Tianyang New Materials (Shanghai) Technology Co., Ltd. (SHSE:603330) Soars 26% But It's A Story Of Risk Vs Reward

Tianyang New Materials (Shanghai) Technology Co., Ltd. (SHSE:603330) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 51% share price decline over the last year.

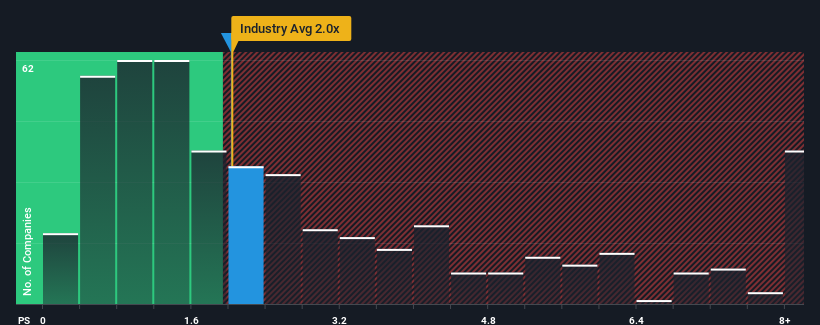

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Tianyang New Materials (Shanghai) Technology's P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in China is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Tianyang New Materials (Shanghai) Technology

How Tianyang New Materials (Shanghai) Technology Has Been Performing

Tianyang New Materials (Shanghai) Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Tianyang New Materials (Shanghai) Technology will help you uncover what's on the horizon.How Is Tianyang New Materials (Shanghai) Technology's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tianyang New Materials (Shanghai) Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.5%. Even so, admirably revenue has lifted 114% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 104% over the next year. With the industry only predicted to deliver 25%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Tianyang New Materials (Shanghai) Technology's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Tianyang New Materials (Shanghai) Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Tianyang New Materials (Shanghai) Technology's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Tianyang New Materials (Shanghai) Technology with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tianyang New Materials (Shanghai) Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603330

Tianyang New Materials (Shanghai) Technology

Tianyang New Materials (Shanghai) Technology Co., Ltd.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives