- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2428

Discovering February 2025's Hidden Stock Gems

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by accelerating U.S. inflation and small-cap stocks lagging behind their larger counterparts, investors are keenly observing how these dynamics might influence the performance of lesser-known equities. With major indices like the S&P 500 and Nasdaq Composite nearing record highs, yet small caps trailing, the search for hidden stock gems becomes particularly intriguing. In this environment, identifying stocks with strong fundamentals and resilience to economic shifts can be crucial for uncovering potential opportunities in February 2025's market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Li Ming Development Construction | 236.64% | 31.54% | 34.00% | ★★★★☆☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

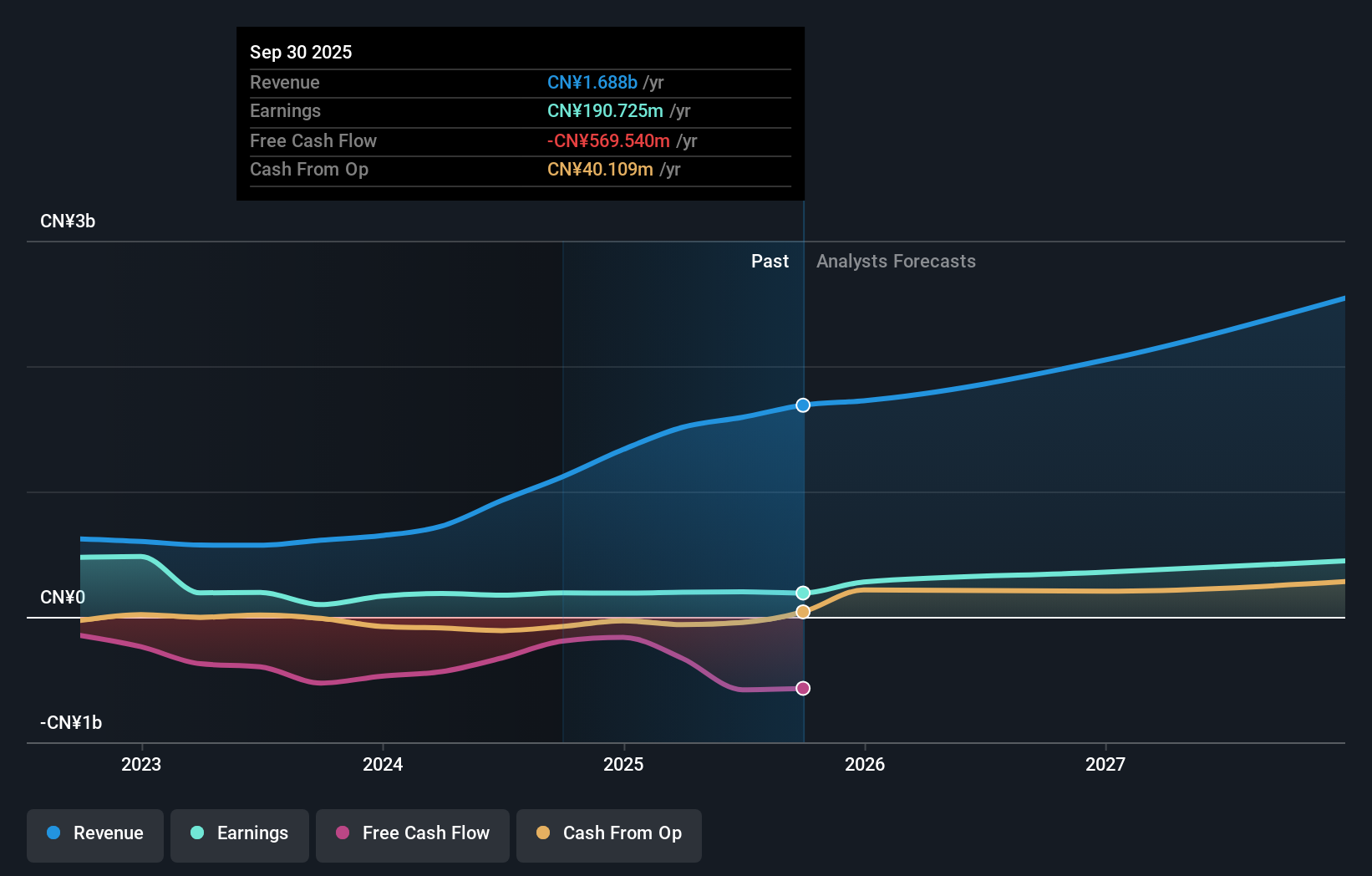

Zhejiang Hengtong HoldingLtd (SHSE:600226)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Hengtong Holding Co., Ltd. engages in the research, development, production, and sale of biological pesticides, veterinary drugs, and animal feed additives both within China and internationally, with a market capitalization of CN¥8.24 billion.

Operations: The company generates revenue through the sale of biological pesticides, veterinary drugs, and animal feed additives. The net profit margin is a key financial metric to consider when evaluating its profitability.

Zhejiang Hengtong Holding Ltd. shows promising growth with earnings surging 94% over the past year, outpacing the Chemicals industry's -5% performance. Despite its small size, it boasts high-quality earnings and maintains interest coverage without issues. The company's financial health is underscored by having more cash than total debt, although the debt-to-equity ratio has risen from 8.3 to 9.6 over five years, suggesting a cautious approach might be necessary regarding leverage trends. Recent shareholder meetings indicate active governance, which could steer future strategic decisions positively in this dynamic sector.

- Click here to discover the nuances of Zhejiang Hengtong HoldingLtd with our detailed analytical health report.

Understand Zhejiang Hengtong HoldingLtd's track record by examining our Past report.

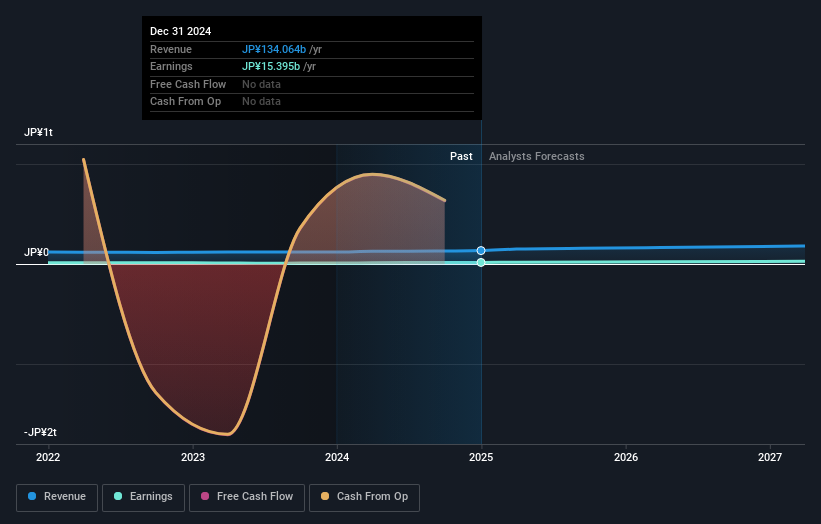

North Pacific BankLtd (TSE:8524)

Simply Wall St Value Rating: ★★★★☆☆

Overview: North Pacific Bank Ltd. offers a range of banking products and services for individuals and corporations in Japan, with a market capitalization of ¥189.45 billion.

Operations: North Pacific Bank Ltd. generates revenue primarily through interest income and fees from its banking services. The company has a market capitalization of ¥189.45 billion, reflecting its significant presence in the Japanese financial sector.

With assets totaling ¥13,175.9 billion and equity of ¥416.1 billion, North Pacific Bank showcases a robust financial foundation. Its deposits stand at ¥10,952.8 billion while loans amount to ¥7,806.1 billion, supported by a net interest margin of 0.6%. The bank's bad loans are at an appropriate level of 1.1%, though the allowance for these is relatively low at 53%. Impressively, earnings have surged by 71%, outpacing industry growth significantly and hinting at its potential as an undiscovered gem in the banking sector. Recently announced dividends are set to rise from JPY 5 to JPY 9 per share this fiscal year.

- Delve into the full analysis health report here for a deeper understanding of North Pacific BankLtd.

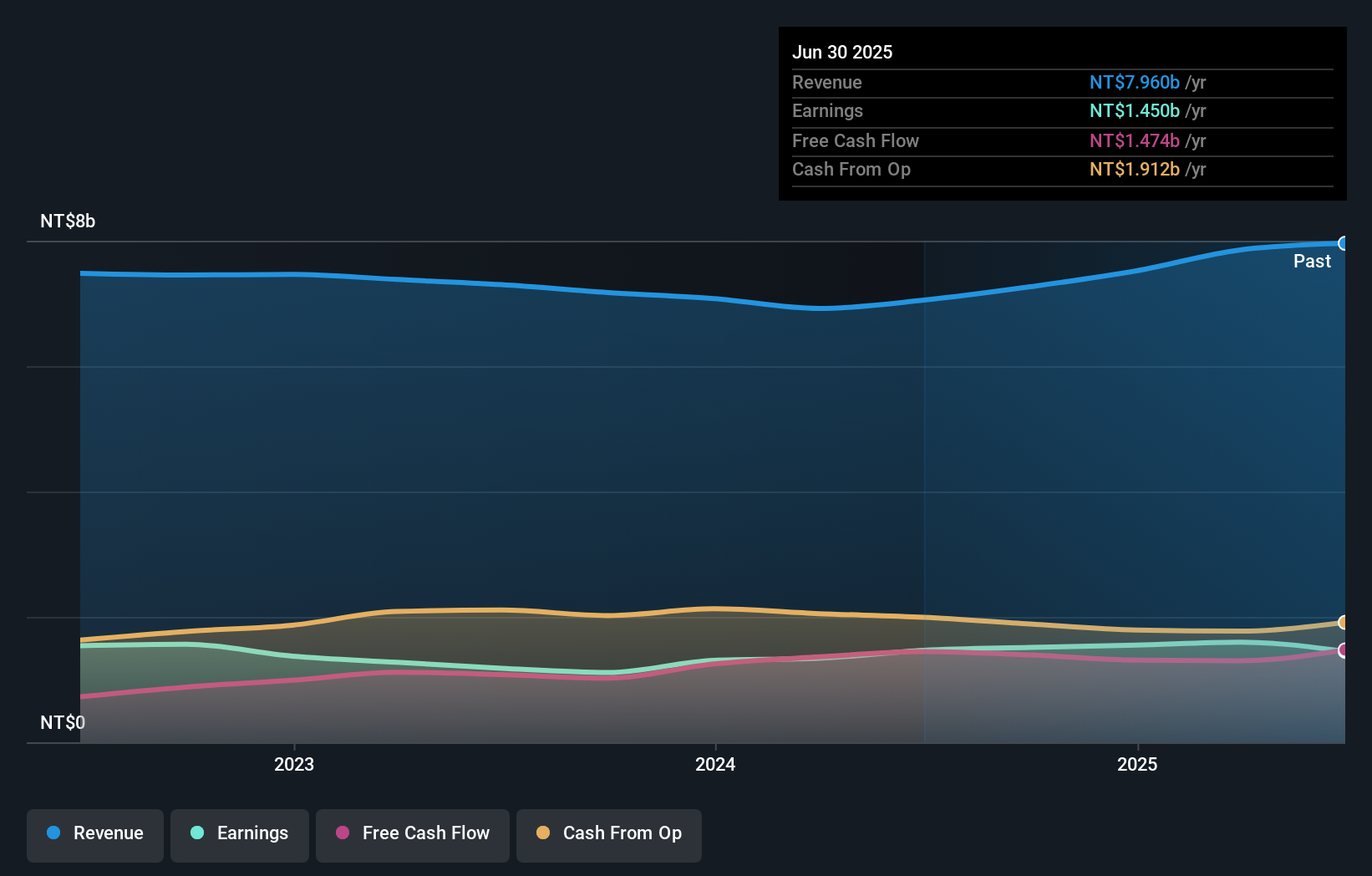

Thinking Electronic Industrial (TWSE:2428)

Simply Wall St Value Rating: ★★★★★☆

Overview: Thinking Electronic Industrial Co., Ltd. is engaged in the manufacturing, processing, and sale of electric devices, thermistors, varistors, and wires across Taiwan, China, and international markets with a market capitalization of NT$20.88 billion.

Operations: Thinking Electronic Industrial generates revenue primarily from its subsidiaries, with Dongguan Welkin Electronic Co. contributing NT$3.90 billion and Xing Qin adding NT$3.35 billion. The company has a market capitalization of NT$20.88 billion and operates in Taiwan, China, and international markets.

With a knack for outpacing its industry, Thinking Electronic Industrial has seen earnings growth of 35.9% over the past year, significantly above the electronic industry's 7.8%. The company’s price-to-earnings ratio stands at 14.4x, which is below the Taiwan market average of 21.4x, indicating potential value for investors. Recent revenue reports show a promising trend with January 2025 revenues hitting TWD 656 million, marking a rise of nearly 14% from last year. Despite an increase in its debt-to-equity ratio from 1.7 to 21.9 over five years, it holds more cash than total debt and remains free cash flow positive.

Seize The Opportunity

- Dive into all 4710 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thinking Electronic Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2428

Thinking Electronic Industrial

Manufactures, processes, and sells electric devices, thermistors, varistors, and wires in Taiwan, China, Europe, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives