As global markets react positively to the recent U.S.-China tariff suspension, with major indices like the Nasdaq Composite and S&P 500 experiencing significant gains, investors are keenly observing opportunities to enhance their income through strategic investments. In this context, dividend stocks can be particularly appealing as they offer a combination of potential capital appreciation and regular income streams, making them a compelling choice amid evolving trade dynamics and economic indicators.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.31% | ★★★★★★ |

| Daicel (TSE:4202) | 4.98% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.92% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.78% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.06% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.04% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.50% | ★★★★★★ |

Click here to see the full list of 1579 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Bolsa Mexicana de Valores. de (BMV:BOLSA A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bolsa Mexicana de Valores, S.A.B. de C.V. operates as the primary stock exchange in Mexico, facilitating trading and financial services with a market cap of MX$24.21 billion.

Operations: Bolsa Mexicana de Valores, S.A.B. de C.V. generates revenue primarily through its role as Mexico's leading stock exchange, offering a range of trading and financial services.

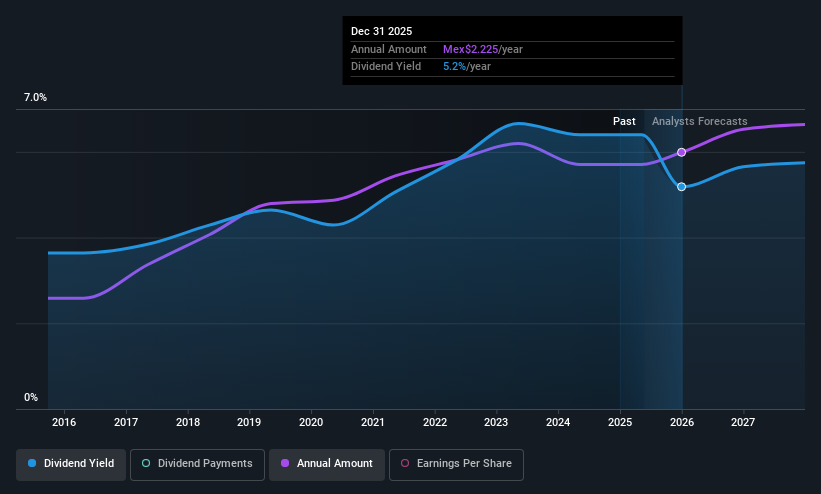

Dividend Yield: 4.9%

Bolsa Mexicana de Valores offers a reliable dividend yield of 4.9%, supported by an earnings payout ratio of 80.4% and a cash payout ratio of 61.2%. Despite being lower than the top quartile in the Mexican market, its dividends have shown stability and growth over the past decade. Recent Q1 results show robust financial health with sales increasing to MXN 1.13 billion, supporting its capacity to maintain dividend payments.

- Click to explore a detailed breakdown of our findings in Bolsa Mexicana de Valores. de's dividend report.

- Upon reviewing our latest valuation report, Bolsa Mexicana de Valores. de's share price might be too optimistic.

Sino-Agri Leading BiosciencesLtd (SHSE:603970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sino-Agri Leading Biosciences Co., Ltd researches, develops, produces, and distributes agrochemicals both in China and internationally with a market cap of CN¥4.20 billion.

Operations: Sino-Agri Leading Biosciences Co., Ltd generates revenue through its activities in the research, development, production, and distribution of agrochemicals across domestic and international markets.

