- China

- /

- Metals and Mining

- /

- SZSE:000933

Top Global Dividend Stocks To Consider In December 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of dovish Federal Reserve signals and mixed economic data, investors are keenly observing the potential for interest rate cuts amid evolving inflation dynamics. With U.S. jobless claims at their lowest since April and consumer confidence sliding, dividend stocks offer a compelling opportunity for those seeking stable income in uncertain times. A good dividend stock typically combines a strong track record of consistent payouts with the potential for growth, aligning well with current market conditions that favor resilient and reliable investments.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.43% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.99% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.54% | ★★★★★★ |

| NCD (TSE:4783) | 4.58% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.62% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.45% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.44% | ★★★★★★ |

Click here to see the full list of 1329 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

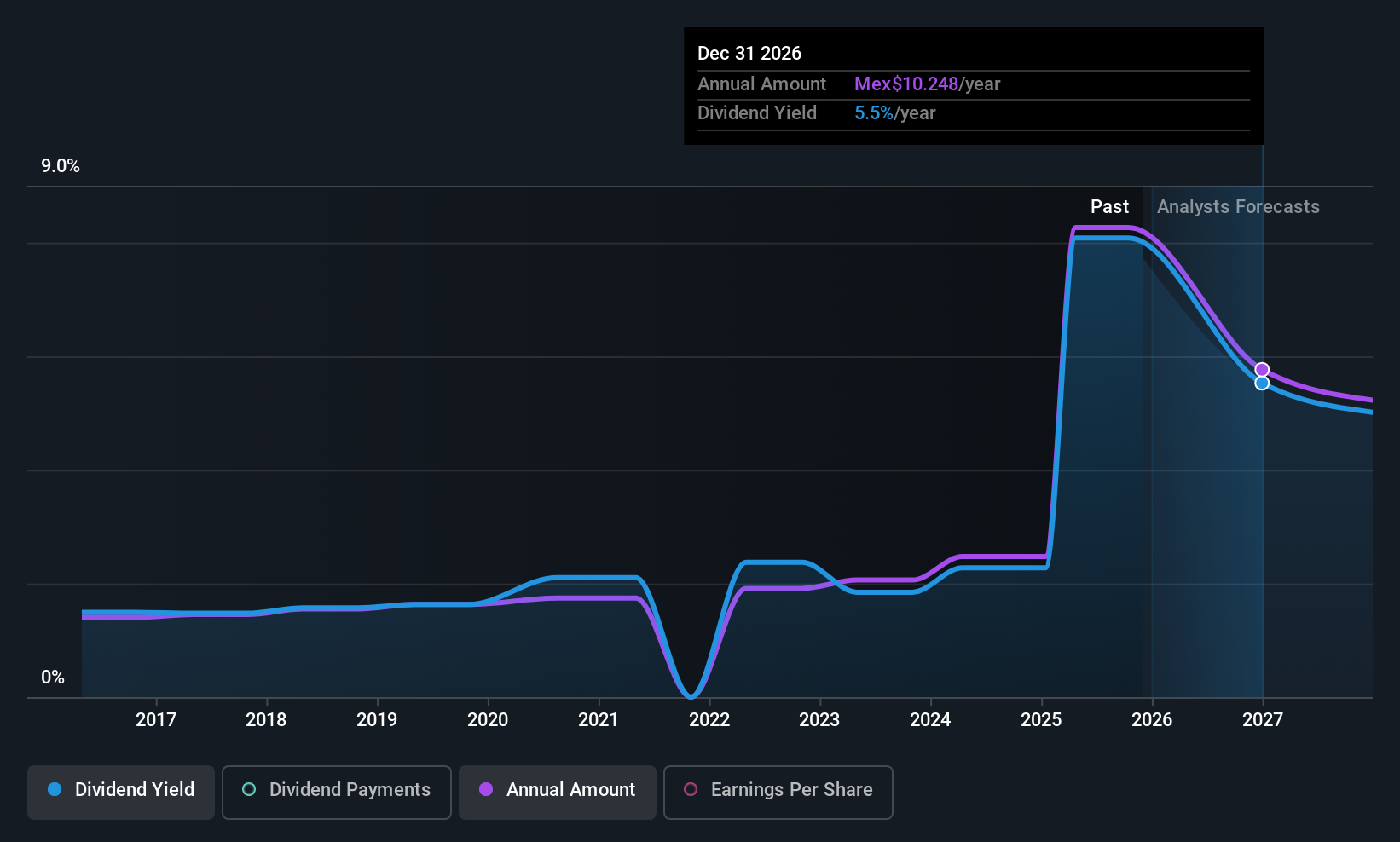

Fomento Económico Mexicano. de (BMV:FEMSA UBD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fomento Económico Mexicano, S.A.B. de C.V. operates globally as a franchise bottler of Coca-Cola trademark beverages through its subsidiaries and has a market cap of MX$582.59 billion.

Operations: Fomento Económico Mexicano, S.A.B. de C.V.'s revenue is primarily derived from its Americas Proximity Division (MX$326.69 billion), Coca-Cola FEMSA (MX$289.90 billion), Health Division (MX$87.13 billion), Fuel Division (MX$66.60 billion), and Proximity Europe (MX$56.68 billion).

Dividend Yield: 7.9%

Fomento Económico Mexicano's dividend yield is notable at 7.93%, placing it in the top 25% of dividend payers in Mexico. However, the sustainability of these dividends is questionable due to a high cash payout ratio of 161.4% and earnings coverage issues, with a payout ratio of 115.6%. Despite stable and reliable dividends over the past decade, recent earnings declines highlight potential challenges for maintaining current dividend levels without improved profitability or cash flow management.

- Unlock comprehensive insights into our analysis of Fomento Económico Mexicano. de stock in this dividend report.

- Our valuation report unveils the possibility Fomento Económico Mexicano. de's shares may be trading at a premium.

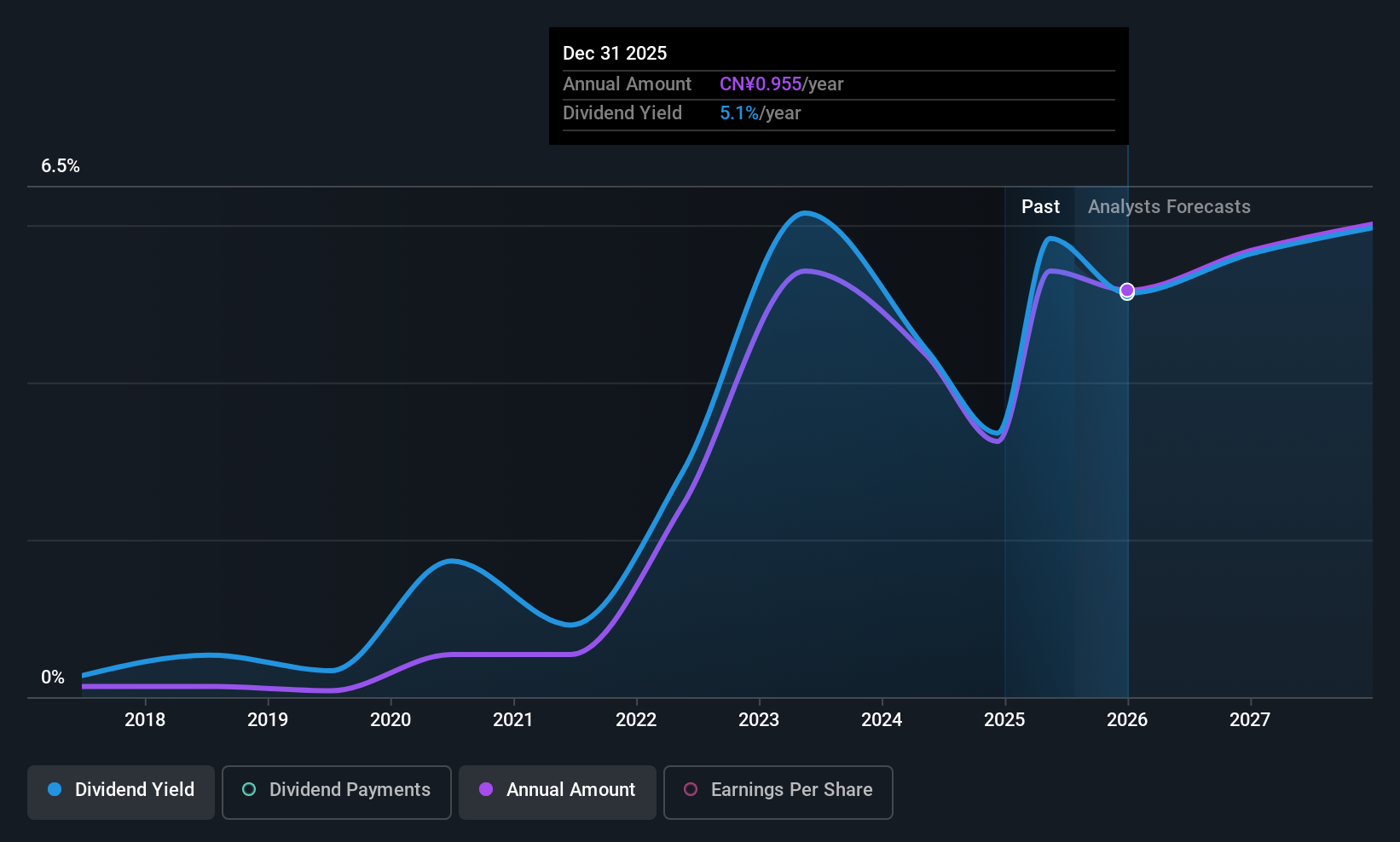

Henan Shenhuo Coal Industry and Electricity Power (SZSE:000933)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Henan Shenhuo Coal Industry and Electricity Power Co. engages in coal mining and electricity generation, with a market cap of CN¥55.66 billion.

Operations: Henan Shenhuo Coal Industry and Electricity Power Co. generates revenue primarily from its coal mining operations and electricity generation activities.

Dividend Yield: 3.9%

Henan Shenhuo Coal Industry and Electricity Power's dividend yield of 3.88% ranks it among the top 25% of dividend payers in China. Despite this, its dividends have been unstable and unreliable over the past eight years, with significant volatility in payments. Positively, the company maintains a low payout ratio of 25.9% and a cash payout ratio of 30.8%, suggesting dividends are well-covered by earnings and cash flows, though they lack a long-term track record for stability.

- Dive into the specifics of Henan Shenhuo Coal Industry and Electricity Power here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Henan Shenhuo Coal Industry and Electricity Power is priced lower than what may be justified by its financials.

