Undiscovered Gems With Strong Fundamentals To Watch This November 2024

Reviewed by Simply Wall St

As global markets react to a significant political shift in the United States, with the so-called "red sweep" fueling optimism for economic growth and tax reforms, small-cap stocks have captured attention by leading gains, evidenced by the Russell 2000 Index's notable surge. Amidst these developments, investors are increasingly on the lookout for undiscovered gems with robust fundamentals that can capitalize on favorable market conditions; such stocks often exhibit strong financial health and resilience to navigate uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Niva Bupa Health Insurance (NSEI:NIVABUPA)

Simply Wall St Value Rating: ★★★★☆☆

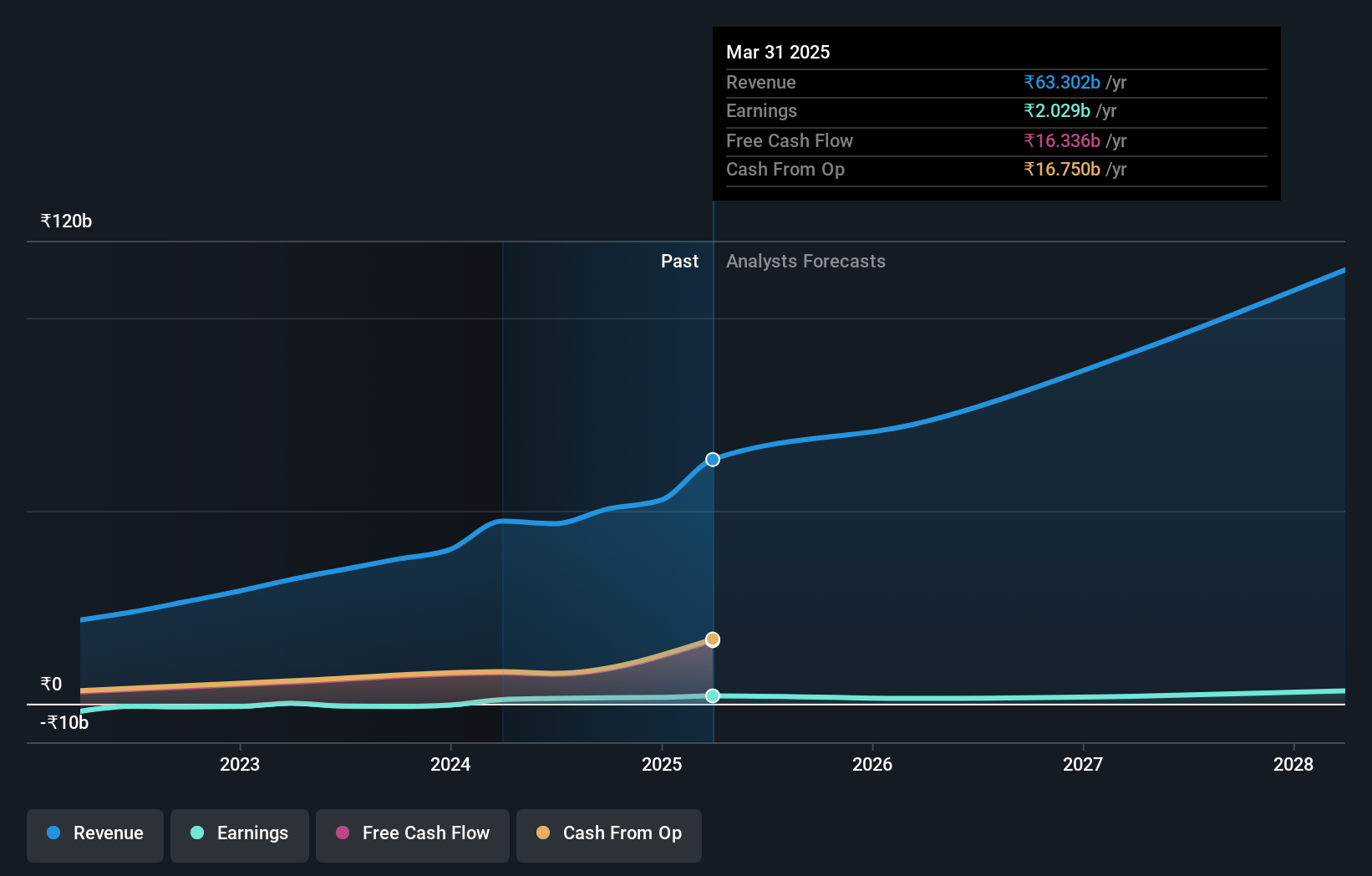

Overview: Niva Bupa Health Insurance Company Limited offers a range of health insurance products in India and has a market capitalization of ₹130.19 billion.

Operations: The primary revenue stream for Niva Bupa comes from its health insurance segment, generating ₹40.01 billion, with additional contributions from travel and personal accident insurance at ₹81.90 million and ₹766.45 million respectively.

Niva Bupa Health Insurance, a relatively small player in the insurance sector, has shown promise by becoming profitable this year. Its interest payments are well covered with an EBIT coverage of 6.1 times, indicating strong financial health. Despite a debt-to-equity ratio increase to 8.4% over five years, it holds more cash than total debt, suggesting prudent financial management. Recent partnerships with AU Small Finance Bank aim to broaden its customer base through extensive distribution across India’s 2,414 touchpoints. However, the company reported a net loss of INR 188 million for Q1 2024 but improved from INR 722 million last year.

Nanjing Well Pharmaceutical GroupLtd (SHSE:603351)

Simply Wall St Value Rating: ★★★★★☆

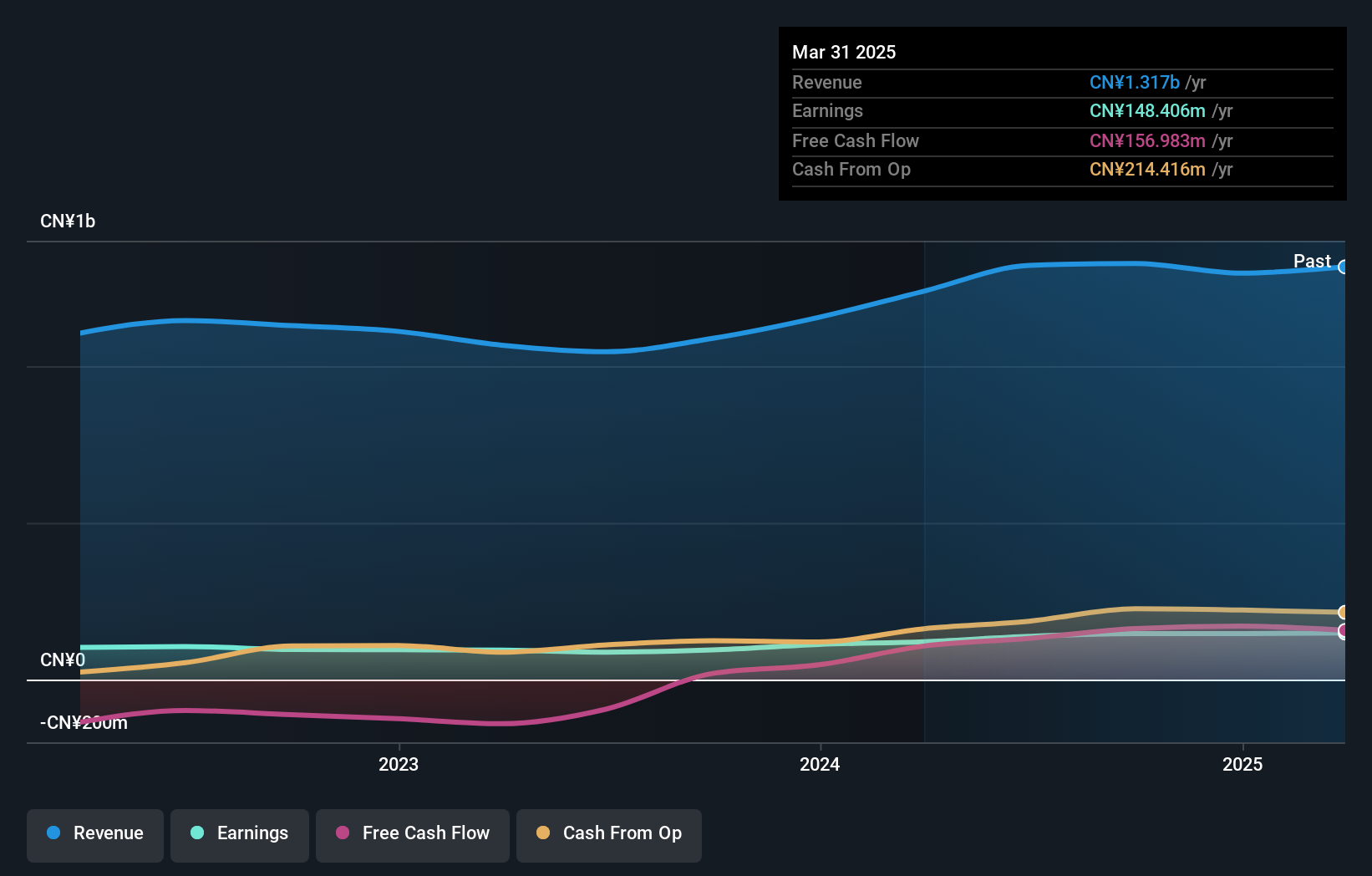

Overview: Nanjing Well Pharmaceutical Group Co., Ltd. operates in the pharmaceutical industry and has a market capitalization of CN¥3.38 billion.

Operations: The company generates revenue primarily through its pharmaceutical segment. It has a market capitalization of CN¥3.38 billion.

Nanjing Well Pharmaceutical Group, a small-cap player in the pharmaceutical sector, seems to be making waves with a robust earnings growth of 55% over the past year, outpacing its industry peers. The company reported net income of CNY 112.9 million for the nine months ending September 2024, up from CNY 78.27 million the previous year. Despite an increase in its debt to equity ratio from 8.4% to 25.3% over five years, its interest payments are well-covered by EBIT at a multiple of 12x. Trading at nearly 79% below estimated fair value suggests potential upside for investors seeking undervalued opportunities.

Vision (TSE:9416)

Simply Wall St Value Rating: ★★★★★☆

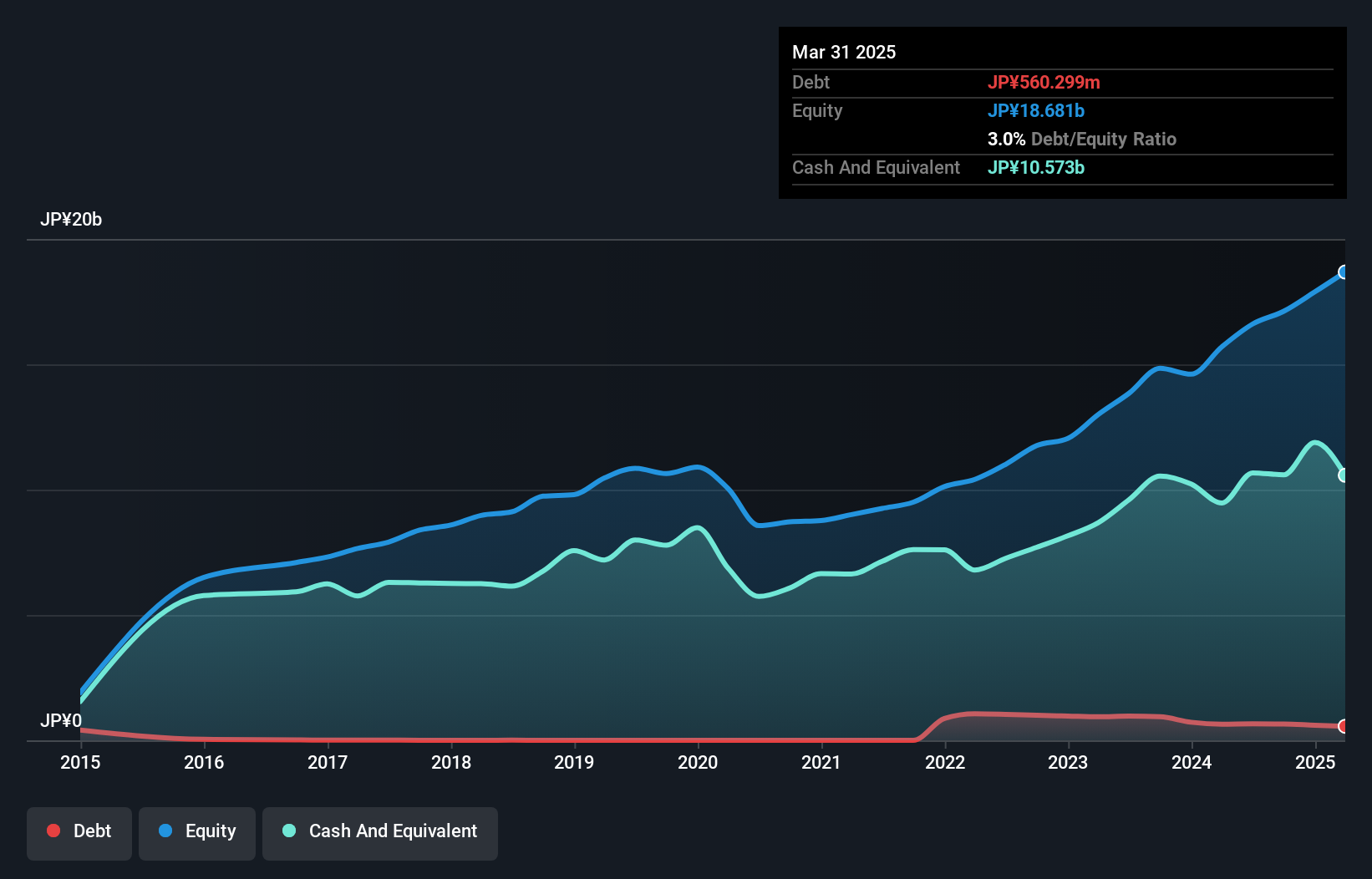

Overview: Vision Inc., along with its subsidiaries, focuses on offering mobile Wi-Fi router rental services both in Japan and internationally, with a market capitalization of ¥51.48 billion.

Operations: Vision Inc. generates revenue primarily from its Global WiFi Business, contributing ¥18.90 billion, and its Information and Communications Service Business, adding ¥13.30 billion. The Glamping/Tourism Business adds a smaller portion with ¥990 million in revenue.

Vision Inc. seems to be making waves with its recent expansion of the GLOBAL WiFi Unlimited Plan, now covering 116 countries and regions, including new additions in Central Asia and the Middle East. This move aligns with their strategy to provide seamless connectivity globally, especially as they roll out 4G plans in Kazakhstan. Financially, Vision is trading at a significant discount of 56.5% below its estimated fair value and boasts a robust earnings growth of 23.1%, outpacing the Telecom industry average of 14.4%. The company also enjoys strong interest coverage with an EBIT ratio of 914 times its debt payments, indicating solid financial health amidst expanding operations.

- Click here to discover the nuances of Vision with our detailed analytical health report.

Understand Vision's track record by examining our Past report.

Next Steps

- Embark on your investment journey to our 4643 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Niva Bupa Health Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NIVABUPA

Solid track record with reasonable growth potential.

Market Insights

Community Narratives