New China Life Insurance Company Ltd. (SHSE:601336) Surges 50% Yet Its Low P/E Is No Reason For Excitement

The New China Life Insurance Company Ltd. (SHSE:601336) share price has done very well over the last month, posting an excellent gain of 50%. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

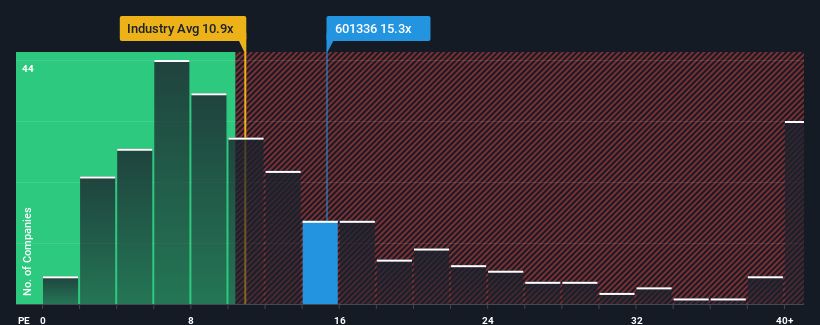

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may still consider New China Life Insurance as a highly attractive investment with its 15.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for New China Life Insurance as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for New China Life Insurance

How Is New China Life Insurance's Growth Trending?

In order to justify its P/E ratio, New China Life Insurance would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 56%. This means it has also seen a slide in earnings over the longer-term as EPS is down 41% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 15% per year over the next three years. That's shaping up to be materially lower than the 19% each year growth forecast for the broader market.

With this information, we can see why New China Life Insurance is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

New China Life Insurance's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that New China Life Insurance maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - New China Life Insurance has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on New China Life Insurance, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade New China Life Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if New China Life Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601336

New China Life Insurance

Provides life insurance products and services to individuals and institutions in China.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives