- China

- /

- Metals and Mining

- /

- SHSE:600988

March 2025 Global Growth Companies With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and trade uncertainties, major indices like the S&P 500 and Dow Jones have faced consecutive weeks of losses, reflecting broader economic anxieties. In such volatile times, companies with high insider ownership can signal strong internal confidence, potentially offering a layer of stability amidst market turbulence.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 44.7% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| Synspective (TSE:290A) | 13.2% | 37.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Chifeng Jilong Gold MiningLtd (SHSE:600988)

Simply Wall St Growth Rating: ★★★★☆☆

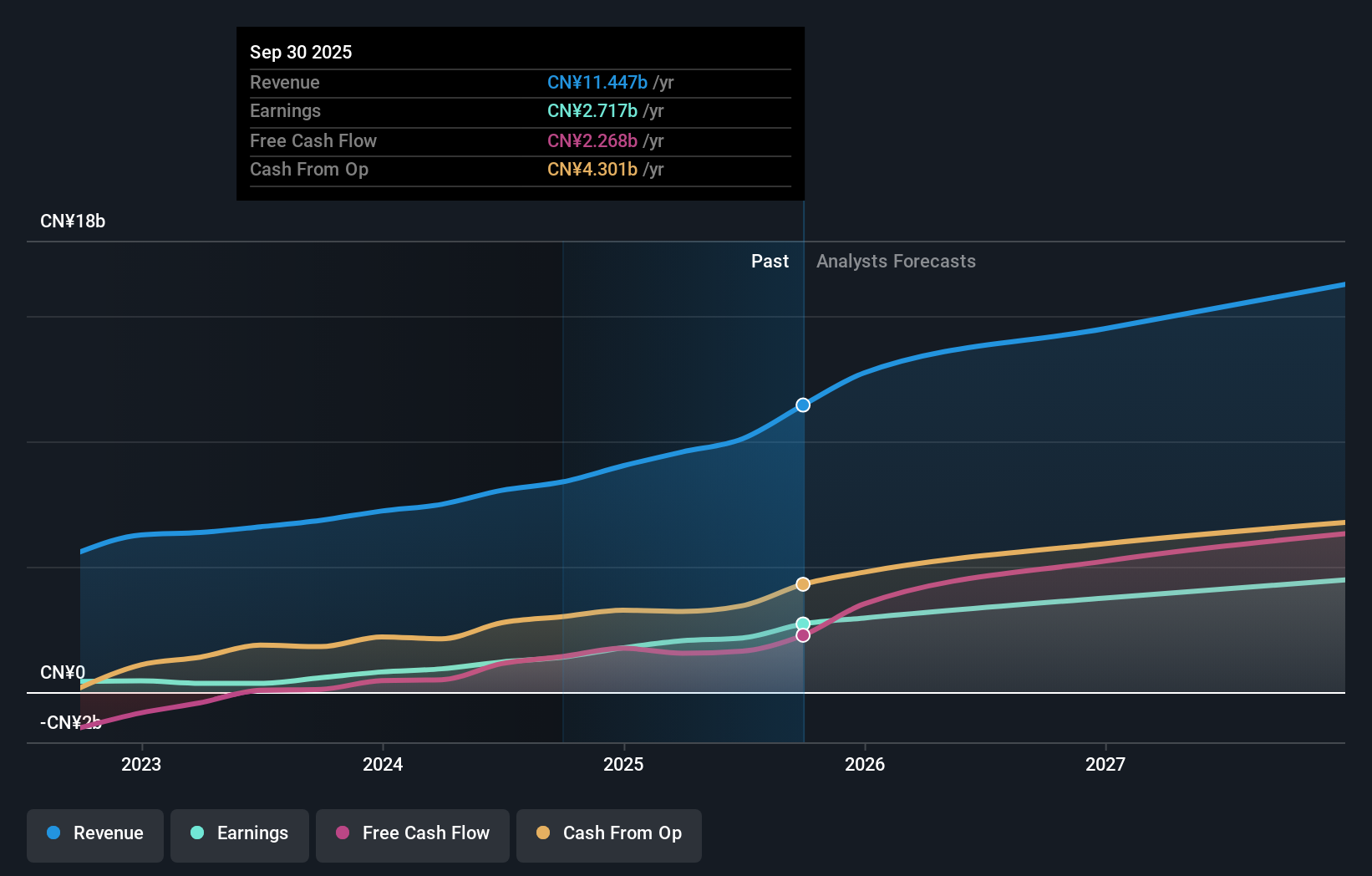

Overview: Chifeng Jilong Gold Mining Co., Ltd. is engaged in the mining of gold and non-ferrous metals, with a market capitalization of CN¥35.13 billion.

Operations: The company's revenue is primarily derived from its operations in gold and non-ferrous metal mining.

Insider Ownership: 14.1%

Earnings Growth Forecast: 21.6% p.a.

Chifeng Jilong Gold Mining Ltd. shows promising growth potential with earnings having grown by 141.7% over the past year and forecasted to grow at 21.6% annually, although slightly below the CN market average of 25.1%. The company recently completed a follow-on equity offering raising HK$3.64 billion, which may support further expansion efforts. Despite trading at a significant discount to its estimated fair value, revenue growth is expected to be moderate at 14.6% per year.

- Get an in-depth perspective on Chifeng Jilong Gold MiningLtd's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Chifeng Jilong Gold MiningLtd's shares may be trading at a discount.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. is a diversified company offering e-commerce, fintech, digital content, and communications services both in Japan and internationally, with a market cap of approximately ¥1.95 trillion.

Operations: The company's revenue segments include Mobile at ¥440.70 billion, Fin Tech at ¥820.42 billion, and Internet Services at ¥1.28 trillion.

Insider Ownership: 27.7%

Earnings Growth Forecast: 66.7% p.a.

Rakuten Group is poised for growth, with revenue projected to increase by 7.1% annually, outpacing the broader JP market. Despite current low return on equity forecasts of 12%, earnings are expected to grow significantly at 66.69% per year and become profitable within three years. Recent board changes and proposed amendments to its Articles of Incorporation indicate strategic shifts. The stock trades at a substantial discount to its estimated fair value, yet remains highly volatile.

- Click to explore a detailed breakdown of our findings in Rakuten Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that Rakuten Group is priced lower than what may be justified by its financials.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★☆☆

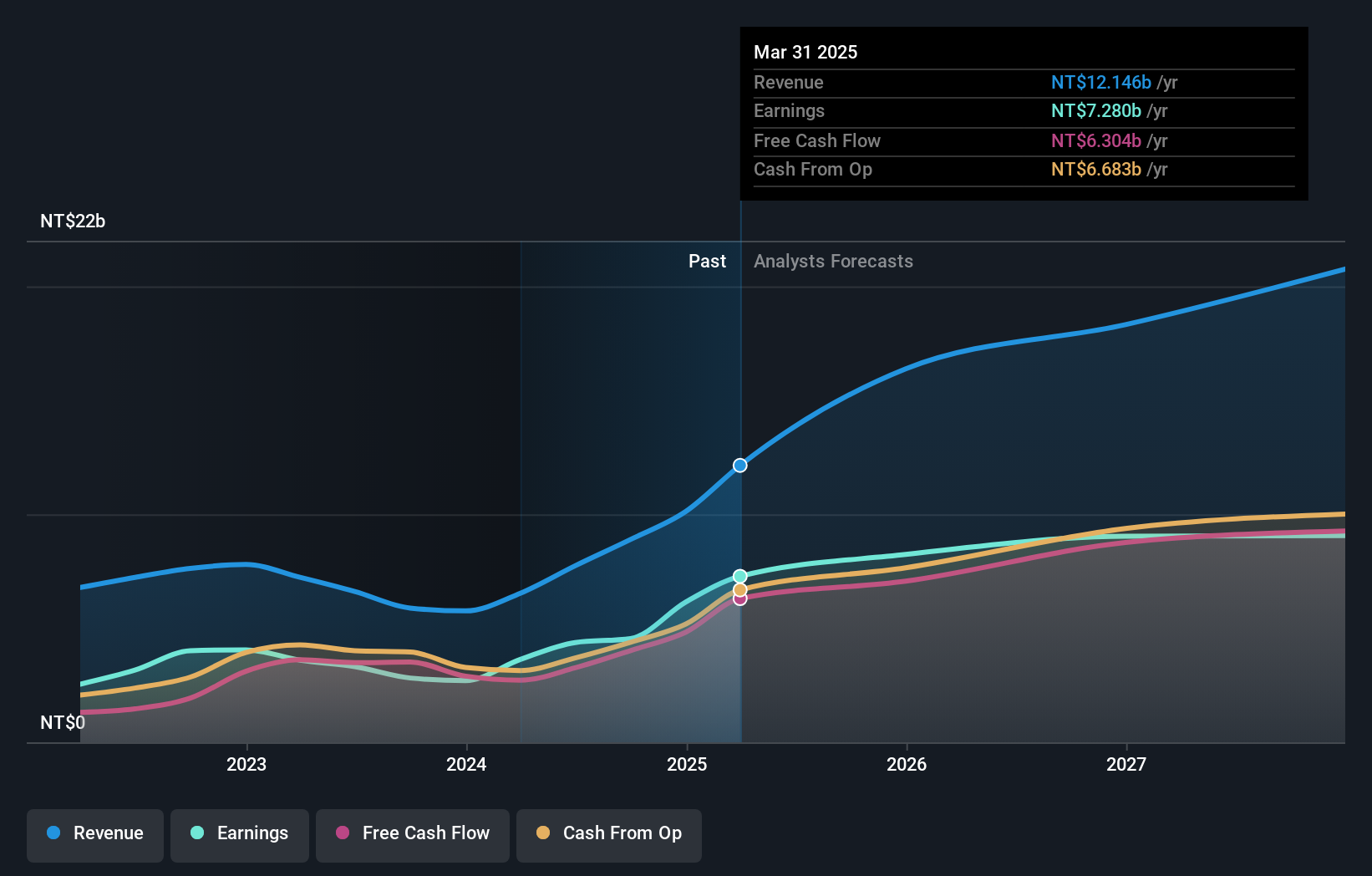

Overview: King Slide Works Co., Ltd. and its subsidiaries focus on the R&D, design, and sale of rail kits for servers and network communication equipment in Taiwan, with a market cap of NT$182.49 billion.

Operations: The company's revenue segments include NT$2.18 billion from King Slide Works Co., Ltd. and NT$8.36 billion from King Slide Technology Co., Ltd.

Insider Ownership: 14.3%

Earnings Growth Forecast: 12.5% p.a.

King Slide Works shows strong growth potential, with revenue increasing significantly from TWD 5.76 billion to TWD 10.13 billion in the past year, and earnings more than doubling to TWD 6.16 billion. Despite high volatility in its share price, the company is expected to outpace market revenue growth at 21.4% annually but will see slower earnings growth compared to the Taiwan market average. Insider ownership remains stable without recent significant insider trading activity.

- Dive into the specifics of King Slide Works here with our thorough growth forecast report.

- Our valuation report unveils the possibility King Slide Works' shares may be trading at a premium.

Key Takeaways

- Access the full spectrum of 888 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600988

Chifeng Jilong Gold MiningLtd

Operates as a gold and non-ferrous metal mining company.

Flawless balance sheet with solid track record.