Undiscovered Gems Three Promising Stocks To Explore December 2024

Reviewed by Simply Wall St

As global markets exhibit mixed performances, with major indexes like the S&P 500 and Nasdaq Composite reaching record highs while the Russell 2000 experiences a decline, investors are closely monitoring economic indicators and Federal Reserve actions for clues on future trends. In this dynamic environment, identifying promising stocks often involves looking beyond immediate market fluctuations to find companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Compañía General de Electricidad | 1.98% | 9.75% | -4.52% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

China Catalyst Holding (SHSE:688267)

Simply Wall St Value Rating: ★★★★★★

Overview: China Catalyst Holding Co., Ltd. specializes in the research, development, production, and sale of zeolite catalysts, customized process package solutions, and fine chemicals both domestically and internationally with a market cap of CN¥4.05 billion.

Operations: China Catalyst generates revenue primarily from its chemical reagent and auxiliary manufacturing segment, which brought in CN¥708.63 million.

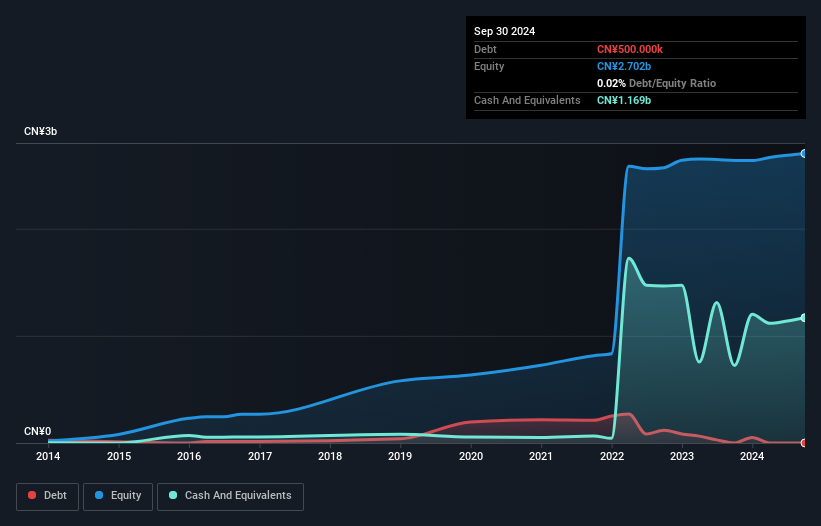

China Catalyst Holding, a promising player in the chemicals industry, has shown robust performance with earnings growing by 35.5% over the past year, outpacing the industry's -5%. The company boasts high-quality earnings and maintains a favorable price-to-earnings ratio of 27.5x, which is below the Chinese market average of 37.2x. Over five years, its debt-to-equity ratio impressively decreased from 24.9% to just 0.02%, indicating strong financial management and more cash than total debt on hand. Recent results highlight significant growth with sales reaching CNY 523 million compared to CNY 364 million last year and net income rising to CNY 113 million from CNY 43 million previously.

Qifeng New Material (SZSE:002521)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qifeng New Material Co., Ltd. is involved in the research, development, manufacturing, and sale of decorative base papers, overlay papers, and non-woven wallpaper base papers in China with a market cap of CN¥5.49 billion.

Operations: Qifeng New Material generates revenue primarily from the sale of decorative base papers, overlay papers, and non-woven wallpaper base papers. The company's net profit margin has shown notable variations over recent periods.

