- Taiwan

- /

- Semiconductors

- /

- TWSE:2330

December 2024's Top Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism amid recent rate cuts and political uncertainty, investors are keenly observing the implications for stock valuations. In this environment, identifying stocks that may be trading below their estimated value becomes crucial, as these opportunities can offer potential resilience and growth despite broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$263.50 | NT$530.63 | 50.3% |

| Wasion Holdings (SEHK:3393) | HK$7.14 | HK$14.05 | 49.2% |

| Kuaishou Technology (SEHK:1024) | HK$43.05 | HK$84.84 | 49.3% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.11 | 49.8% |

| GlobalData (AIM:DATA) | £1.87 | £3.74 | 50% |

| T'Way Air (KOSE:A091810) | ₩2510.00 | ₩5028.62 | 50.1% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.90 | 50% |

| Medley (TSE:4480) | ¥3795.00 | ¥7634.96 | 50.3% |

| GRCS (TSE:9250) | ¥1413.00 | ¥2824.56 | 50% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.61 | 49.9% |

Let's explore several standout options from the results in the screener.

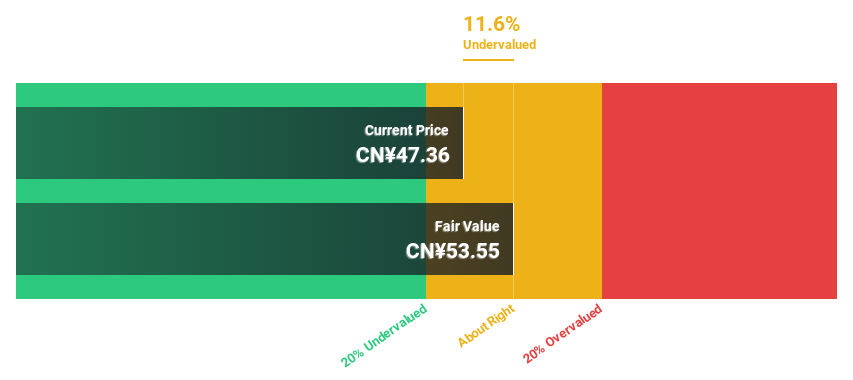

Ningxia Baofeng Energy Group (SHSE:600989)

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining and various chemical products, with a market capitalization of approximately CN¥114.69 billion.

Operations: The company generates revenue from coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefin products.

Estimated Discount To Fair Value: 38%

Ningxia Baofeng Energy Group is trading at CNY 16.17, significantly below its estimated fair value of CNY 26.08, indicating it may be undervalued based on cash flows. Despite high debt levels, the company shows strong financial performance with a net income increase to CNY 4.54 billion for the first nine months of 2024 and an expected annual earnings growth rate of 38.5%, surpassing market averages and suggesting robust future profitability potential.

- Our expertly prepared growth report on Ningxia Baofeng Energy Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Ningxia Baofeng Energy Group here with our thorough financial health report.

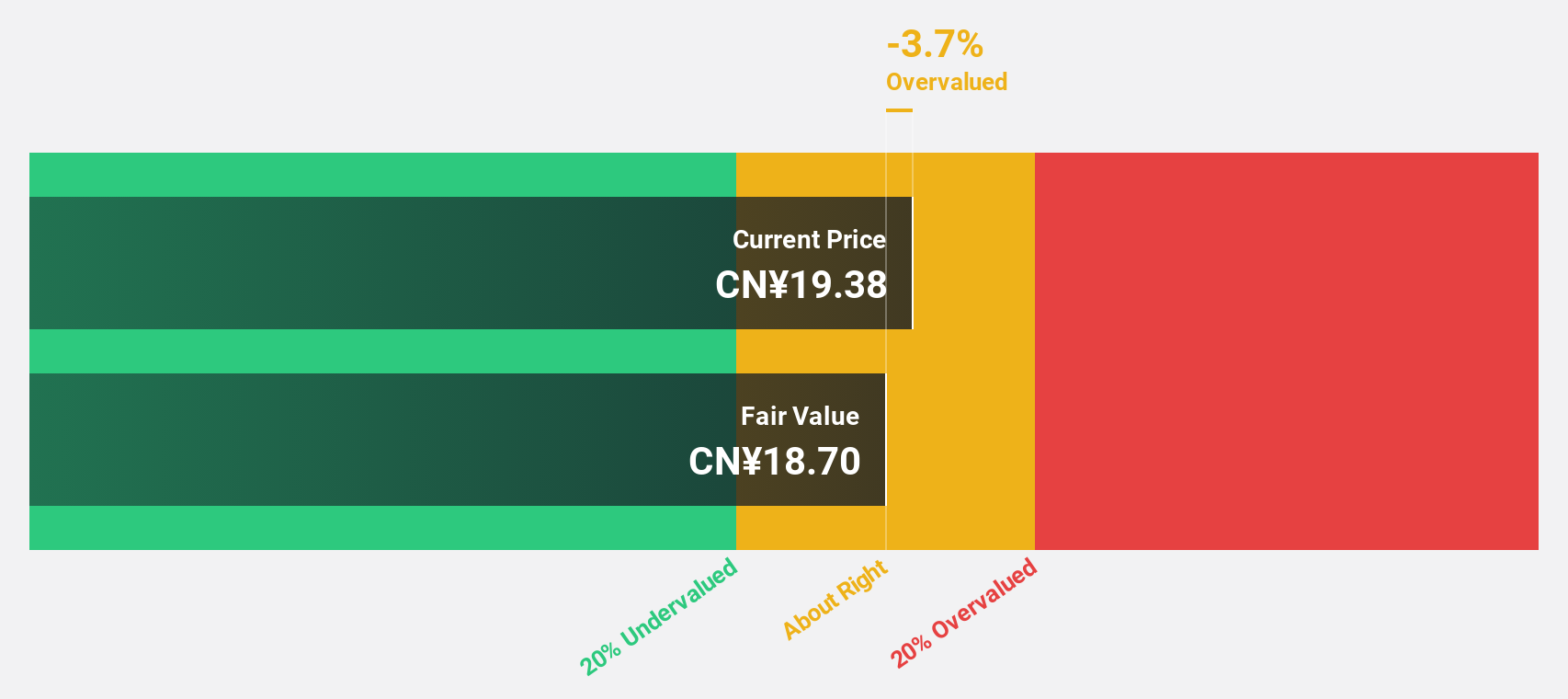

Guobo Electronics (SHSE:688375)

Overview: Guobo Electronics Co., Ltd. specializes in the R&D, production, and sale of active phased array transmitter and receiver components and RF integrated circuit products in China, with a market cap of CN¥28.14 billion.

Operations: Guobo Electronics generates revenue through its focus on active phased array transmitter and receiver components, as well as radio frequency integrated circuit products in China.

Estimated Discount To Fair Value: 10.3%

Guobo Electronics is trading at CN¥47.99, slightly below its estimated fair value of CN¥53.5, reflecting limited undervaluation based on cash flows. Despite recent declines in revenue and net income compared to the previous year, the company is expected to see significant earnings growth of 27.45% annually over the next three years, outpacing market averages. However, its return on equity remains low and share price volatility persists.

- Our growth report here indicates Guobo Electronics may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Guobo Electronics.

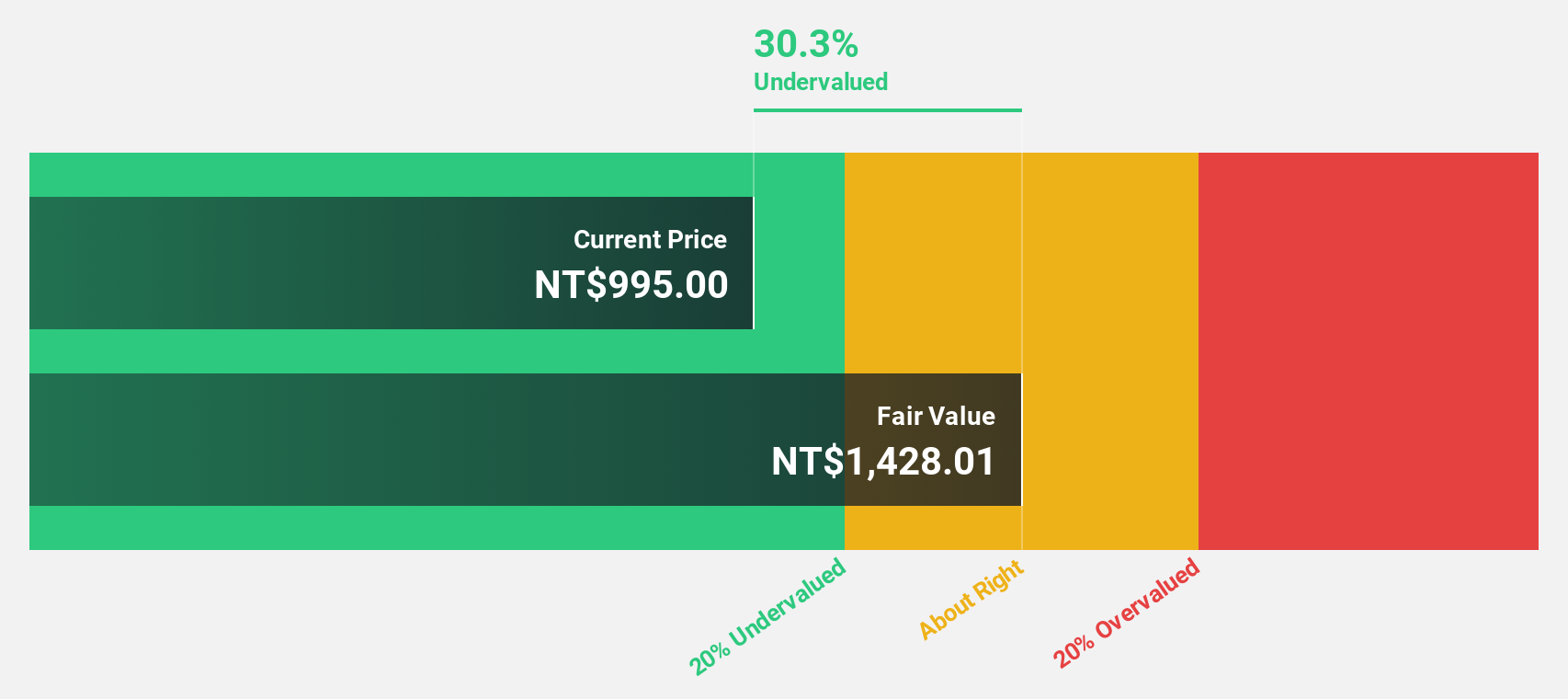

Taiwan Semiconductor Manufacturing (TWSE:2330)

Overview: Taiwan Semiconductor Manufacturing Company Limited is a global leader in the manufacturing, packaging, testing, and sale of integrated circuits and semiconductor devices across various regions including Taiwan, China, Europe, the Middle East, Africa, Japan, and the United States with a market cap of NT$28.01 trillion.

Operations: The company's revenue is primarily derived from its Foundry segment, which generated NT$2.65 trillion.

Estimated Discount To Fair Value: 17%

Taiwan Semiconductor Manufacturing is trading at NT$1,080, approximately 17% below its fair value of NT$1,301.07 based on discounted cash flow analysis. Recent revenue growth of 31.8% year-to-date and a strategic partnership with ROHM for GaN power devices highlight strong operational momentum. Despite earnings growth forecasts of 19.64% annually, slightly above the Taiwan market average, its valuation discount is modest rather than significant by our criteria.

- Our comprehensive growth report raises the possibility that Taiwan Semiconductor Manufacturing is poised for substantial financial growth.

- Click here to discover the nuances of Taiwan Semiconductor Manufacturing with our detailed financial health report.

Taking Advantage

- Click this link to deep-dive into the 872 companies within our Undervalued Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2330

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives