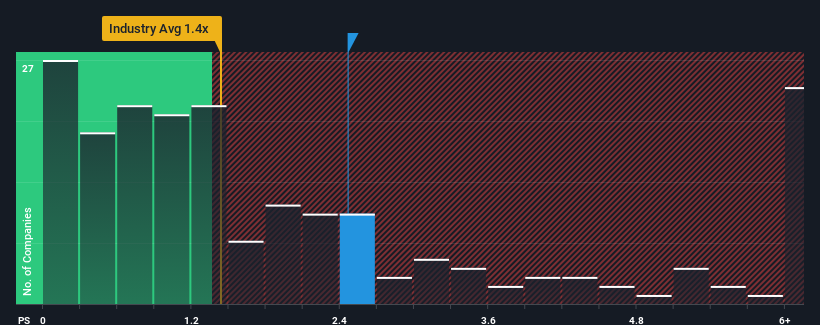

Since its price has surged higher, given close to half the companies operating in China's Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Shandong Hontron Aluminum Industry Holding as a stock to potentially avoid with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Shandong Hontron Aluminum Industry Holding

How Has Shandong Hontron Aluminum Industry Holding Performed Recently?

For example, consider that Shandong Hontron Aluminum Industry Holding's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Shandong Hontron Aluminum Industry Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Shandong Hontron Aluminum Industry Holding's Revenue Growth Trending?

Shandong Hontron Aluminum Industry Holding's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 14% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 16% shows it's noticeably less attractive.

With this in mind, we find it worrying that Shandong Hontron Aluminum Industry Holding's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Shandong Hontron Aluminum Industry Holding's P/S?

The large bounce in Shandong Hontron Aluminum Industry Holding's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Shandong Hontron Aluminum Industry Holding currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

You should always think about risks. Case in point, we've spotted 2 warning signs for Shandong Hontron Aluminum Industry Holding you should be aware of, and 1 of them is a bit unpleasant.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Shandong Hontron Aluminum Industry Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002379

Shandong Hontron Aluminum Industry Holding

Manufactures and sells aluminum products in China and internationally.

Excellent balance sheet minimal.

Market Insights

Community Narratives