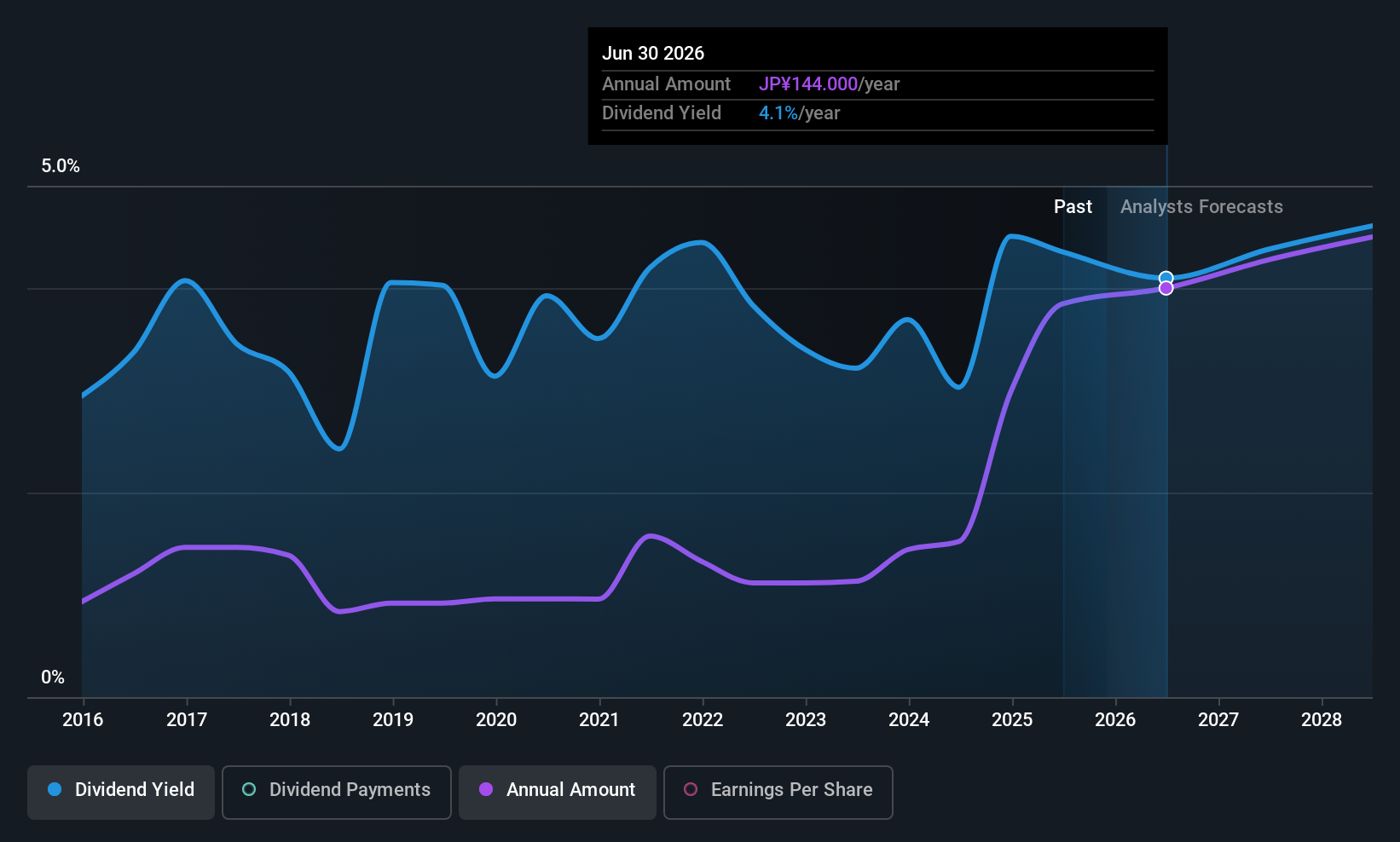

ZERO (TSE:9028)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ZERO Co., Ltd., along with its subsidiaries, offers vehicle transportation and maintenance services in Japan, with a market cap of ¥56.76 billion.

Operations: ZERO Co., Ltd. generates revenue through its vehicle transportation and maintenance services in Japan.

Dividend Yield: 4%

ZERO Co., Ltd. offers a dividend yield of 4%, placing it in the top 25% of Japanese dividend payers. However, its dividends have been volatile and unreliable over the past decade, with significant annual drops. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios of 33.7% and 21.8% respectively. The company is trading at a significant discount to fair value and has shown strong recent earnings growth, though its long-term dividend stability remains questionable.

- Click to explore a detailed breakdown of our findings in ZERO's dividend report.

- The valuation report we've compiled suggests that ZERO's current price could be quite moderate.

Seize The Opportunity

- Click this link to deep-dive into the 1329 companies within our Top Global Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henan Shenhuo Coal Industry and Electricity Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000933

Henan Shenhuo Coal Industry and Electricity Power

Henan Shenhuo Coal Industry and Electricity Power Co.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026