Asian Market Value Picks: Discover 3 Companies Priced Below Estimated Worth

Reviewed by Simply Wall St

Amidst renewed U.S.-China trade tensions and geopolitical uncertainties, Asian markets have shown a mixed performance, with Japan's indices rising sharply while China's markets ended on a mixed note. In such an environment, identifying undervalued stocks becomes crucial as investors seek opportunities that are priced below their estimated worth, offering potential value even in volatile conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.89 | CN¥164.70 | 49.1% |

| Sheng Siong Group (SGX:OV8) | SGD2.15 | SGD4.29 | 49.9% |

| Shanghai V-Test Semiconductor Tech (SHSE:688372) | CN¥84.00 | CN¥163.87 | 48.7% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥49.93 | CN¥97.77 | 48.9% |

| MIXUE Group (SEHK:2097) | HK$432.00 | HK$857.09 | 49.6% |

| Lotes (TWSE:3533) | NT$1460.00 | NT$2857.84 | 48.9% |

| Everest Medicines (SEHK:1952) | HK$52.80 | HK$104.99 | 49.7% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥66.70 | CN¥132.85 | 49.8% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.85 | ₱7.66 | 49.8% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.50 | CN¥59.80 | 49% |

Let's take a closer look at a couple of our picks from the screened companies.

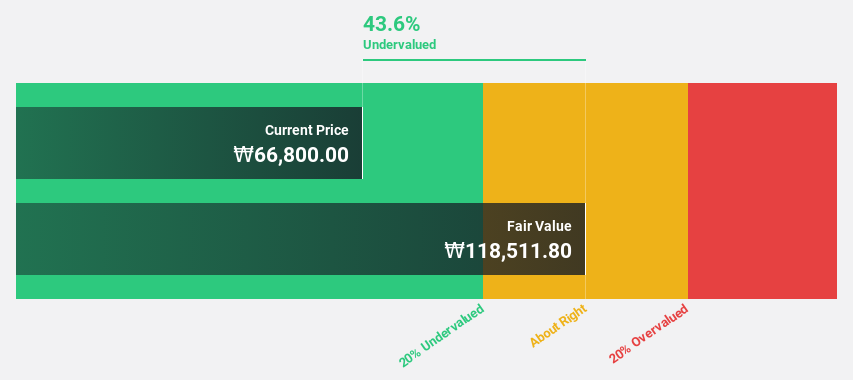

Sanil Electric (KOSE:A062040)

Overview: Sanil Electric Co., Ltd. manufactures and sells transformers in Korea and internationally, with a market cap of ₩3.26 billion.

Operations: Sanil Electric's revenue primarily comes from its Electric Equipment segment, which generated ₩415.20 million.

Estimated Discount To Fair Value: 12.2%

Sanil Electric is trading at ₩107,200, slightly undervalued compared to its estimated fair value of ₩122,094.68. Despite high volatility in the share price recently, the company's revenue growth forecast of 21.1% per year surpasses the Korean market average of 7.8%. Earnings grew by a substantial 105% over the past year and are expected to grow significantly at 22.72% annually over the next three years, although this lags behind market expectations.

- Our growth report here indicates Sanil Electric may be poised for an improving outlook.

- Navigate through the intricacies of Sanil Electric with our comprehensive financial health report here.

SDIC Fengle Seed (SZSE:000713)

Overview: SDIC Fengle Seed Co., Ltd. operates in China focusing on the research, development, production, and sale of seeds, agrochemicals, and spices with a market cap of CN¥4.30 billion.

Operations: The company's revenue is derived from three main segments: the Spice Division at CN¥294.66 million, the Agrochemical Division at CN¥1.39 billion, and the Seed Industry Division at CN¥1.06 billion.

Estimated Discount To Fair Value: 40.3%

SDIC Fengle Seed is trading at CN¥7, significantly below its estimated fair value of CN¥11.72, presenting a potential opportunity for investors focused on cash flow valuations. Despite a recent net loss of CN¥28.03 million for the half year ending June 2025, the company's earnings are forecast to grow robustly at 41.4% annually, outpacing the Chinese market's expected growth rate of 26.4%. Revenue is projected to increase by 17% per year.

- Our expertly prepared growth report on SDIC Fengle Seed implies its future financial outlook may be stronger than recent results.

- Take a closer look at SDIC Fengle Seed's balance sheet health here in our report.

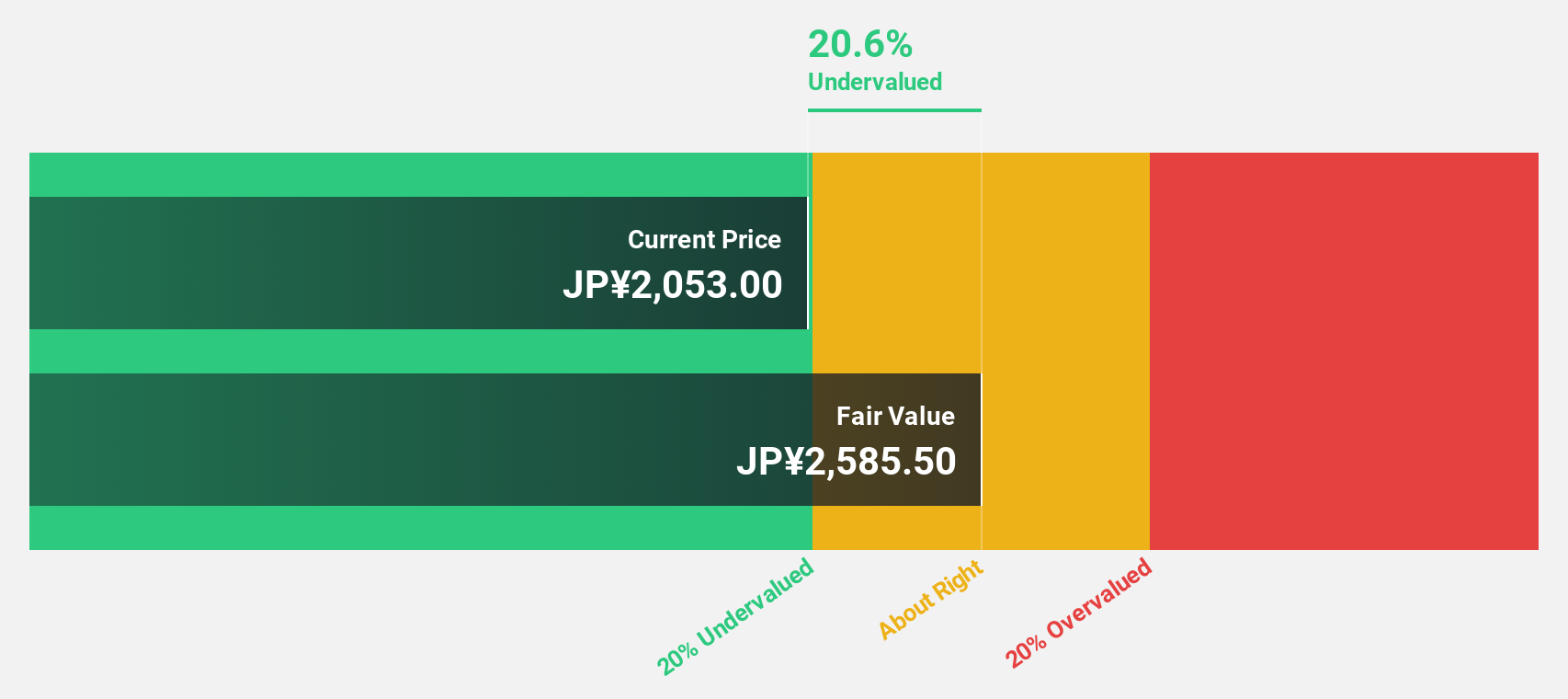

Mandom (TSE:4917)

Overview: Mandom Corporation manufactures and sells cosmetics and perfumes in Japan, Indonesia, and internationally, with a market cap of ¥104.63 billion.

Operations: The company's revenue is derived from its operations in Japan (¥47.11 billion), Indonesia (¥18.96 billion), and other international markets (¥22.61 billion).

Estimated Discount To Fair Value: 12.6%

Mandom Corporation is trading at ¥2,318, slightly below its estimated fair value of ¥2,653.43, indicating a modest undervaluation based on cash flows. Despite recent volatility and the impact of a management buyout by CVC Capital Partners, Mandom's earnings are projected to grow significantly at 32.1% annually over the next three years, surpassing Japan's market average growth rate. However, anticipated revenue growth remains moderate at 5.7% per year.

- The analysis detailed in our Mandom growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Mandom's balance sheet health report.

Where To Now?

- Dive into all 283 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000713

SDIC Fengle Seed

Engages in the research, development, production, and sale of seeds, agrochemicals, and spices in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives