- China

- /

- Metals and Mining

- /

- SZSE:000426

Does Inner Mongolia Xingye Silver &Tin MiningLtd (SZSE:000426) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Inner Mongolia Xingye Silver &Tin MiningLtd (SZSE:000426), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Inner Mongolia Xingye Silver &Tin MiningLtd

How Fast Is Inner Mongolia Xingye Silver &Tin MiningLtd Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that Inner Mongolia Xingye Silver &Tin MiningLtd grew its EPS from CN¥0.097 to CN¥0.94, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

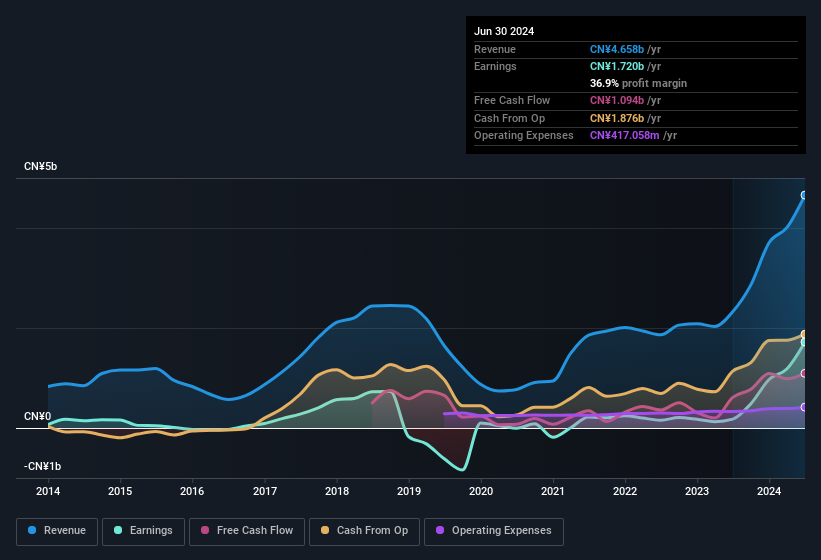

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Inner Mongolia Xingye Silver &Tin MiningLtd shareholders can take confidence from the fact that EBIT margins are up from 20% to 47%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Inner Mongolia Xingye Silver &Tin MiningLtd's future profits.

Are Inner Mongolia Xingye Silver &Tin MiningLtd Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Inner Mongolia Xingye Silver &Tin MiningLtd followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at CN¥198m. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between CN¥14b and CN¥46b, like Inner Mongolia Xingye Silver &Tin MiningLtd, the median CEO pay is around CN¥1.5m.

Inner Mongolia Xingye Silver &Tin MiningLtd offered total compensation worth CN¥1.2m to its CEO in the year to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Inner Mongolia Xingye Silver &Tin MiningLtd Worth Keeping An Eye On?

Inner Mongolia Xingye Silver &Tin MiningLtd's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Inner Mongolia Xingye Silver &Tin MiningLtd certainly ticks a few boxes, so we think it's probably well worth further consideration. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Inner Mongolia Xingye Silver &Tin MiningLtd is trading on a high P/E or a low P/E, relative to its industry.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000426

Inner Mongolia Xingye Silver&Tin MiningLtd

Engages in mining and smelting non-ferrous and precious metals in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives