- South Korea

- /

- Hospitality

- /

- KOSE:A039130

3 Growth Companies With Insider Ownership Up To 33%

Reviewed by Simply Wall St

As global markets navigate a period of rate cuts by the ECB and SNB, with expectations for a similar move by the Federal Reserve, growth stocks continue to outperform their value counterparts, highlighted by the Nasdaq Composite reaching new highs. In this environment of shifting monetary policies and economic indicators, companies with strong insider ownership often signal confidence in their growth potential and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 65.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

Hanatour Service (KOSE:A039130)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanatour Service Inc. offers travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe, with a market cap of ₩886.02 billion.

Operations: The company's revenue segments include Trip services generating ₩582.45 billion and Hotel services contributing ₩24.71 billion.

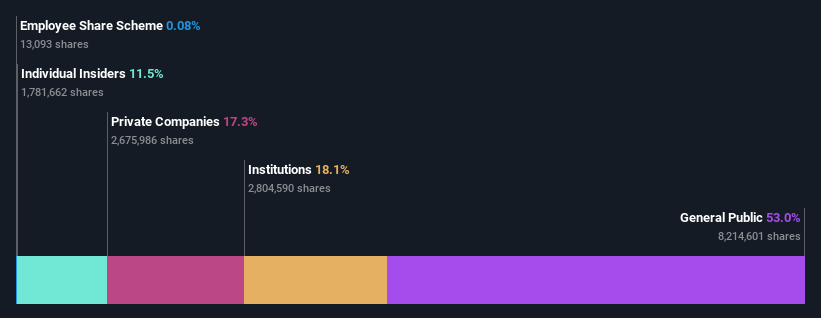

Insider Ownership: 11.5%

Hanatour Service shows potential as a growth company with high insider ownership, despite some challenges. Recent earnings indicate a mixed performance, with third-quarter net income decreasing to KRW 11.39 billion from KRW 14.18 billion year-over-year, but nine-month figures show improvement. Revenue is forecast to grow at 7.8% annually, outpacing the Korean market's 5.3%. Although profit margins have declined and dividends are not well-covered by earnings, the stock trades below fair value estimates and has no recent insider selling activity.

- Get an in-depth perspective on Hanatour Service's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Hanatour Service's share price might be on the cheaper side.

Runben Biotechnology (SHSE:603193)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runben Biotechnology Co., Ltd. focuses on the research, production, and sale of mosquito repellent products, baby care products, and essential oil products with a market cap of CN¥9.79 billion.

Operations: The company's revenue is primarily derived from its Personal Products segment, amounting to CN¥1.25 billion.

Insider Ownership: 33.1%

Runben Biotechnology demonstrates growth potential, with earnings increasing by 46.3% over the past year and revenue forecasted to grow at 24.8% annually, surpassing the Chinese market average of 13.7%. The company's recent financial results show sales rising to CNY 1.04 billion from CNY 823.53 million year-over-year, while net income improved to CNY 260.88 million from CNY 180.73 million. Despite a low future return on equity forecast of 17%, its price-to-earnings ratio remains attractive compared to the broader CN market.

- Delve into the full analysis future growth report here for a deeper understanding of Runben Biotechnology.

- Upon reviewing our latest valuation report, Runben Biotechnology's share price might be too optimistic.

Giant Manufacturing (TWSE:9921)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Giant Manufacturing Co., Ltd. and its subsidiaries manufacture and sell bicycles, electric bicycles, and related parts in Taiwan and internationally, with a market cap of NT$61.16 billion.

Operations: The company's revenue segments are comprised of Bicycle at NT$64.21 billion and Material at NT$4.86 billion.

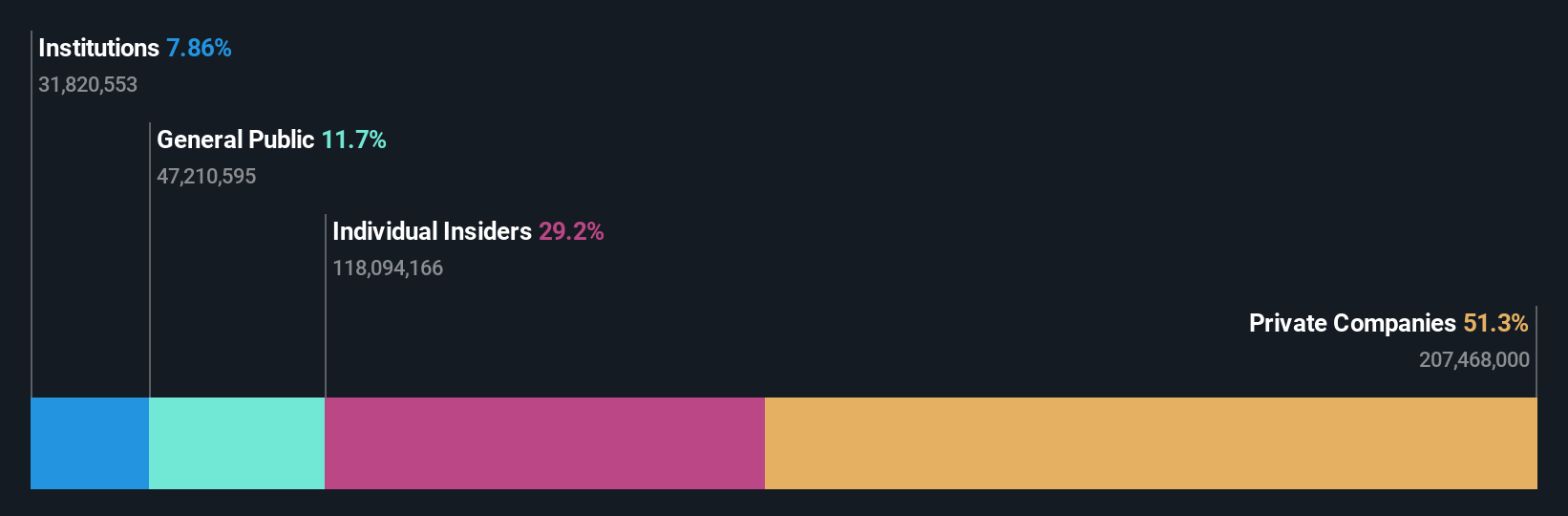

Insider Ownership: 16.4%

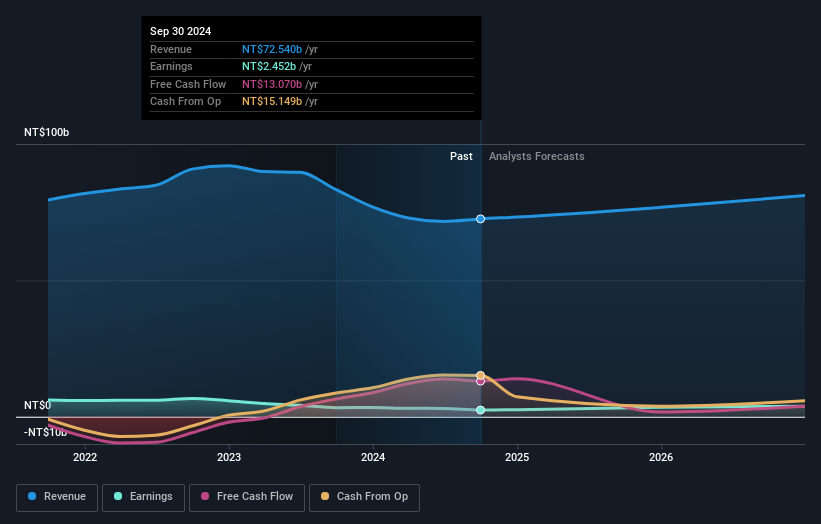

Giant Manufacturing's earnings are expected to grow significantly at 22.1% annually, outpacing the TW market's 6.1%. However, recent financials show a decline in net income for Q3 and nine months ending September 2024, with TWD 498.88 million and TWD 2,171.08 million respectively. Despite this drop, analysts agree on a potential stock price rise of 22.3%. Revenue growth is modest but exceeds the TW market average of 2.1%.

- Unlock comprehensive insights into our analysis of Giant Manufacturing stock in this growth report.

- In light of our recent valuation report, it seems possible that Giant Manufacturing is trading beyond its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 1539 Fast Growing Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hanatour Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A039130

Hanatour Service

Provides travel and related services in South Korea, Northeast and Southeast Asia, the United States, and Europe.

Flawless balance sheet, undervalued and pays a dividend.