- Singapore

- /

- Aerospace & Defense

- /

- SGX:S63

Asian Value Stock Picks With Possible Undervaluation

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown signs of resilience despite global economic uncertainties, with Chinese stocks gaining traction due to renewed interest in technology and artificial intelligence sectors. As investors navigate these fluctuating conditions, identifying undervalued stocks in Asia can offer potential opportunities for those seeking value investments amidst the broader market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.90 | CN¥301.88 | 49% |

| Visional (TSE:4194) | ¥9969.00 | ¥19638.66 | 49.2% |

| Last One MileLtd (TSE:9252) | ¥3450.00 | ¥6848.65 | 49.6% |

| KoMiCo (KOSDAQ:A183300) | ₩84700.00 | ₩166235.75 | 49% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩28700.00 | ₩57169.43 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥5560.00 | ¥10890.52 | 48.9% |

| H.U. Group Holdings (TSE:4544) | ¥3300.00 | ¥6592.59 | 49.9% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩445500.00 | ₩890508.57 | 50% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥261.75 | CN¥511.07 | 48.8% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.26 | CN¥55.81 | 49.4% |

Here's a peek at a few of the choices from the screener.

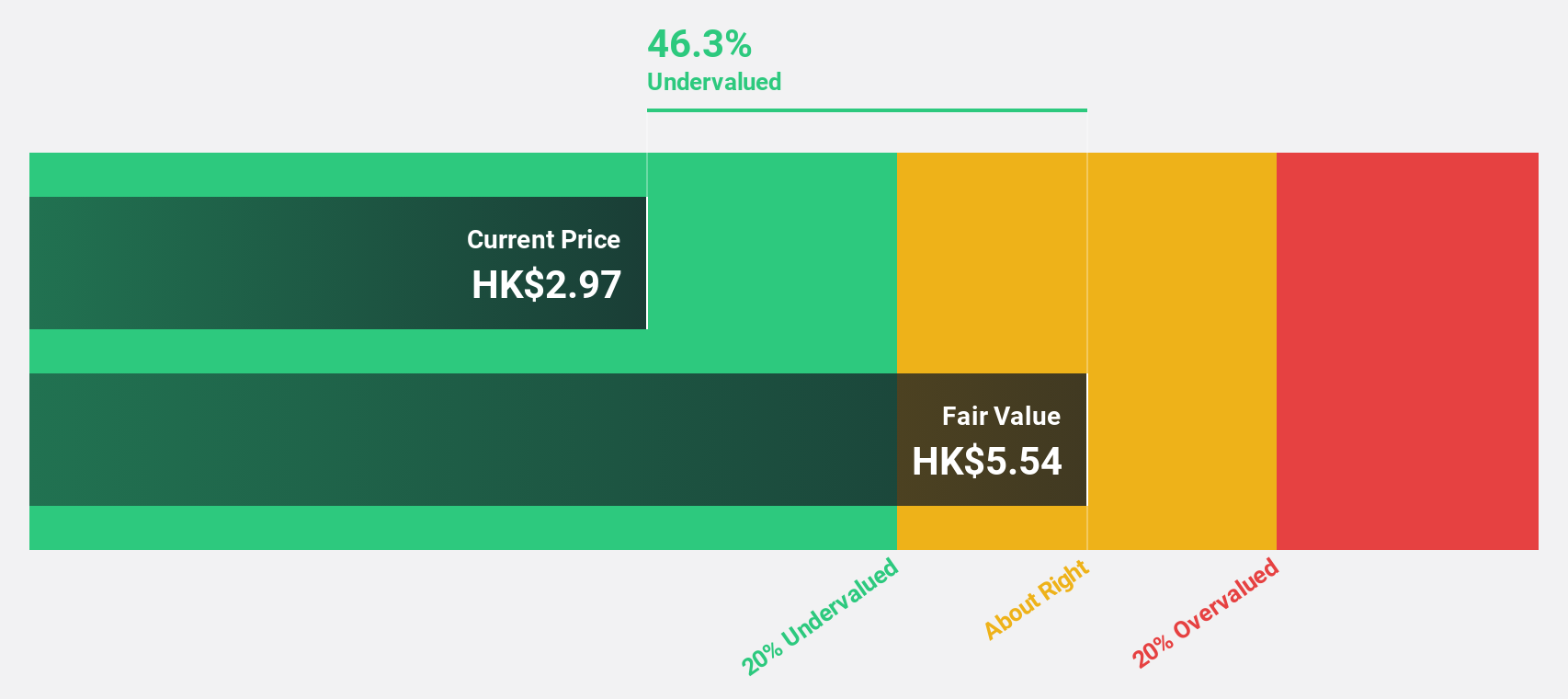

Tongguan Gold Group (SEHK:340)

Overview: Tongguan Gold Group Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and related products in China with a market cap of HK$14.66 billion.

Operations: The company's revenue primarily comes from its Gold Mining Operation, which generated HK$1.69 billion.

Estimated Discount To Fair Value: 33.6%

Tongguan Gold Group is trading at HK$2.82, significantly below its estimated fair value of HK$4.25, presenting a compelling case for undervaluation based on cash flows. The company's earnings are forecast to grow 33.32% annually, outpacing the Hong Kong market's 12.1%. Despite past shareholder dilution, revenue growth remains robust at 18% per year. Recent leadership changes with Mr. Wang Dequan as CEO may steer strategic direction positively following his extensive experience in gold mining and exploration.

- The analysis detailed in our Tongguan Gold Group growth report hints at robust future financial performance.

- Click here to discover the nuances of Tongguan Gold Group with our detailed financial health report.

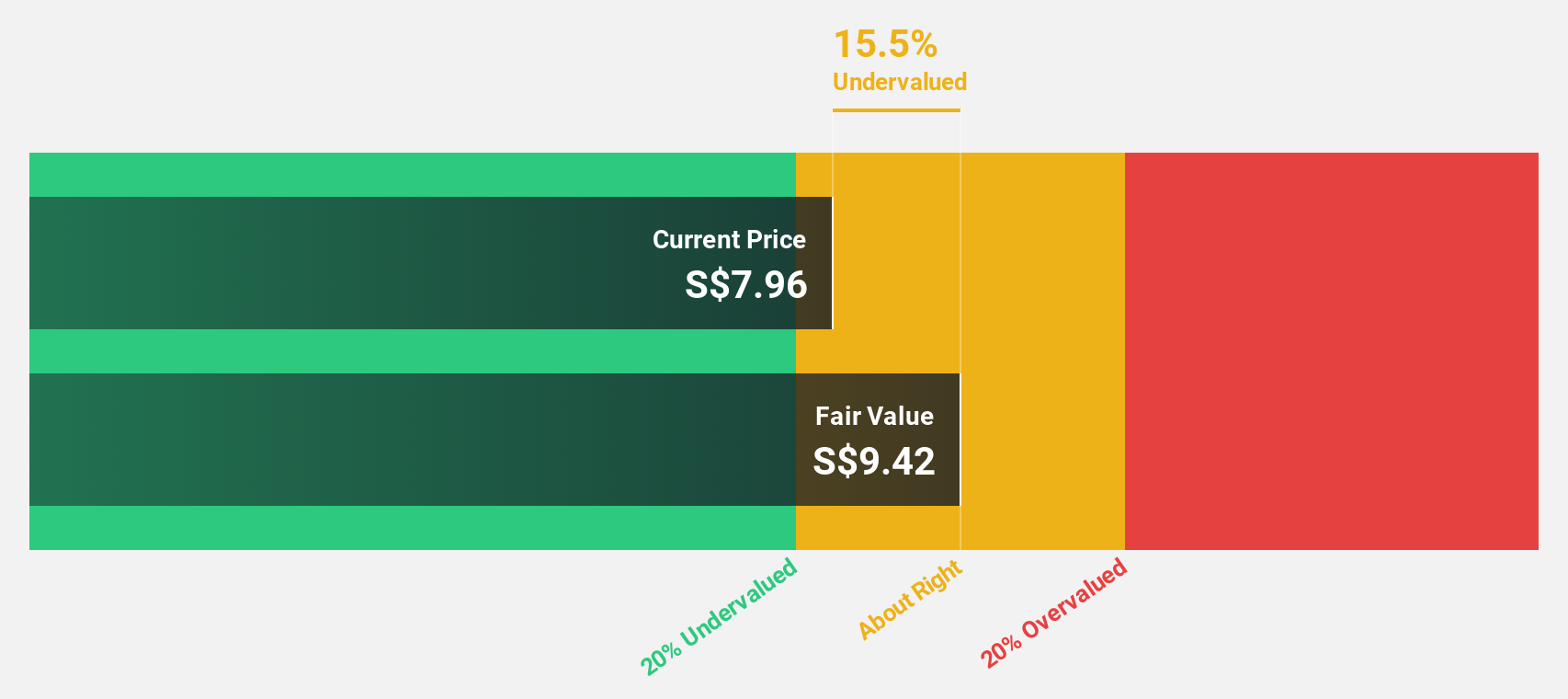

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD25.59 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace with SGD4.56 billion, Urban Solutions & Satcom contributing SGD2.02 billion, and Defence & Public Security at SGD5.25 billion.

Estimated Discount To Fair Value: 20.5%

Singapore Technologies Engineering is trading at S$8.21, below its estimated fair value of S$10.32, indicating undervaluation based on cash flows. The company secured significant contract wins totaling $14 billion in 2025 across aerospace, defense, and urban solutions sectors, supporting robust revenue growth forecasts of 8.1% annually. Despite a high debt level and an unstable dividend track record, earnings are projected to grow faster than the Singapore market at 15.7% per year.

- Our comprehensive growth report raises the possibility that Singapore Technologies Engineering is poised for substantial financial growth.

- Dive into the specifics of Singapore Technologies Engineering here with our thorough financial health report.

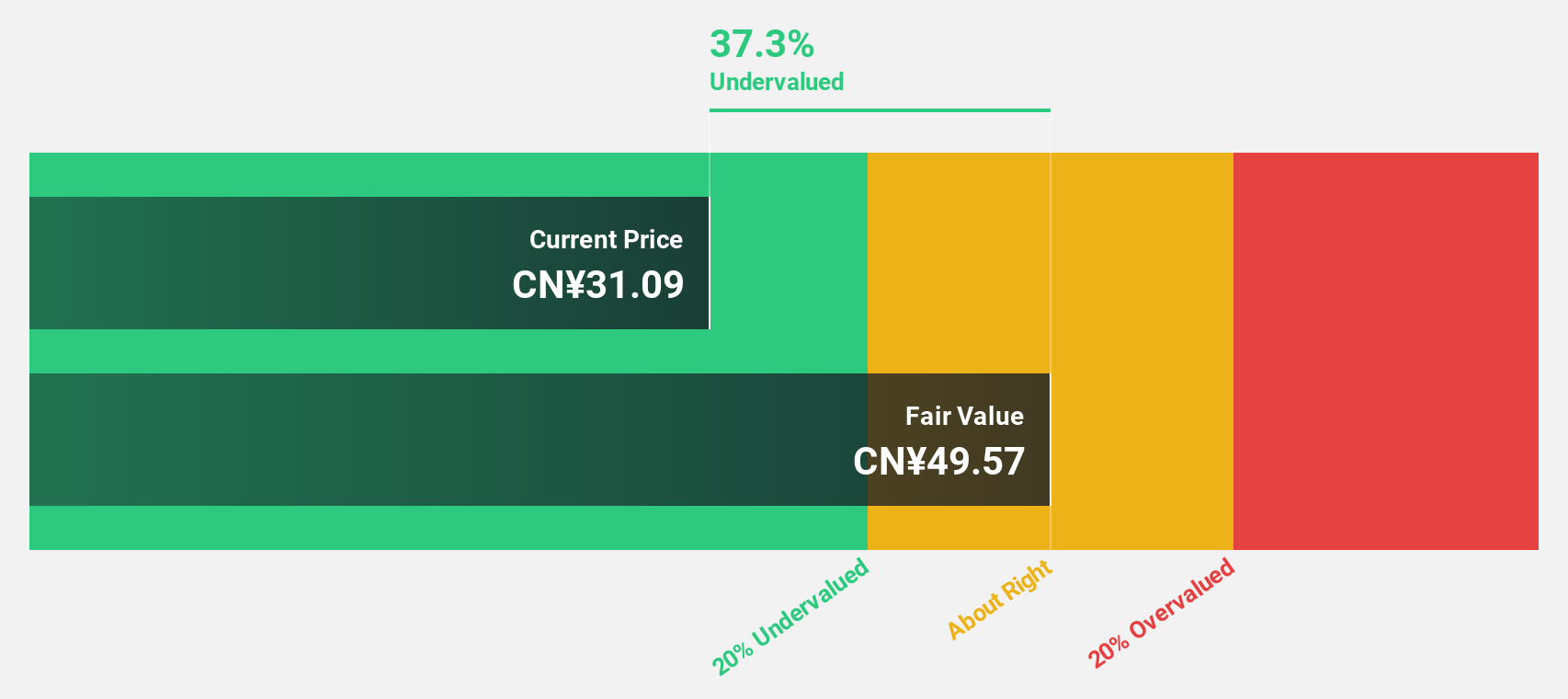

Shengda ResourcesLtd (SZSE:000603)

Overview: Shengda Resources Co., Ltd. operates in China through its subsidiaries, focusing on mining development, resource trading, and investment management, with a market cap of CN¥20.59 billion.

Operations: Shengda Resources Co., Ltd. is involved in mining development, resource trading, and investment management through its subsidiaries in China.

Estimated Discount To Fair Value: 39.1%

Shengda Resources Ltd. is trading at CN¥30.08, significantly below its estimated fair value of CN¥49.43, highlighting its undervaluation based on cash flows. The company's earnings surged by 140.8% over the past year and are forecast to grow 36.42% annually, outpacing the Chinese market's growth rate of 27.4%. Despite recent share price volatility and proposed amendments to company bylaws, Shengda's robust revenue growth projections support its investment potential in Asia's undervalued stock segment.

- Our expertly prepared growth report on Shengda ResourcesLtd implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Shengda ResourcesLtd's balance sheet health report.

Key Takeaways

- Unlock our comprehensive list of 279 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:S63

Singapore Technologies Engineering

Operates as a technology, defence, and engineering company worldwide.

Solid track record with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)