- France

- /

- Capital Markets

- /

- ENXTPA:VIL

3 Dividend Stocks To Consider With Up To 7.4% Yield

Reviewed by Simply Wall St

Amid recent market volatility driven by geopolitical tensions, consumer spending concerns, and fluctuating economic indicators, investors are increasingly seeking stability in their portfolios. In such an uncertain environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to balance risk with reward.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2011 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

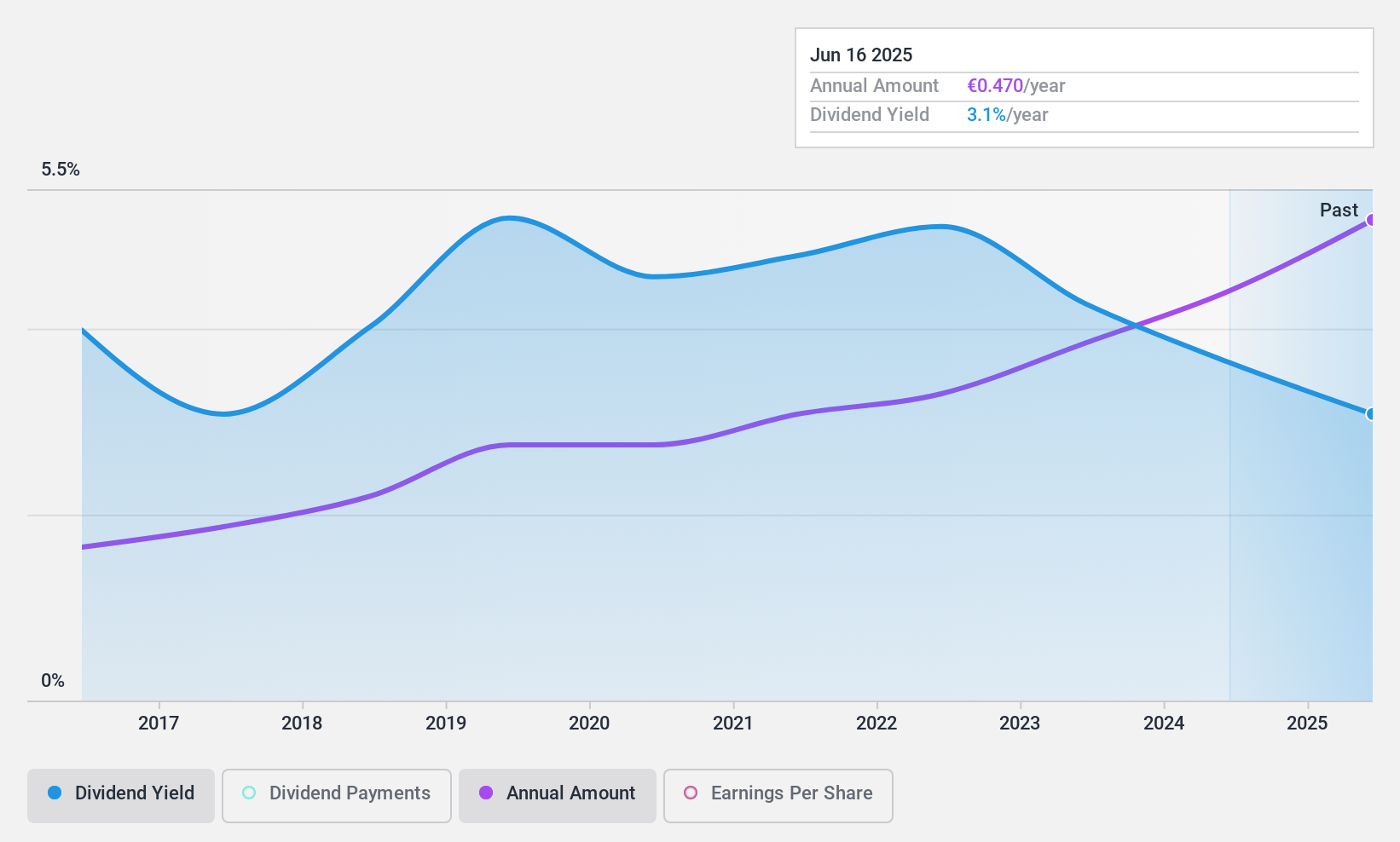

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market cap of €768.31 million.

Operations: VIEL & Cie's revenue segments consist of Professional Intermediation (€1.05 billion), Stock Exchange Online (€71.02 million), and Contribution from Holdings (€3.63 million).

Dividend Yield: 3.3%

VIEL & Cie société anonyme offers a stable and reliable dividend, with payments consistently increasing over the past decade. The dividend yield of 3.25% is lower than the top 25% of French market payers but remains well-covered by both earnings and cash flows, with payout ratios around 22%. Despite trading at a discount to its estimated fair value, its upcoming earnings release on February 7, 2025, may provide further insights into future performance.

- Dive into the specifics of VIEL & Cie société anonyme here with our thorough dividend report.

- Our expertly prepared valuation report VIEL & Cie société anonyme implies its share price may be lower than expected.

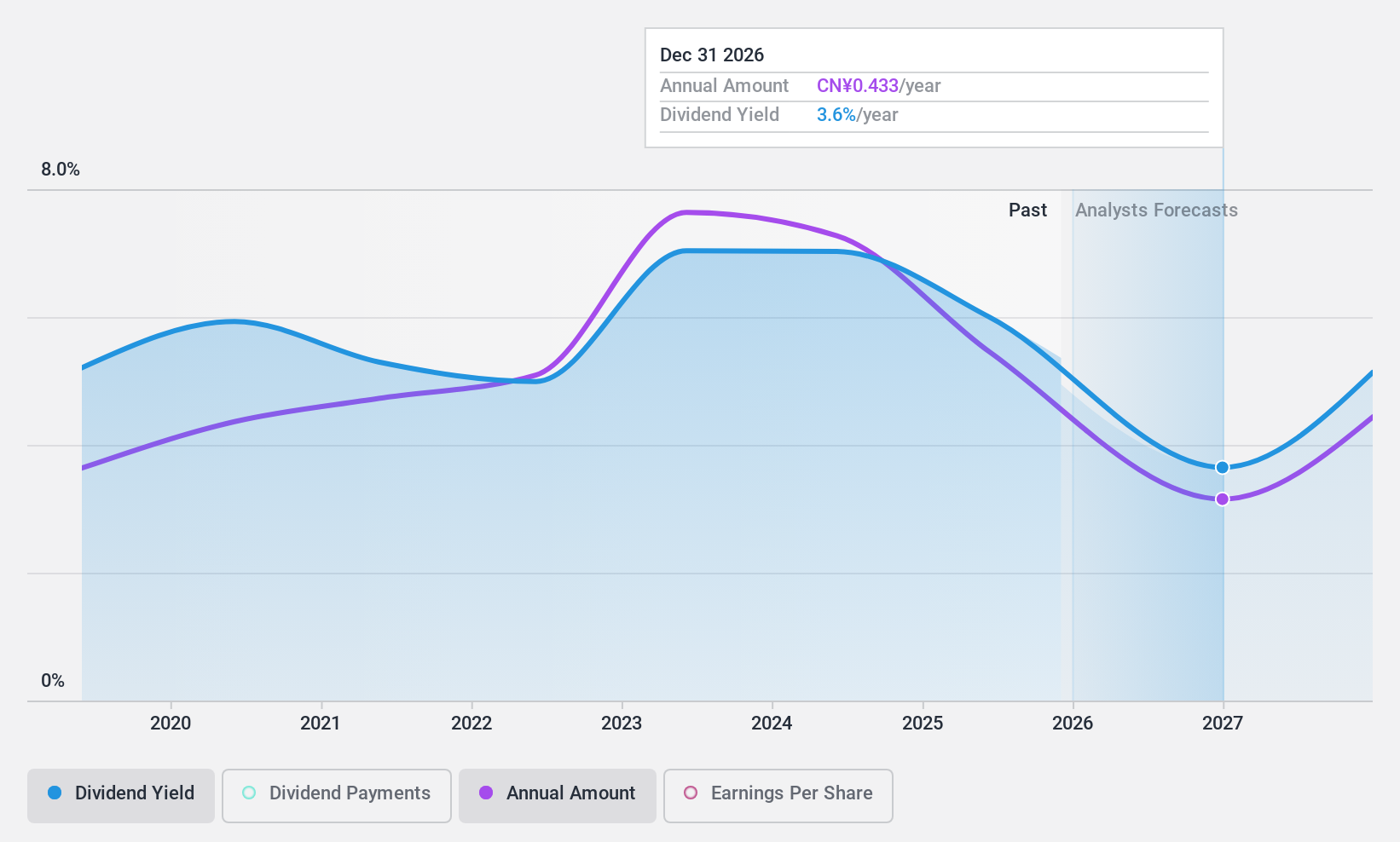

Huaibei Mining HoldingsLtd (SHSE:600985)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huaibei Mining Holdings Co., Ltd. is involved in coal mining, washing, processing, sales, and storage operations in China with a market cap of CN¥36.12 billion.

Operations: Huaibei Mining Holdings Co., Ltd. generates revenue through its operations in coal mining, washing, processing, sales, and storage within China.

Dividend Yield: 7.5%

Huaibei Mining Holdings Ltd. offers a high dividend yield, ranking in the top 25% of CN market payers. The dividends are well-covered by earnings with a payout ratio of 48.7% and cash flows at 70.1%. While dividends have been stable and reliable, they have only been paid for six years. Trading below its estimated fair value, it presents good relative value compared to peers despite recent declines in profit margins from last year.

- Unlock comprehensive insights into our analysis of Huaibei Mining HoldingsLtd stock in this dividend report.

- Our valuation report here indicates Huaibei Mining HoldingsLtd may be undervalued.

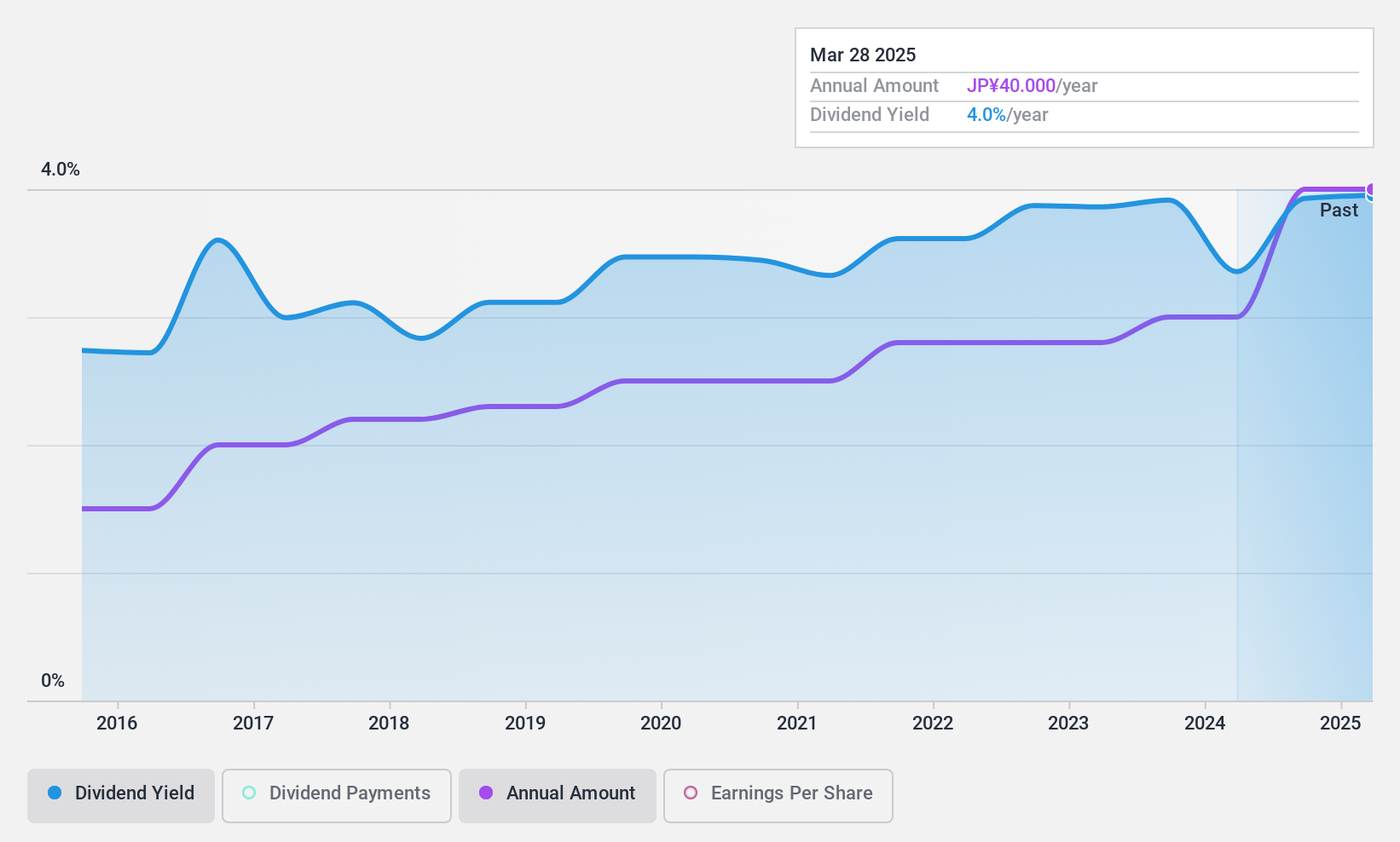

Nippon Air conditioning Services (TSE:4658)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Air Conditioning Services Co., Ltd. specializes in providing air conditioning and related services, with a market cap of ¥34.59 billion.

Operations: Nippon Air Conditioning Services Co., Ltd. generates its revenue primarily from Maintenance Services and Renewal Construction, amounting to ¥62.80 billion.

Dividend Yield: 4%

Nippon Air Conditioning Services offers a dividend yield of 3.99%, placing it in the top 25% of JP market payers, though not covered by free cash flows. The payout ratio is reasonable at 52.4%, indicating dividends are supported by earnings. Over the past decade, dividends have been stable and reliable with consistent growth. Trading at a price-to-earnings ratio of 12x, it presents good value relative to peers and industry standards.

- Click to explore a detailed breakdown of our findings in Nippon Air conditioning Services' dividend report.

- Our valuation report unveils the possibility Nippon Air conditioning Services' shares may be trading at a discount.

Make It Happen

- Get an in-depth perspective on all 2011 Top Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in France, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)