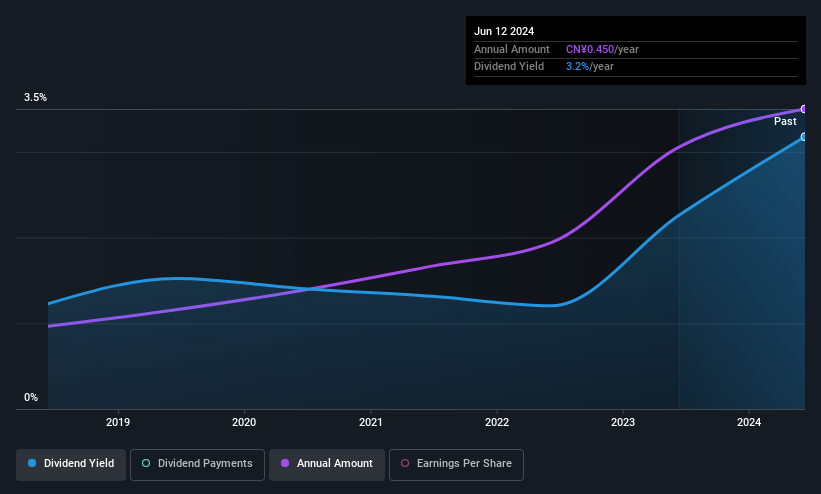

Dividend Yield: 3%

Sino-Agri Leading Biosciences offers a dividend yield of 3.04%, placing it in the top quartile of Chinese dividend payers. Its dividends are well-supported by a payout ratio of 60.3% and a cash payout ratio of 33.7%. While the company has only paid dividends for seven years, they have been stable and gradually increasing. Despite slight declines in net income, recent earnings reports show sales growth to CNY 2.53 billion, underscoring its ability to sustain dividends.

- Dive into the specifics of Sino-Agri Leading BiosciencesLtd here with our thorough dividend report.

- Our valuation report unveils the possibility Sino-Agri Leading BiosciencesLtd's shares may be trading at a premium.

Carlit (TSE:4275)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carlit Co., Ltd. operates through its subsidiaries in the manufacture and sale of industrial explosives, with a market cap of ¥25.05 billion.

Operations: Carlit Co., Ltd. focuses on the production and distribution of industrial explosives through its subsidiaries.

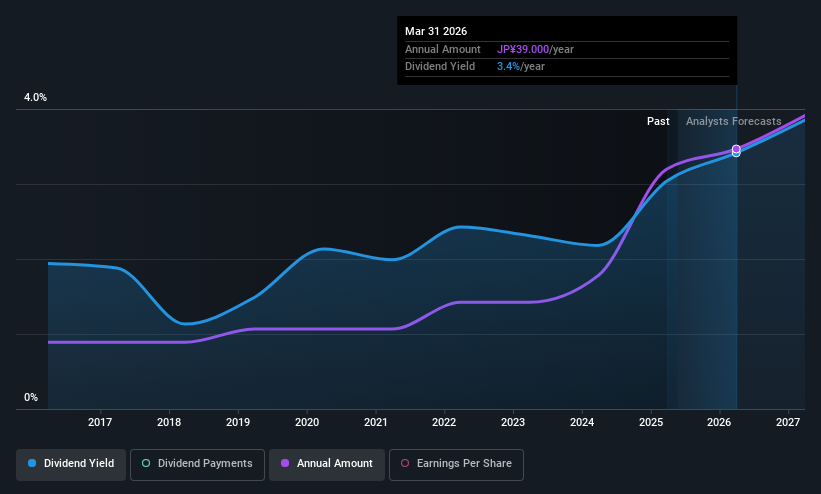

Dividend Yield: 3.2%

Carlit Co., Ltd. offers a dividend yield of 3.19%, below the top quartile in Japan, yet its dividends are well-covered by earnings and cash flows with payout ratios of 35.3% and 56.2%, respectively. The company has consistently increased dividends over the past decade, recently raising them to ¥36 per share for fiscal year 2025. A new shareholder return policy targets a total return ratio of 40%, enhancing future dividend prospects alongside a share buyback program valued at ¥1 billion.

- Take a closer look at Carlit's potential here in our dividend report.

- The valuation report we've compiled suggests that Carlit's current price could be quite moderate.

Summing It All Up

- Take a closer look at our Top Global Dividend Stocks list of 1579 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Carlit, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4275

Carlit

Through its subsidiaries, engages in the manufacture and sale of industrial explosives.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives