Exploring Zhejiang Huangma TechnologyLtd And 2 Other Promising Asian Small Caps

Reviewed by Simply Wall St

In the wake of renewed tariffs and trade policy uncertainties, global markets have experienced notable fluctuations, with smaller-cap indexes like the Russell 2000 and S&P MidCap 400 facing significant declines. Amidst this volatility, investors are increasingly interested in uncovering potential opportunities within Asian small-cap stocks that may offer resilience and growth prospects. Identifying promising stocks often involves assessing their ability to navigate economic challenges while capitalizing on regional strengths—qualities that Zhejiang Huangma Technology Ltd and two other Asian small caps exhibit as they emerge as intriguing candidates for exploration.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| YAPP Automotive Systems | 1.38% | -1.99% | -0.31% | ★★★★★★ |

| Lemtech Holdings | 49.04% | -1.33% | -4.79% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Ascentech K.K | NA | 133.18% | 172.84% | ★★★★★★ |

| Shenzhen Bsc TechnologyLtd | NA | 16.05% | 1.02% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 1.77% | 31.72% | ★★★★★★ |

| Torigoe | 9.03% | 4.76% | 8.35% | ★★★★★☆ |

| Well Lead Medical | 25.36% | 7.92% | 12.58% | ★★★★★☆ |

| Huang Hsiang Construction | 268.99% | 13.29% | 10.70% | ★★★★☆☆ |

| Sinomag Technology | 68.80% | 16.08% | 3.66% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Zhejiang Huangma TechnologyLtd (SHSE:603181)

Simply Wall St Value Rating: ★★★★★☆

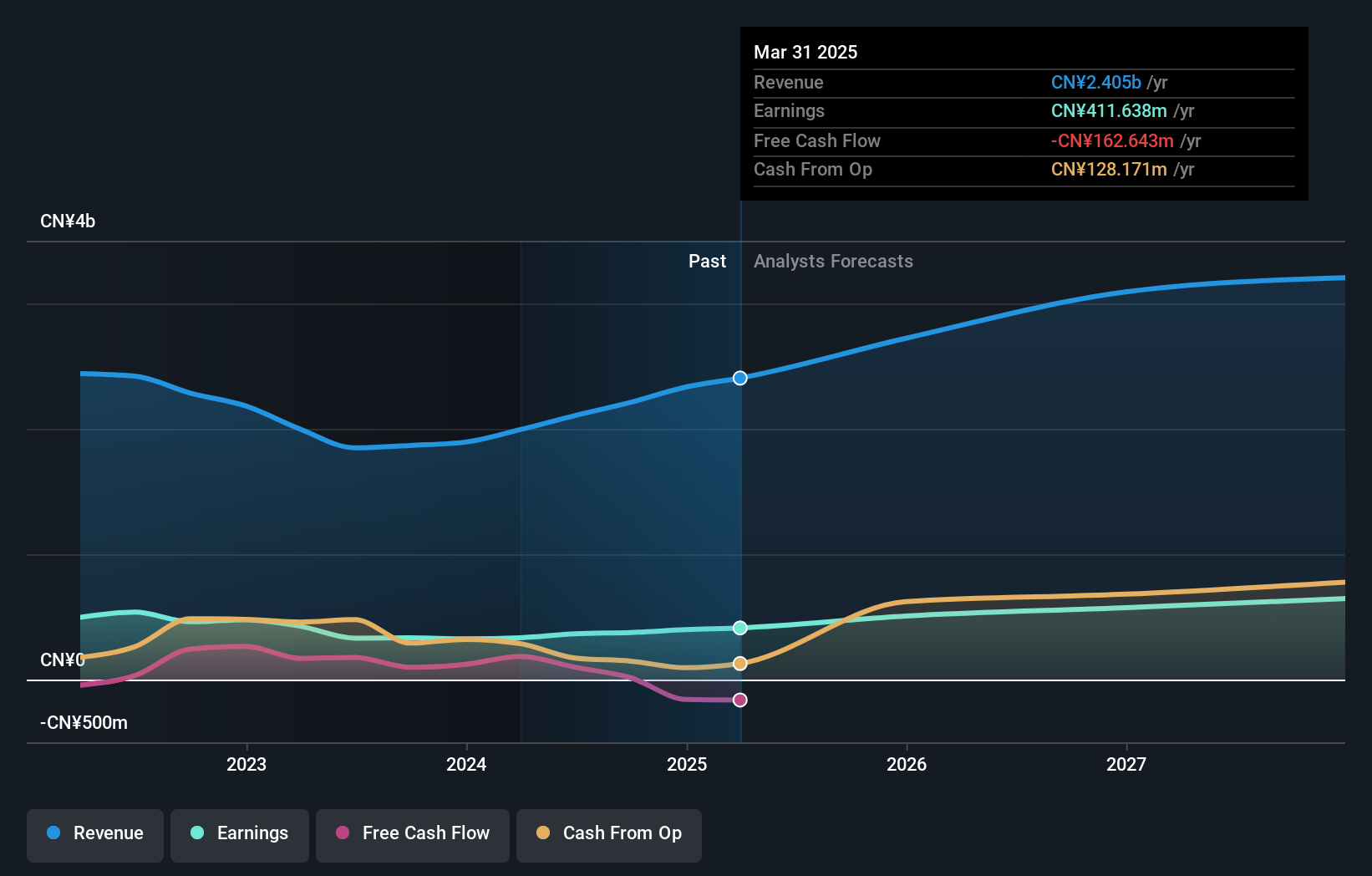

Overview: Zhejiang Huangma Technology Co., Ltd is engaged in the research, development, production, and sale of surfactants both domestically and internationally, with a market capitalization of approximately CN¥8.66 billion.

Operations: Zhejiang Huangma Technology generates revenue primarily from its specialty chemicals segment, amounting to CN¥2.40 billion.

Zhejiang Huangma Technology, a nimble player in the chemicals sector, has shown strong earnings growth of 23.3% over the past year, outpacing its industry peers at 4.5%. With a price-to-earnings ratio of 21x, it appears attractively valued compared to the broader CN market average of 42.4x. The company holds more cash than total debt, suggesting financial stability despite an increased debt-to-equity ratio from 3.3% to 12.1% over five years. While free cash flow remains negative, high non-cash earnings and strong profit coverage for interest payments highlight operational robustness amidst challenges.

Cisen Pharmaceutical (SHSE:603367)

Simply Wall St Value Rating: ★★★★★★

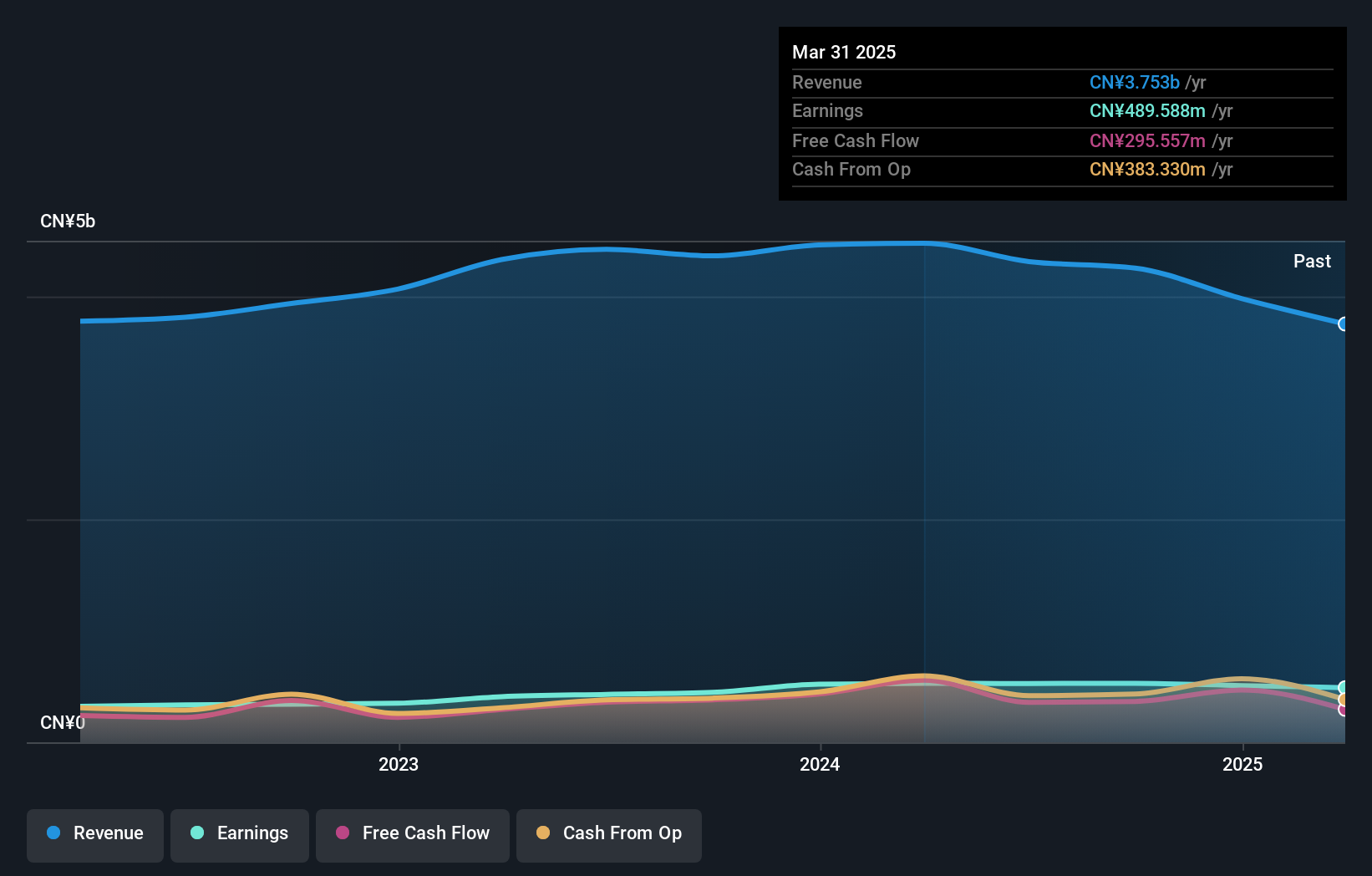

Overview: Cisen Pharmaceutical Co., Ltd. is involved in the research, development, production, and sale of drug products both in China and internationally, with a market cap of CN¥13.60 billion.

Operations: Cisen generates revenue primarily from pharmaceutical manufacturing, amounting to CN¥3.75 billion. The company's financial performance can be analyzed through its net profit margin, which provides insights into its profitability relative to total revenue.

Cisen Pharmaceutical stands out with its robust financial footing, having reduced its debt-to-equity ratio from 6.5 to 0.2 over five years, indicating a strong balance sheet. The company generates positive free cash flow and holds more cash than its total debt, underscoring financial stability. Despite a negative earnings growth of 7.3% last year against the industry average of 2.6%, it maintains high-quality earnings and covers interest payments comfortably. Its price-to-earnings ratio of 27.8x is attractive compared to the CN market's 42.4x, suggesting potential value for investors in this dynamic sector.

- Get an in-depth perspective on Cisen Pharmaceutical's performance by reading our health report here.

Explore historical data to track Cisen Pharmaceutical's performance over time in our Past section.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd is involved in the manufacturing of auto parts in China, with a market capitalization of CN¥9.37 billion.

Operations: Wuxi Longsheng Technology Co., Ltd generates revenue primarily from the manufacturing of auto parts. The company has a market capitalization of CN¥9.37 billion.

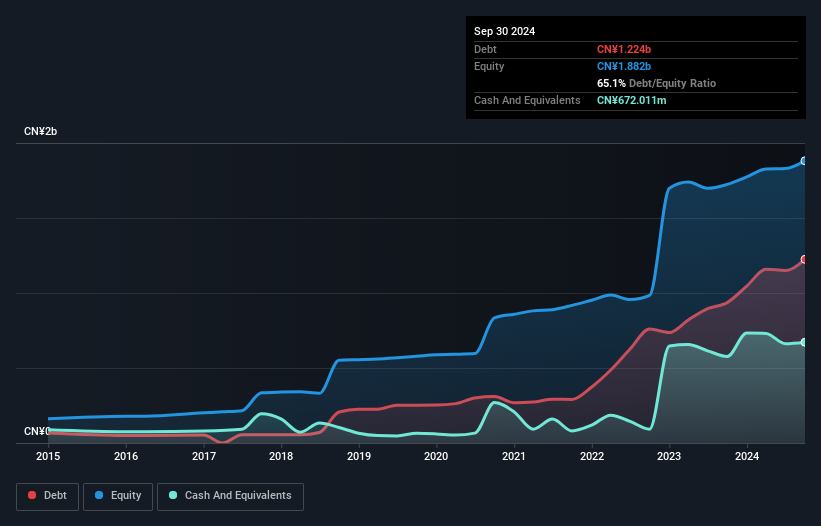

Wuxi Longsheng Technology, a notable player in the auto components sector, has shown impressive earnings growth of 44.9% over the past year, outpacing the industry average of 4.3%. The company's debt to equity ratio rose from 44.4% to 59.4% over five years, yet its net debt to equity remains satisfactory at 23.9%. With a price-to-earnings ratio of 40.7x below the CN market's average and well-covered interest payments at a multiple of 9.1 times EBIT, it seems poised for continued profitability despite recent one-off gains impacting results by CN¥49.8 million.

- Take a closer look at Wuxi Longsheng TechnologyLtd's potential here in our health report.

Gain insights into Wuxi Longsheng TechnologyLtd's past trends and performance with our Past report.

Make It Happen

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2569 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603367

Cisen Pharmaceutical

Research, develops, produces, and sells drug products in China and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)