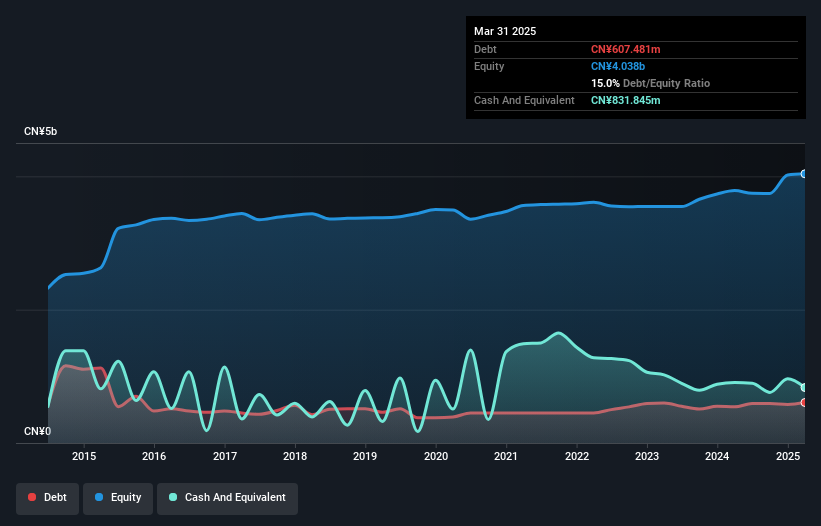

Qifeng New Material is navigating some challenges, with sales for the first nine months of 2024 at CNY 2.55 billion, down from CNY 2.71 billion last year, and net income dropping to CNY 106.43 million from CNY 157.41 million. Despite these figures, it remains profitable and covers its interest payments comfortably. The debt-to-equity ratio has risen slightly over five years to 15.8%, indicating a cautious approach to leverage while still trading at a notable discount of about 24% below estimated fair value. Earnings per share also saw a dip from CNY 0.32 to CNY 0.22 this year, reflecting current market pressures but suggesting potential undervaluation opportunities for investors willing to explore further into this sector's dynamics.

Noritsu Koki (TSE:7744)

Simply Wall St Value Rating: ★★★★★★

Overview: Noritsu Koki Co., Ltd. manufactures and sells audio equipment and peripheral products in Japan, with a market cap of ¥166.01 billion.

Operations: Noritsu Koki generates revenue primarily through the sale of audio equipment and peripheral products. The company's financial performance is reflected in its market capitalization of ¥166.01 billion.

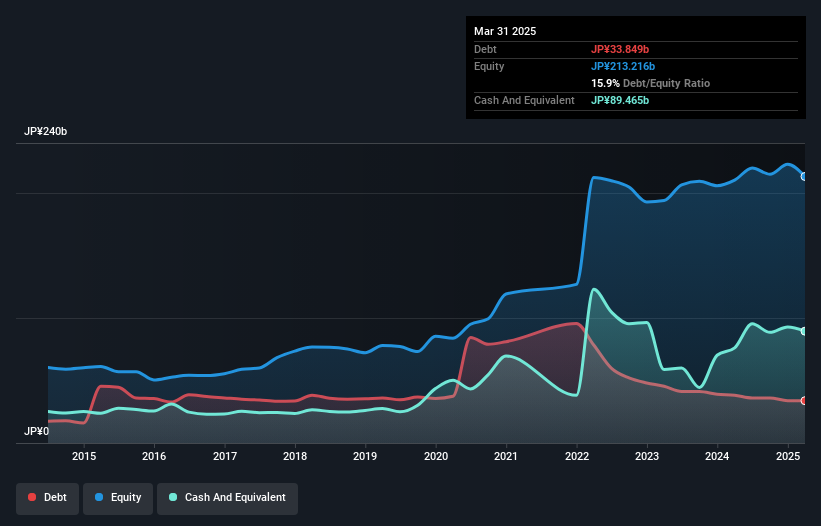

Noritsu Koki stands out with its earnings surging by 70% in the past year, outpacing the Industrials industry's modest 2% growth. This small-cap company is trading at a significant discount, about 39% below its estimated fair value, making it an intriguing option for investors. Despite recent share price volatility, Noritsu's financial health seems robust; it holds more cash than total debt and has successfully reduced its debt-to-equity ratio from 50% to 17% over five years. With high-quality earnings and positive free cash flow, future prospects appear promising as earnings are projected to grow annually by 6%.

- Click here and access our complete health analysis report to understand the dynamics of Noritsu Koki.

Assess Noritsu Koki's past performance with our detailed historical performance reports.

Summing It All Up

- Get an in-depth perspective on all 4628 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade China Catalyst Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688267

China Catalyst Holding

Engages in the research and development, production, and sale of zeolite catalyst, customized process package solutions, and fine chemicals in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives