- China

- /

- Metals and Mining

- /

- SHSE:600595

Exploring February 2025's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile corporate earnings and geopolitical tariff tensions, small-cap stocks face unique challenges and opportunities. Amidst this backdrop, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and adaptability in the face of fluctuating economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Petrolimex Insurance | 32.25% | 4.70% | 7.91% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Henan Zhongfu IndustrialLtd (SHSE:600595)

Simply Wall St Value Rating: ★★★★★★

Overview: Henan Zhongfu Industrial Co., Ltd engages in the processing, manufacturing, and sale of electrolytic aluminum and aluminum products in China with a market cap of CN¥12.31 billion.

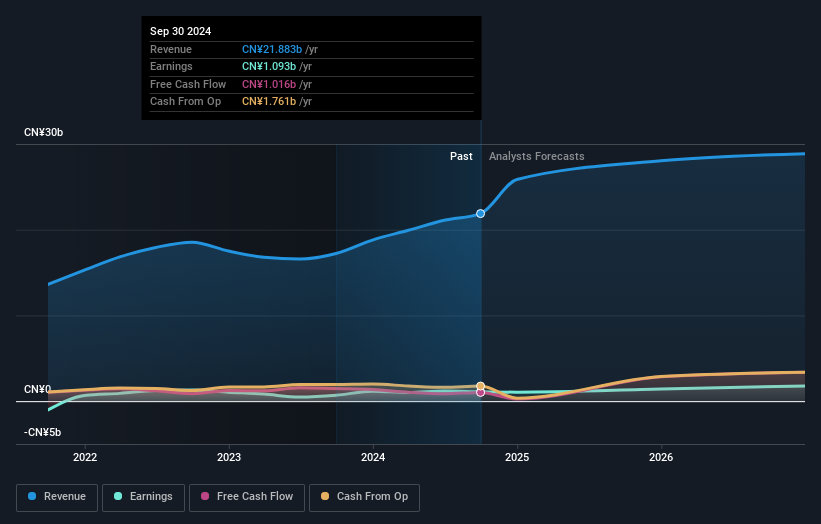

Operations: The company generates revenue primarily from the sale of electrolytic aluminum and aluminum products. Its net profit margin is a key financial metric to consider, reflecting the company's profitability relative to its total revenue.

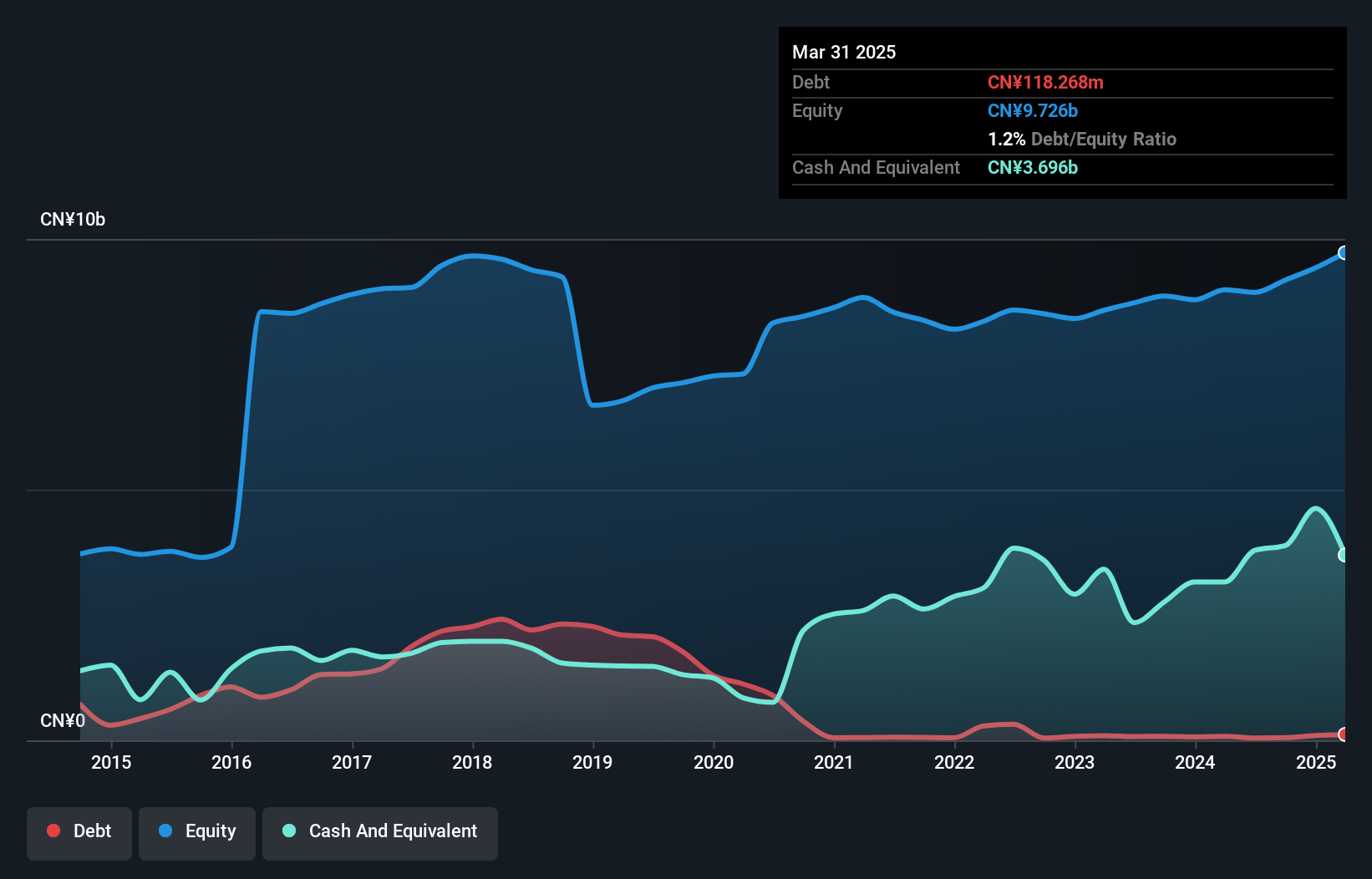

Henan Zhongfu, a dynamic player in the metals and mining sector, has shown impressive financial health with its net debt to equity ratio standing at a satisfactory 20.2%, significantly reduced from 215.3% over five years. The company has been trading at 79.2% below its estimated fair value, suggesting potential undervaluation compared to peers. Earnings growth of 58.4% last year outpaced the industry average of -2.3%, indicating robust operational performance and high-quality earnings that are well-covered by EBIT at 5.7 times interest payments, providing confidence in its ability to manage debt obligations effectively.

- Take a closer look at Henan Zhongfu IndustrialLtd's potential here in our health report.

Understand Henan Zhongfu IndustrialLtd's track record by examining our Past report.

Zhongshan Broad-Ocean Motor (SZSE:002249)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongshan Broad-Ocean Motor Co., Ltd. operates in the motor systems industry in China with a market capitalization of CN¥13.95 billion.

Operations: Broad-Ocean Motor generates revenue primarily from its motor systems business in China. The company's financial performance includes a notable net profit margin trend, reflecting its ability to manage costs relative to revenue.

Zhongshan Broad-Ocean Motor, a notable player in the electrical industry, showcases impressive financial health with earnings growth of 50% over the past year, outpacing the sector's 0.8%. The company trades at a significant discount of 47.5% below its estimated fair value, suggesting potential upside for investors. Over five years, its debt-to-equity ratio has impressively decreased from 24.8% to just 0.6%, highlighting robust balance sheet management. Free cash flow remains positive and interest coverage is strong, indicating sound operational efficiency and financial stability amidst evolving market conditions in China’s dynamic motor industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of Zhongshan Broad-Ocean Motor.

Gain insights into Zhongshan Broad-Ocean Motor's past trends and performance with our Past report.

NINGBO HENGSHUAI (SZSE:300969)

Simply Wall St Value Rating: ★★★★★★

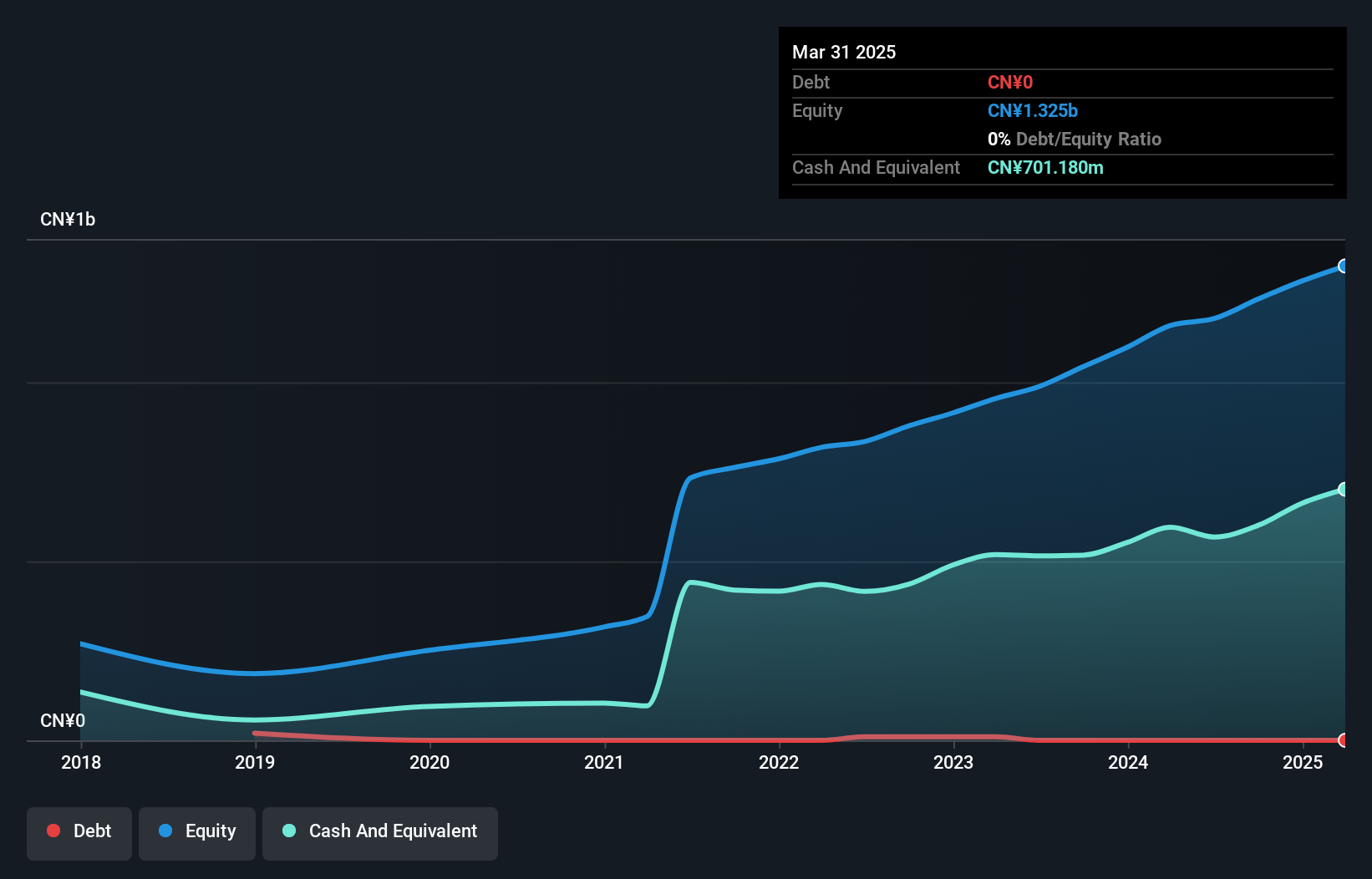

Overview: Ningbo Hengshuai Co., Ltd. is engaged in the global production and distribution of automotive micro-motors and components, with a market capitalization of CN¥7.76 billion.

Operations: Ningbo Hengshuai generates revenue primarily from its Auto Parts & Accessories segment, amounting to CN¥965.11 million. The company's financial performance is influenced by the cost structure associated with manufacturing and selling these automotive components.

Hengshuai, a player in the auto components sector, has shown promising growth with earnings increasing by 14.7% over the past year, outpacing the industry's 10.5%. The company is debt-free and reported high-quality earnings, which suggests robust financial health. Its free cash flow turned positive recently at US$109.28 million as of September 2024, indicating improved operational efficiency despite capital expenditures of US$108.75 million during the same period. With earnings projected to grow at an impressive rate of 22% annually, Hengshuai seems poised for continued expansion in its market niche.

- Navigate through the intricacies of NINGBO HENGSHUAI with our comprehensive health report here.

Evaluate NINGBO HENGSHUAI's historical performance by accessing our past performance report.

Taking Advantage

- Reveal the 4713 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henan Zhongfu IndustrialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600595

Henan Zhongfu IndustrialLtd

Processes, manufactures, and sells electrolytic aluminum and aluminum products in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives