As global markets navigate geopolitical tensions and economic uncertainties, Asian indices have shown mixed performance, with China's tech sector experiencing a notable boost amid supportive government signals. In such a climate, dividend stocks can offer investors potential stability and income, making them an attractive option for those seeking to balance risk with returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.88% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.14% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.28% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1135 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

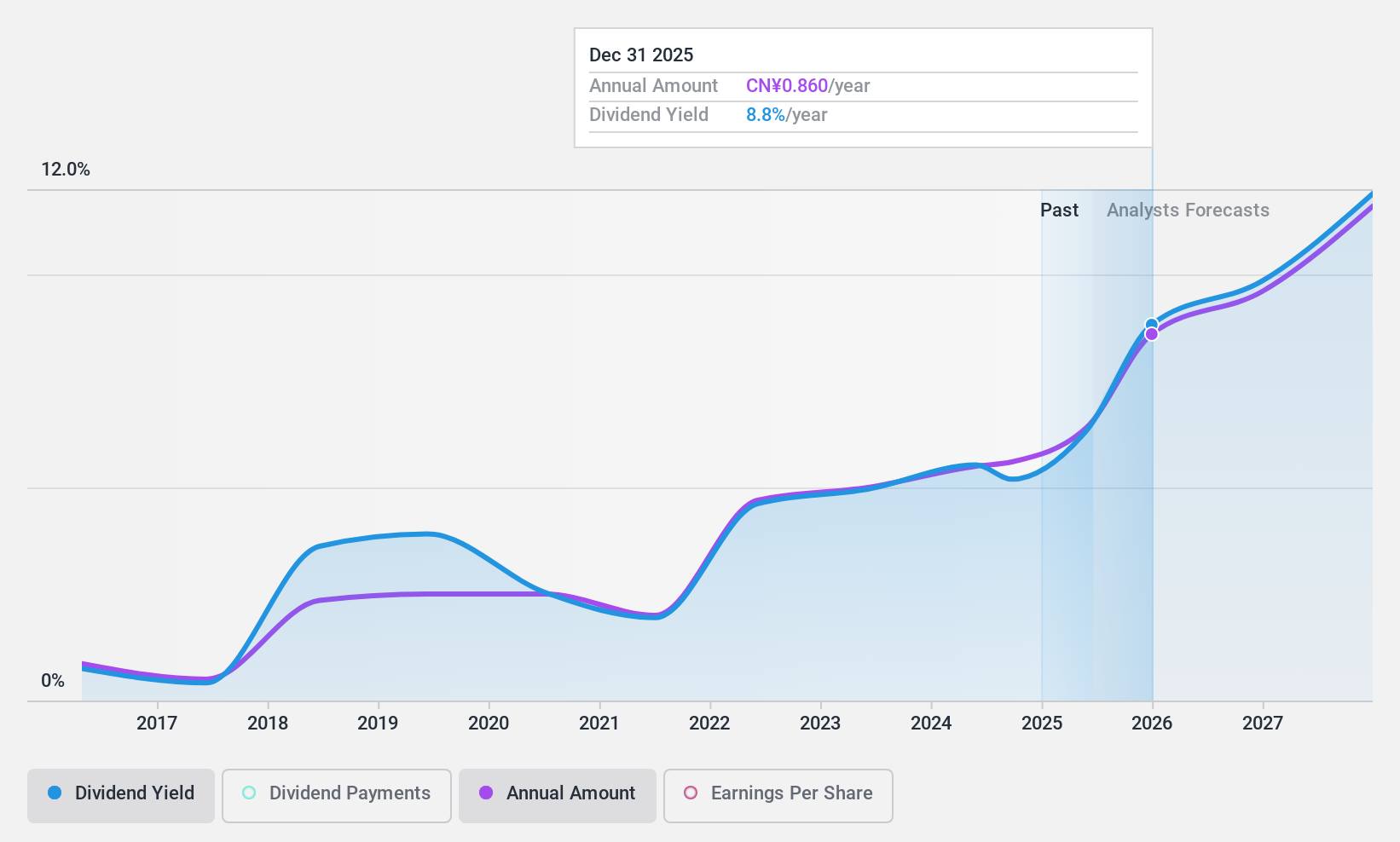

DeHua TB New Decoration MaterialLtd (SZSE:002043)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DeHua TB New Decoration Material Co., Ltd specializes in the production and sale of environmentally friendly furniture panels both in China and internationally, with a market cap of CN¥9.22 billion.

Operations: DeHua TB New Decoration Material Co., Ltd generates its revenue primarily through the production and sale of eco-friendly furniture panels.

Dividend Yield: 5%

DeHua TB New Decoration Material Ltd. reported CNY 9.20 billion in sales for 2024, with net income dropping to CNY 588.27 million from the previous year. Its dividend yield of 4.99% ranks in the top quarter of CN market payers but is not well covered by earnings due to a high payout ratio of 93.3%. While cash flow coverage is adequate, past dividend volatility and recent earnings decline suggest caution for income-focused investors.

- Dive into the specifics of DeHua TB New Decoration MaterialLtd here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of DeHua TB New Decoration MaterialLtd shares in the market.

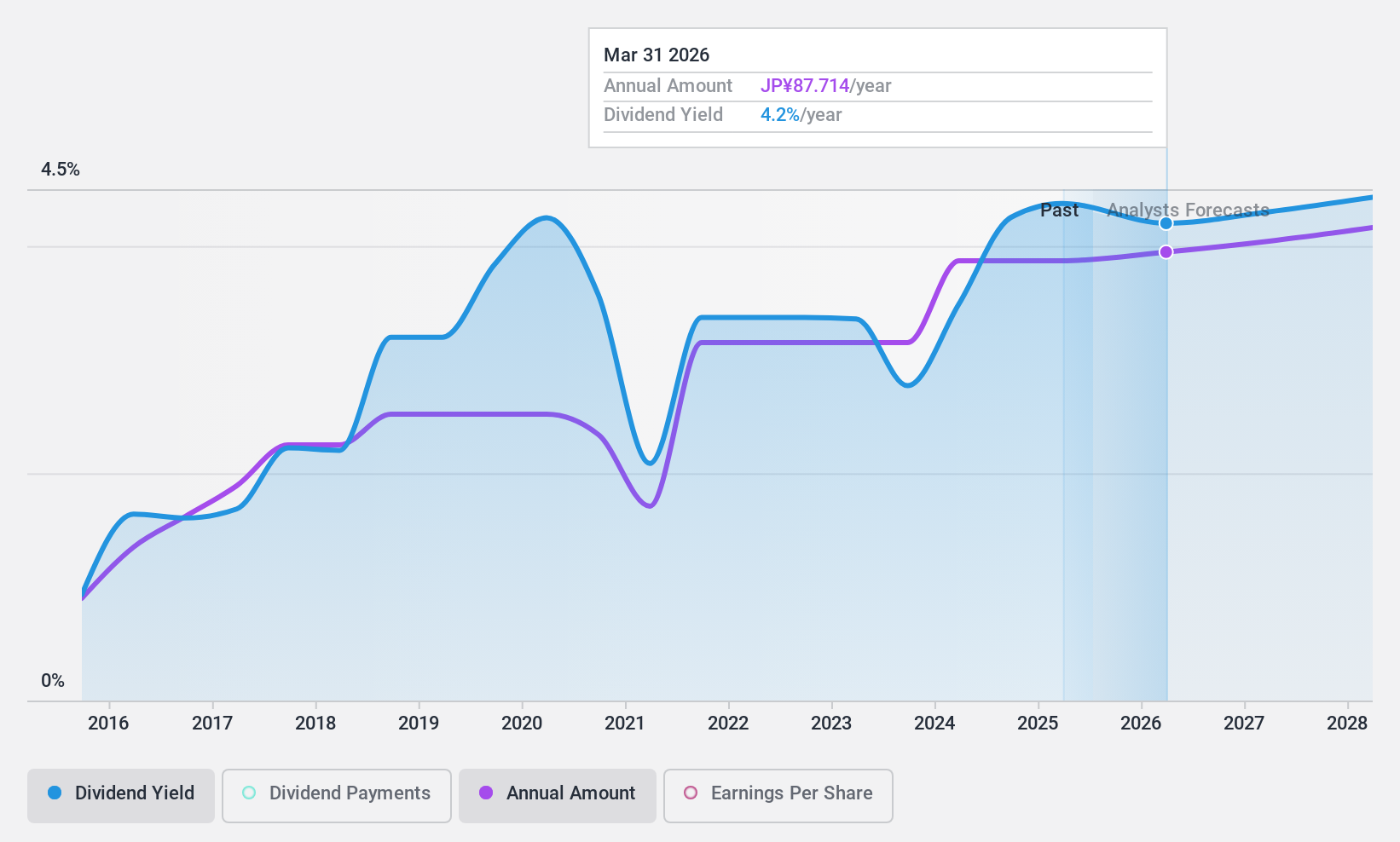

Toyota Boshoku (TSE:3116)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Boshoku Corporation develops, manufactures, and sells automotive interior systems in Japan, the United States, China, and internationally with a market cap of ¥3.68 billion.

Operations: Toyota Boshoku Corporation's revenue is primarily derived from its operations in Japan (¥910.20 billion), North, Central and South America (¥505.67 billion), Asia (¥281.98 billion), China (¥225.18 billion), and Europe and Africa (¥118.37 billion).

Dividend Yield: 4.2%

Toyota Boshoku's dividend yield of 4.18% places it in the top 25% of Japanese market payers, supported by a payout ratio of 35% and a cash payout ratio of 39.1%, indicating strong coverage by both earnings and cash flows. However, its dividends have been volatile over the past decade, raising concerns about reliability despite recent growth. The stock trades at good value compared to peers, potentially appealing to value-focused investors.

- Click here to discover the nuances of Toyota Boshoku with our detailed analytical dividend report.

- Our valuation report unveils the possibility Toyota Boshoku's shares may be trading at a discount.

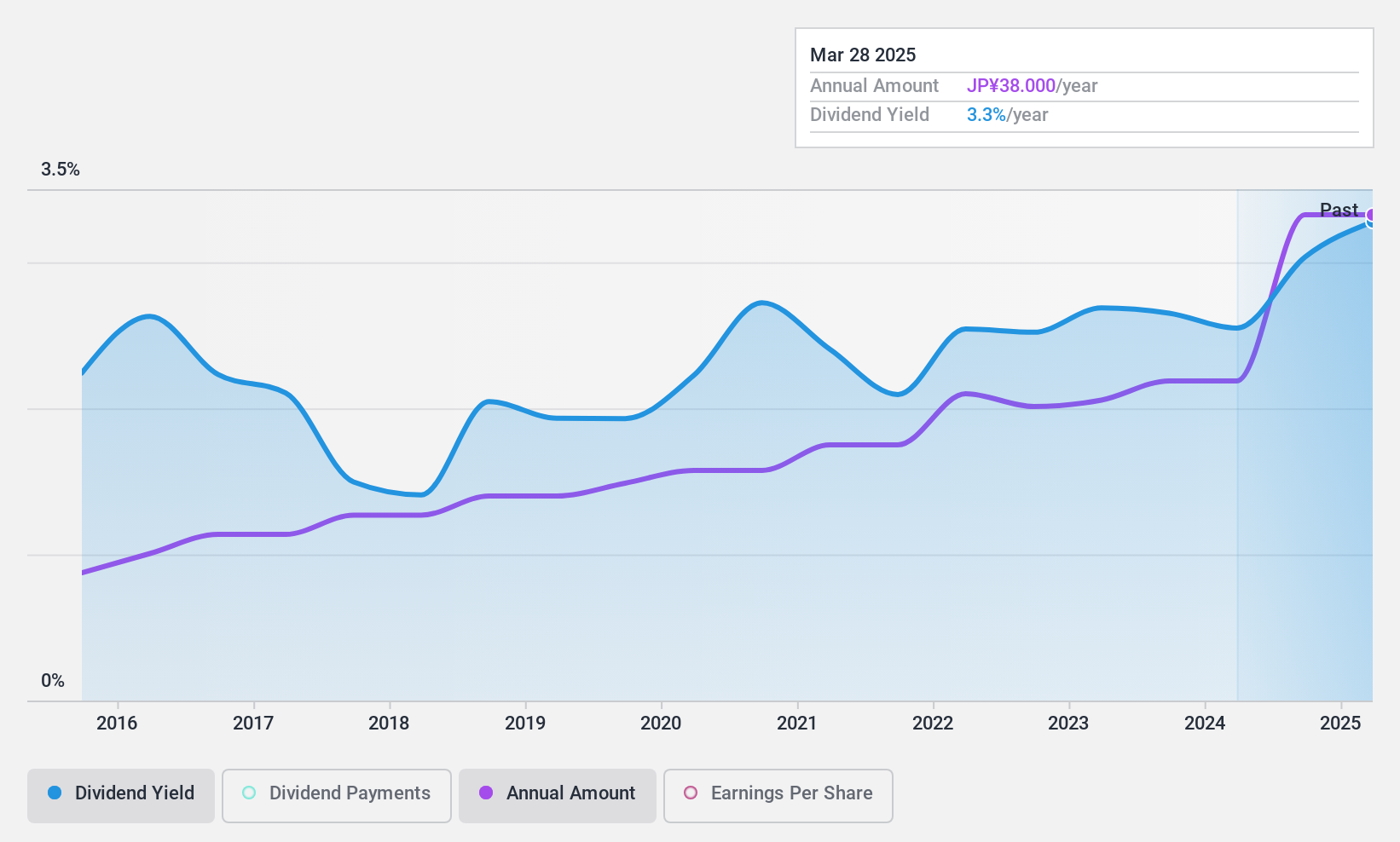

Cresco (TSE:4674)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cresco Ltd., along with its subsidiaries, provides IT services and digital solutions in Japan, with a market cap of ¥48.58 billion.

Operations: Cresco Ltd.'s revenue segments include the provision of information technology services and digital solutions in Japan.

Dividend Yield: 3.2%

Cresco's dividend payments are well-covered by earnings and cash flows, with payout ratios of 31.5% and 36%, respectively. Despite a history of volatility, dividends have increased over the past decade. However, its current yield of 3.23% is below the top quartile in Japan's market (3.85%). Trading at nearly half its estimated fair value could attract value investors, though recent board decisions on treasury shares might influence future payouts' stability or growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Cresco.

- Our comprehensive valuation report raises the possibility that Cresco is priced lower than what may be justified by its financials.

Seize The Opportunity

- Dive into all 1135 of the Top Asian Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4674

Cresco

Engages in the provision of information technology (IT) services and digital solutions in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives