Discovering HD Korea Shipbuilding & Offshore Engineering And 2 Other Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies and fluctuating interest rates, investors are keenly observing sectoral shifts and economic indicators for potential opportunities. Amidst this environment, identifying stocks that may be trading below their estimated value can offer strategic entry points for those looking to capitalize on market inefficiencies. In this context, a good stock is often characterized by strong fundamentals and potential for growth despite current market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$48.90 | HK$97.69 | 49.9% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.50 | 49.9% |

| SISB (SET:SISB) | THB31.75 | THB63.41 | 49.9% |

| Shoei (TSE:7839) | ¥2368.00 | ¥4720.11 | 49.8% |

| A.L.A. società per azioni (BIT:ALA) | €24.80 | €49.51 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1474.00 | ¥2940.30 | 49.9% |

| Enento Group Oyj (HLSE:ENENTO) | €18.06 | €36.11 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.87 | 50% |

| Saipem (BIT:SPM) | €2.327 | €4.65 | 50% |

| Credit Clear (ASX:CCR) | A$0.355 | A$0.71 | 50% |

Let's take a closer look at a couple of our picks from the screened companies.

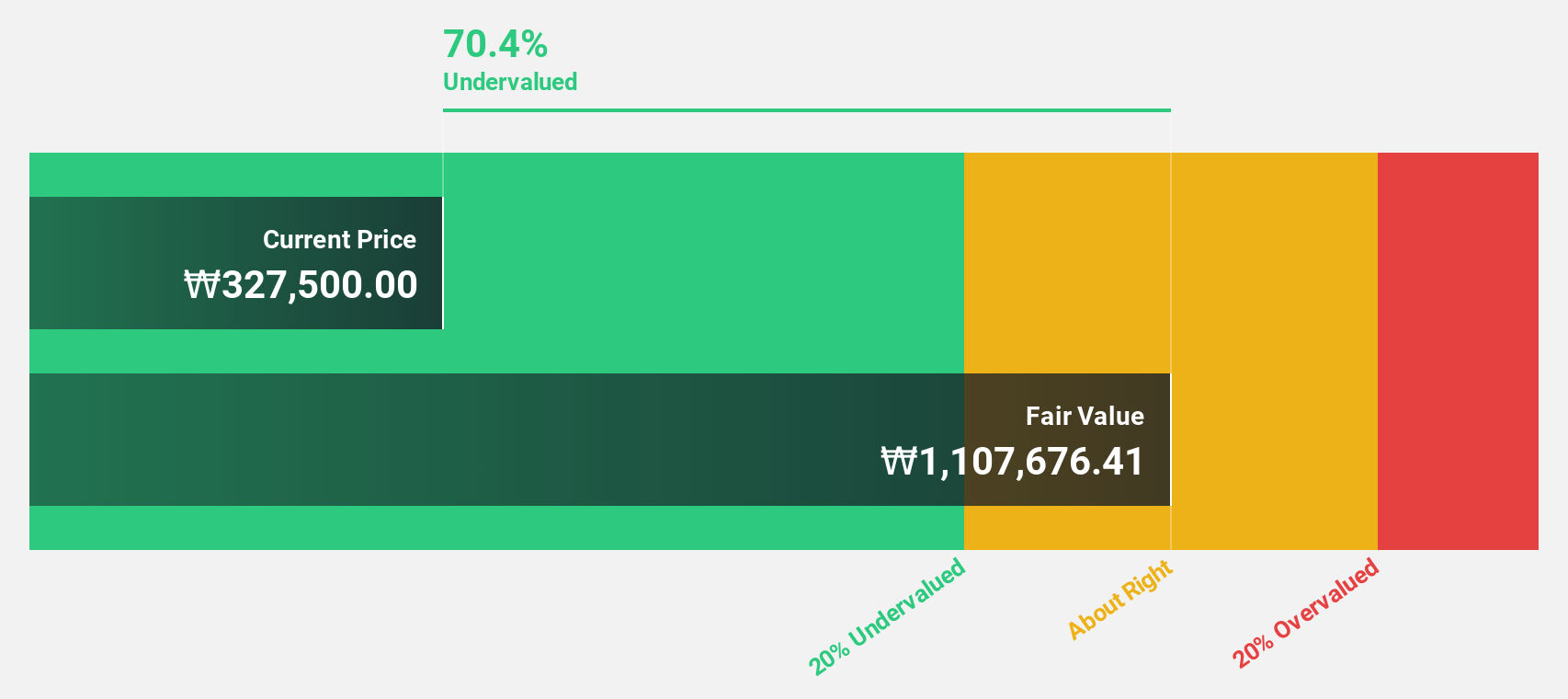

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. is a leading company in the shipbuilding and offshore engineering industry with a market cap of ₩14.43 trillion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for HD Korea Shipbuilding & Offshore Engineering Co., Ltd.

Estimated Discount To Fair Value: 49.5%

HD Korea Shipbuilding & Offshore Engineering is trading at ₩204,000, significantly below its estimated fair value of ₩403,788.45. With earnings expected to grow substantially over the next three years and revenue forecasted to outpace the South Korean market, the company presents a compelling case for undervaluation based on cash flows. Despite a decline in quarterly net income year-over-year, nine-month results showed strong sales growth and improved profitability compared to last year.

- Our growth report here indicates HD Korea Shipbuilding & Offshore Engineering may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of HD Korea Shipbuilding & Offshore Engineering.

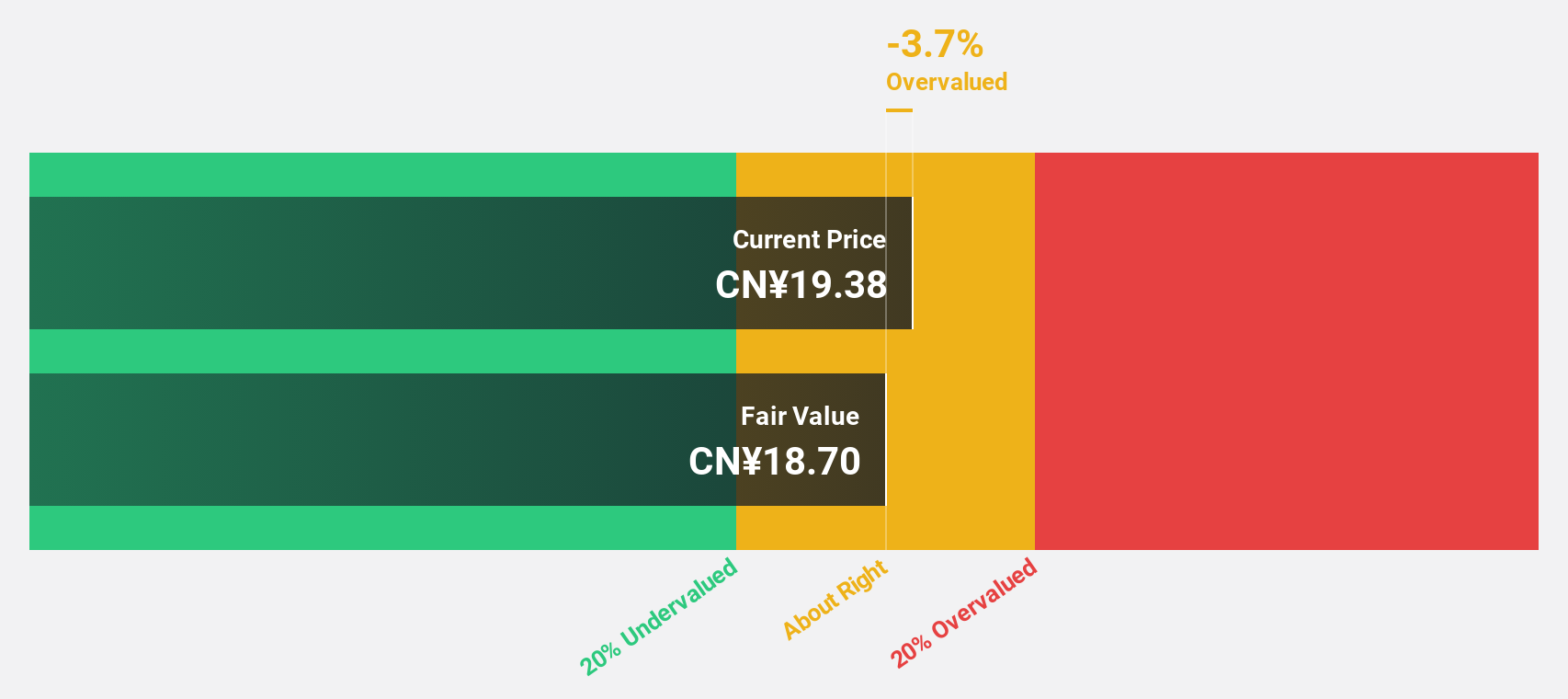

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin products with a market cap of CN¥121.88 billion.

Operations: The company's revenue segments include coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin products.

Estimated Discount To Fair Value: 35.8%

Ningxia Baofeng Energy Group, trading at CN¥16.62, is valued 35.8% below its estimated fair value of CN¥25.89, with earnings projected to grow significantly over the next three years, outpacing the broader Chinese market. Despite a high debt level and a dividend not well covered by free cash flows, recent earnings showed improved profitability and sales growth from CN¥20.4 billion to CN¥24.27 billion year-over-year for the first nine months of 2024.

- The analysis detailed in our Ningxia Baofeng Energy Group growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Ningxia Baofeng Energy Group's balance sheet health report.

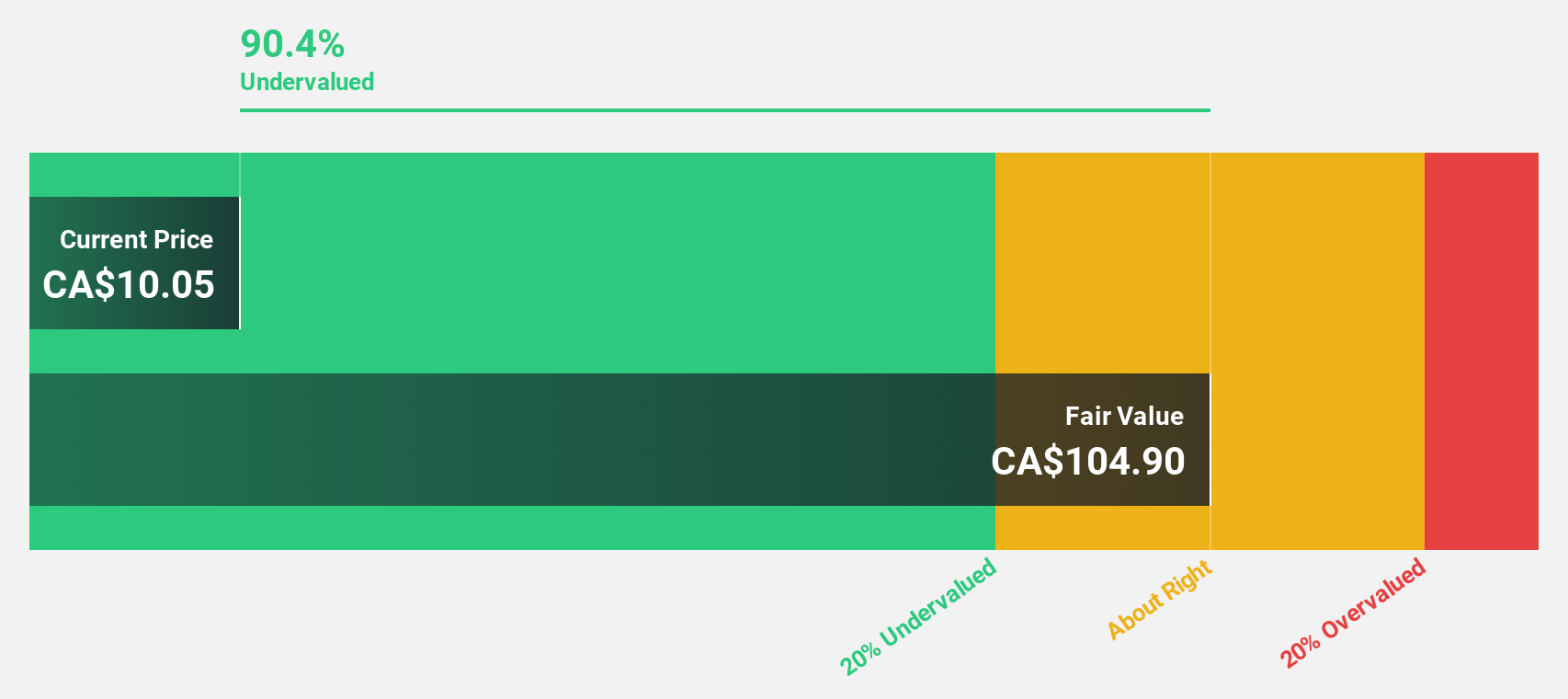

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. focuses on the mining, development, and exploration of minerals and precious metals mainly in Africa, with a market capitalization of CA$25.25 billion.

Operations: Ivanhoe Mines Ltd. generates revenue from its activities in mining, developing, and exploring minerals and precious metals across Africa.

Estimated Discount To Fair Value: 10.7%

Ivanhoe Mines, priced at CA$18.72, is trading 10.7% below its estimated fair value of CA$20.95, with earnings forecasted to grow significantly over the next three years at 43.2% annually, surpassing the Canadian market's growth rate. Recent operational achievements include record copper production and milling rates at the Kamoa-Kakula Copper Complex in October 2024, enhancing cash flows despite a decline in year-to-date net income compared to last year.

- Insights from our recent growth report point to a promising forecast for Ivanhoe Mines' business outlook.

- Dive into the specifics of Ivanhoe Mines here with our thorough financial health report.

Where To Now?

- Investigate our full lineup of 921 Undervalued Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Baofeng Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600989

Ningxia Baofeng Energy Group

Produces, processes, and sells coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed, methanol, and olefin products.

Good value with reasonable growth potential.