- Hong Kong

- /

- Communications

- /

- SEHK:1523

Asian Market Stocks That May Be Trading Below Their Estimated Value In March 2025

Reviewed by Simply Wall St

The Asian markets have been navigating a challenging environment, with concerns over U.S. trade policies and economic uncertainties impacting investor sentiment. Amidst these conditions, opportunities may arise in stocks that are potentially trading below their estimated value, offering investors a chance to consider companies with strong fundamentals and growth potential despite broader market pressures.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wiwynn (TWSE:6669) | NT$1935.00 | NT$3836.24 | 49.6% |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥177.70 | CN¥350.94 | 49.4% |

| Shenzhou International Group Holdings (SEHK:2313) | HK$57.95 | HK$114.00 | 49.2% |

| Hibino (TSE:2469) | ¥2779.00 | ¥5552.25 | 49.9% |

| Power Wind Health Industry (TWSE:8462) | NT$116.50 | NT$228.99 | 49.1% |

| Akatsuki (TSE:3932) | ¥3145.00 | ¥6219.56 | 49.4% |

| APAC Realty (SGX:CLN) | SGD0.415 | SGD0.83 | 49.8% |

| Bide Pharmatech (SHSE:688073) | CN¥53.80 | CN¥106.91 | 49.7% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥12.53 | CN¥24.90 | 49.7% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.52 | CN¥16.82 | 49.3% |

Let's review some notable picks from our screened stocks.

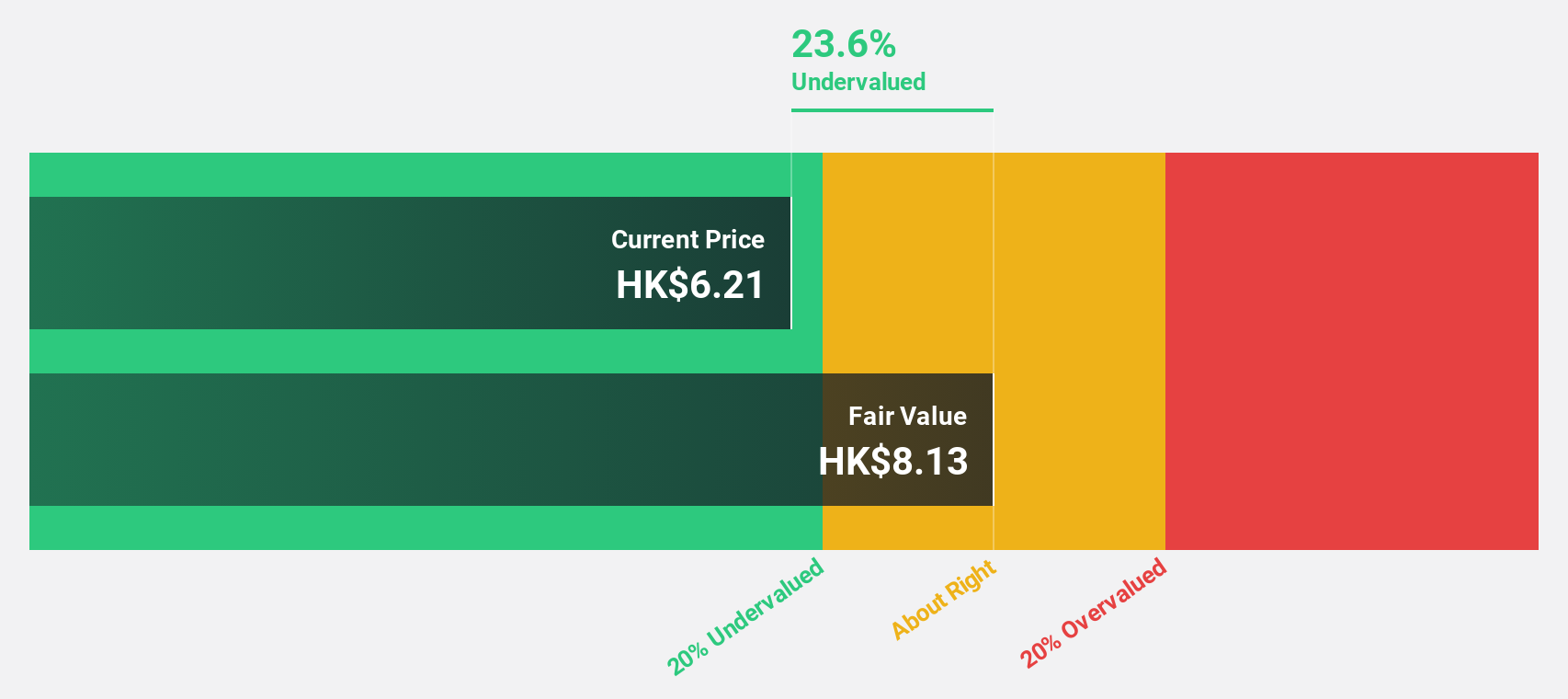

Plover Bay Technologies (SEHK:1523)

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market cap of HK$6.10 billion.

Operations: The company's revenue segments include Sales of SD-WAN Routers - Fixed First Connectivity at $17.15 million, Sales of SD-WAN Routers - Mobile First Connectivity at $66.18 million, and Software Licenses and Warranty and Support Services at $33.47 million.

Estimated Discount To Fair Value: 36%

Plover Bay Technologies is trading at HK$5.53, significantly below its estimated fair value of HK$8.64, suggesting it may be undervalued based on cash flows. The company's earnings grew by 35.4% last year and are forecast to grow 16.98% annually, outpacing the Hong Kong market's growth rate of 11.6%. Despite a dividend yield of 5.4%, it's not well covered by earnings, posing a potential risk for income-focused investors. Recent results showed increased sales and net income for 2024, indicating strong operational performance.

- According our earnings growth report, there's an indication that Plover Bay Technologies might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Plover Bay Technologies.

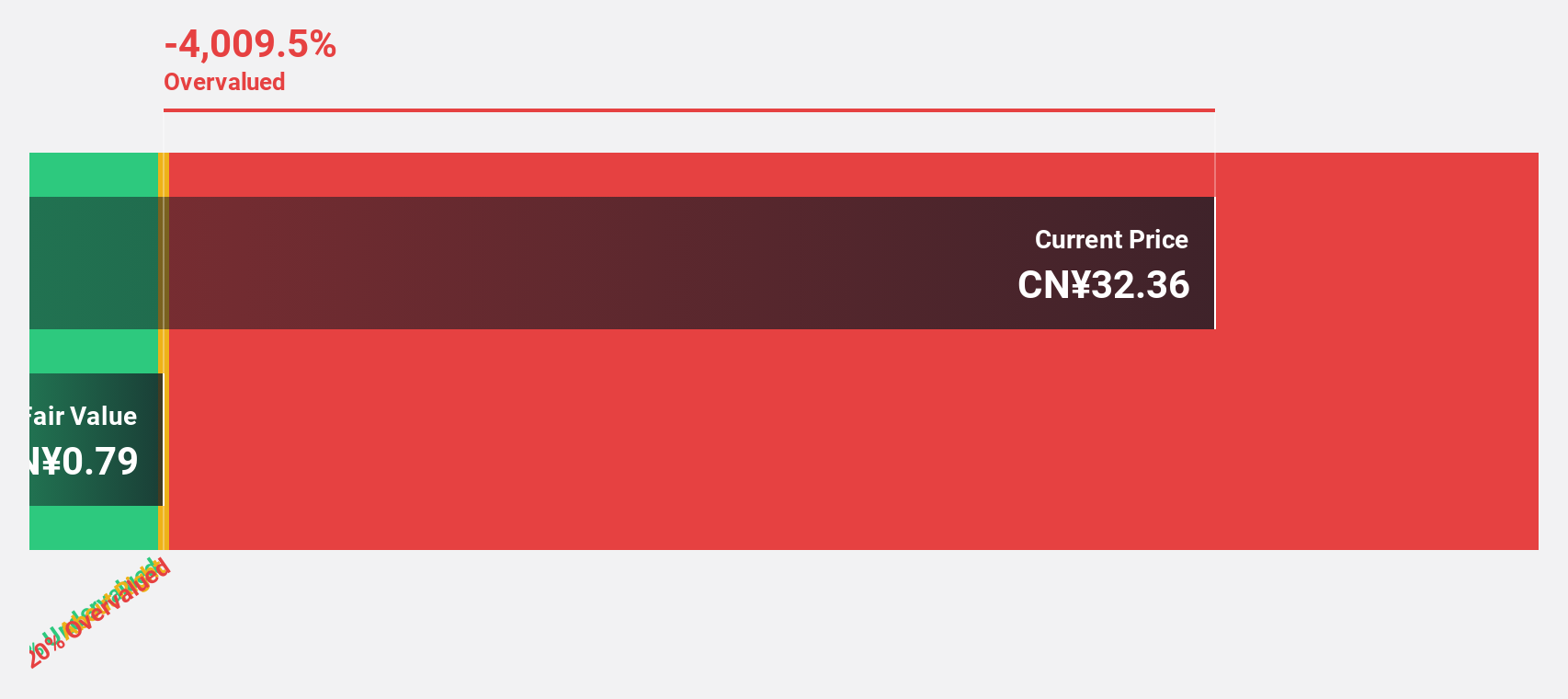

Shenzhen Breo Technology (SHSE:688793)

Overview: Shenzhen Breo Technology Co., Ltd. focuses on the research and development of portable massage products targeting headache swelling, eye fatigue, and shoulder and neck pain, with a market cap of CN¥2.74 billion.

Operations: Shenzhen Breo Technology Co., Ltd. generates revenue through the development and sale of portable massage devices designed to alleviate headache swelling, eye fatigue, and pain in the shoulder and neck areas.

Estimated Discount To Fair Value: 27.7%

Shenzhen Breo Technology, trading at CN¥32.8, is highly undervalued with an estimated fair value of CN¥45.4. The company recently turned profitable with a net income of CN¥9.43 million for 2024, reversing a prior loss. Earnings are projected to grow significantly at 81.1% annually over the next three years, surpassing the Chinese market's growth rate and indicating robust future prospects despite recent revenue decline from CN¥1,274.8 million to CN¥1,084.86 million.

- Upon reviewing our latest growth report, Shenzhen Breo Technology's projected financial performance appears quite optimistic.

- Take a closer look at Shenzhen Breo Technology's balance sheet health here in our report.

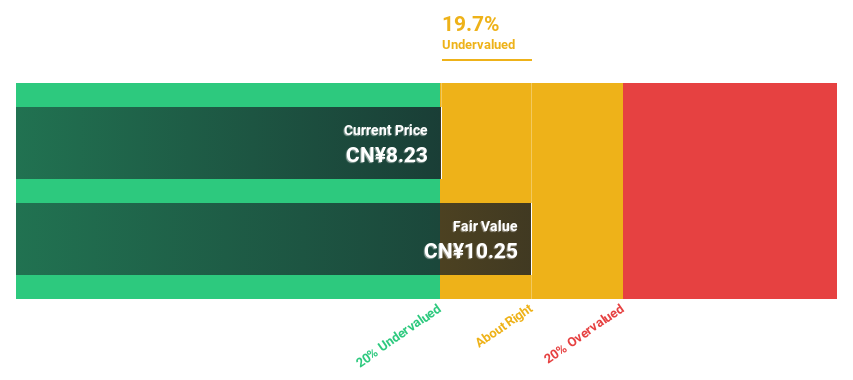

ZheJiang Haers Vacuum ContainersLtd (SZSE:002615)

Overview: ZheJiang Haers Vacuum Containers Co., Ltd. (SZSE:002615) specializes in the production and sale of vacuum containers and related products, with a market cap of CN¥3.82 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment data for ZheJiang Haers Vacuum Containers Co., Ltd.

Estimated Discount To Fair Value: 19.5%

ZheJiang Haers Vacuum Containers Ltd., trading at CN¥8.27, is undervalued compared to its estimated fair value of CN¥10.27. Despite a recent dividend affirmation, the company has an unstable dividend track record. Earnings grew by 80% last year but are forecasted to grow slower than the market at 17.2% annually, while revenue growth is expected to outpace the market at 20.7%. The stock trades below fair value but not significantly so based on discounted cash flow analysis.

- The growth report we've compiled suggests that ZheJiang Haers Vacuum ContainersLtd's future prospects could be on the up.

- Get an in-depth perspective on ZheJiang Haers Vacuum ContainersLtd's balance sheet by reading our health report here.

Next Steps

- Navigate through the entire inventory of 282 Undervalued Asian Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1523

Plover Bay Technologies

An investment holding company, designs, develops, and markets software defined wide area network routers.

Outstanding track record with excellent balance sheet.