- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A213420

Three Companies That Could Be Priced Below Their Estimated Value In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with the Nasdaq Composite reaching new heights while other major indexes face declines, investors are keenly observing central bank actions and economic indicators that suggest potential shifts in monetary policy. Amidst these fluctuations, identifying stocks that may be undervalued can offer opportunities for those looking to capitalize on discrepancies between market price and intrinsic value. In this context, understanding what makes a stock potentially undervalued—such as strong fundamentals or market mispricing—becomes crucial for investors aiming to make informed decisions in an ever-changing economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.14 | 49.9% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.68 | CN¥11.35 | 50% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.18 | HK$18.27 | 49.8% |

| Management SolutionsLtd (TSE:7033) | ¥1701.00 | ¥3400.08 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK254.00 | SEK506.18 | 49.8% |

| BYD Electronic (International) (SEHK:285) | HK$39.85 | HK$79.45 | 49.8% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.13 | A$6.26 | 50% |

| ASMPT (SEHK:522) | HK$75.95 | HK$150.94 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

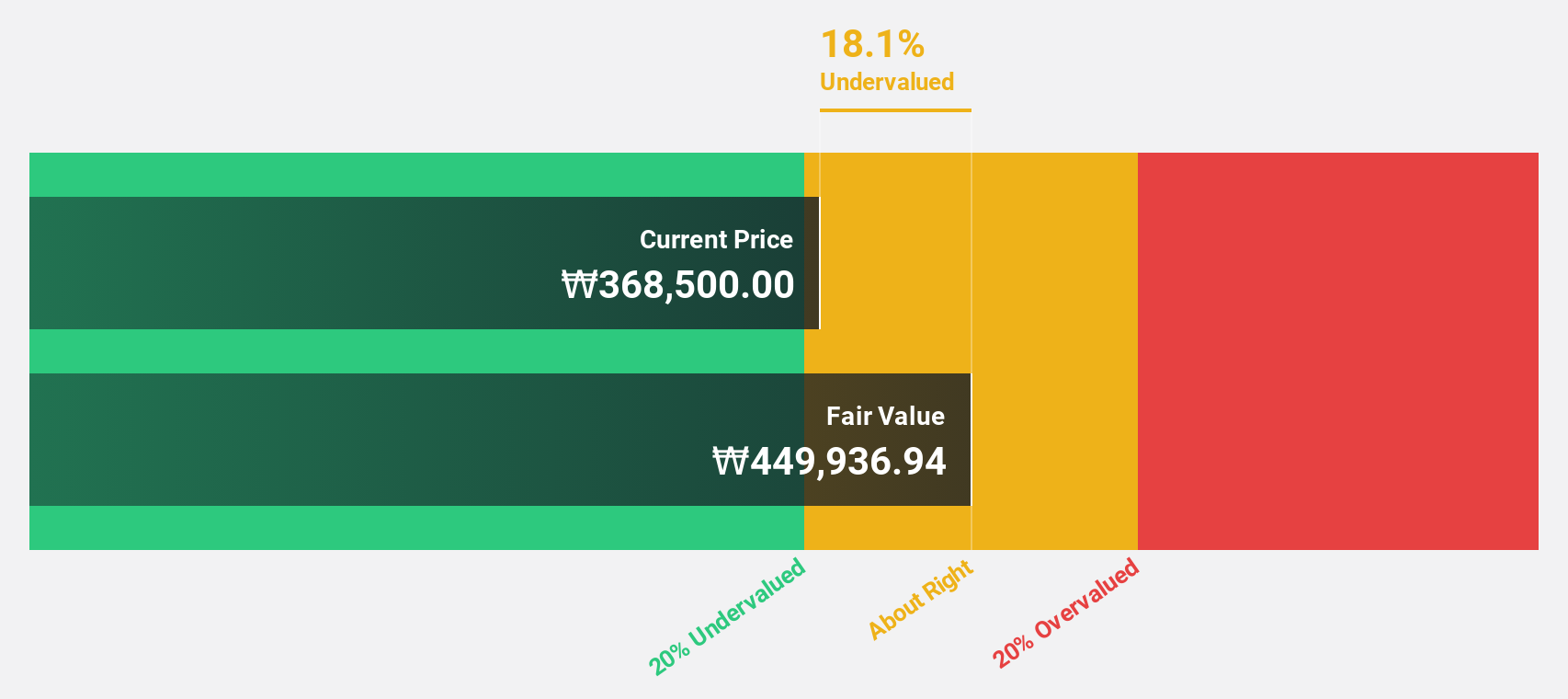

Hugel (KOSDAQ:A145020)

Overview: Hugel, Inc. is a biopharmaceutical company that develops and manufactures products in South Korea and internationally, with a market cap of ₩2.99 trillion.

Operations: The company's revenue segment includes pharmaceuticals, generating ₩363.79 billion.

Estimated Discount To Fair Value: 49.2%

Hugel is trading at ₩269,500, significantly below its estimated fair value of ₩530,453.69, indicating potential undervaluation based on cash flows. Earnings are expected to grow 22% annually, outpacing the South Korean market's 12.3%. Recent strategic moves include a share buyback program worth KRW 70 billion and a renewed distribution agreement in China for its Letybo product until 2030, enhancing shareholder value and market presence.

- Our comprehensive growth report raises the possibility that Hugel is poised for substantial financial growth.

- Get an in-depth perspective on Hugel's balance sheet by reading our health report here.

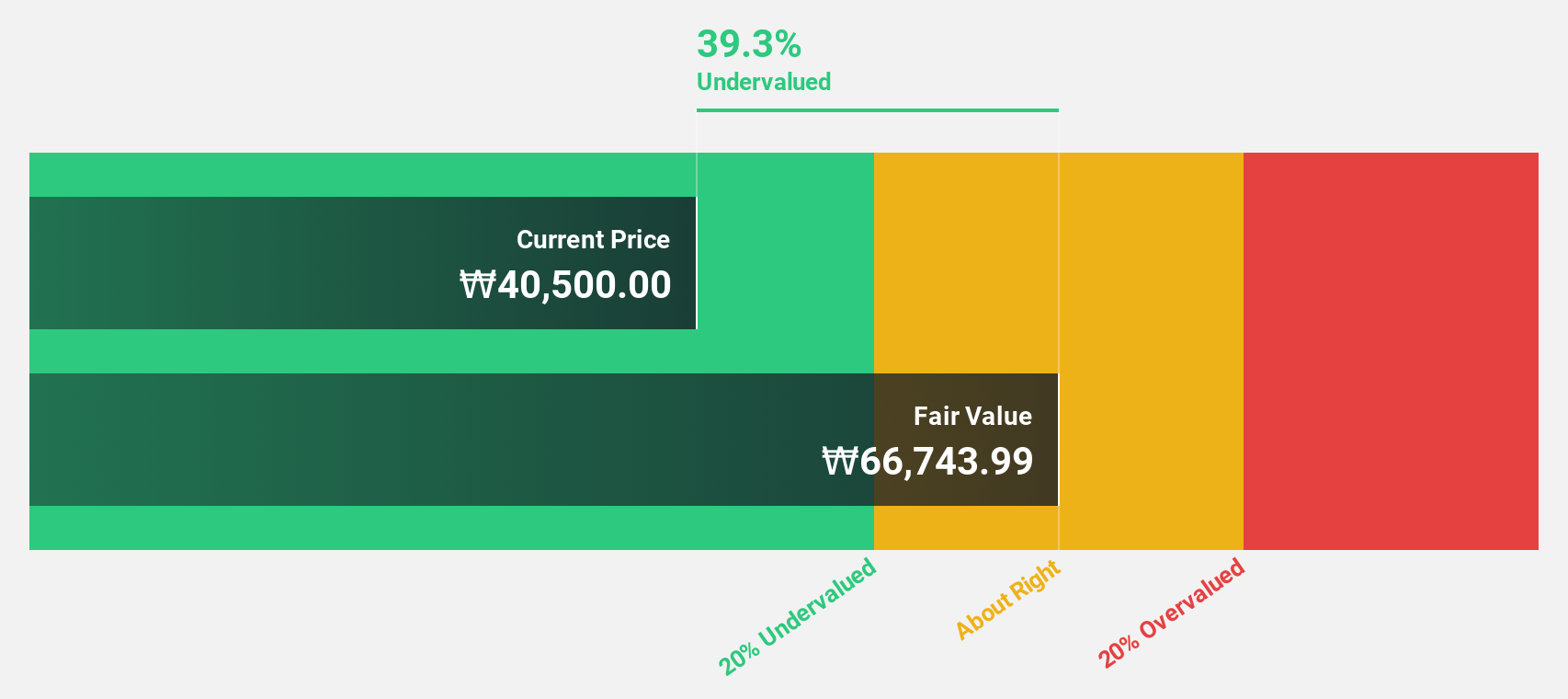

Duk San NeoluxLtd (KOSDAQ:A213420)

Overview: Duk San Neolux Co., Ltd is a South Korean company that develops and manufactures OLED materials for the display industry, with a market cap of ₩671.80 billion.

Operations: The company's revenue from the semiconductors segment is ₩205.55 billion.

Estimated Discount To Fair Value: 39.1%

Duk San Neolux Ltd. is trading at ₩28,800, significantly below its estimated fair value of ₩47,279.03, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 22.4% annually over the next three years, surpassing the South Korean market's growth rate of 12.3%. Despite a low forecasted return on equity of 13.4%, robust revenue growth expectations and recent shareholder engagement reflect a promising outlook for investors focused on cash flow valuation metrics.

- Our growth report here indicates Duk San NeoluxLtd may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Duk San NeoluxLtd.

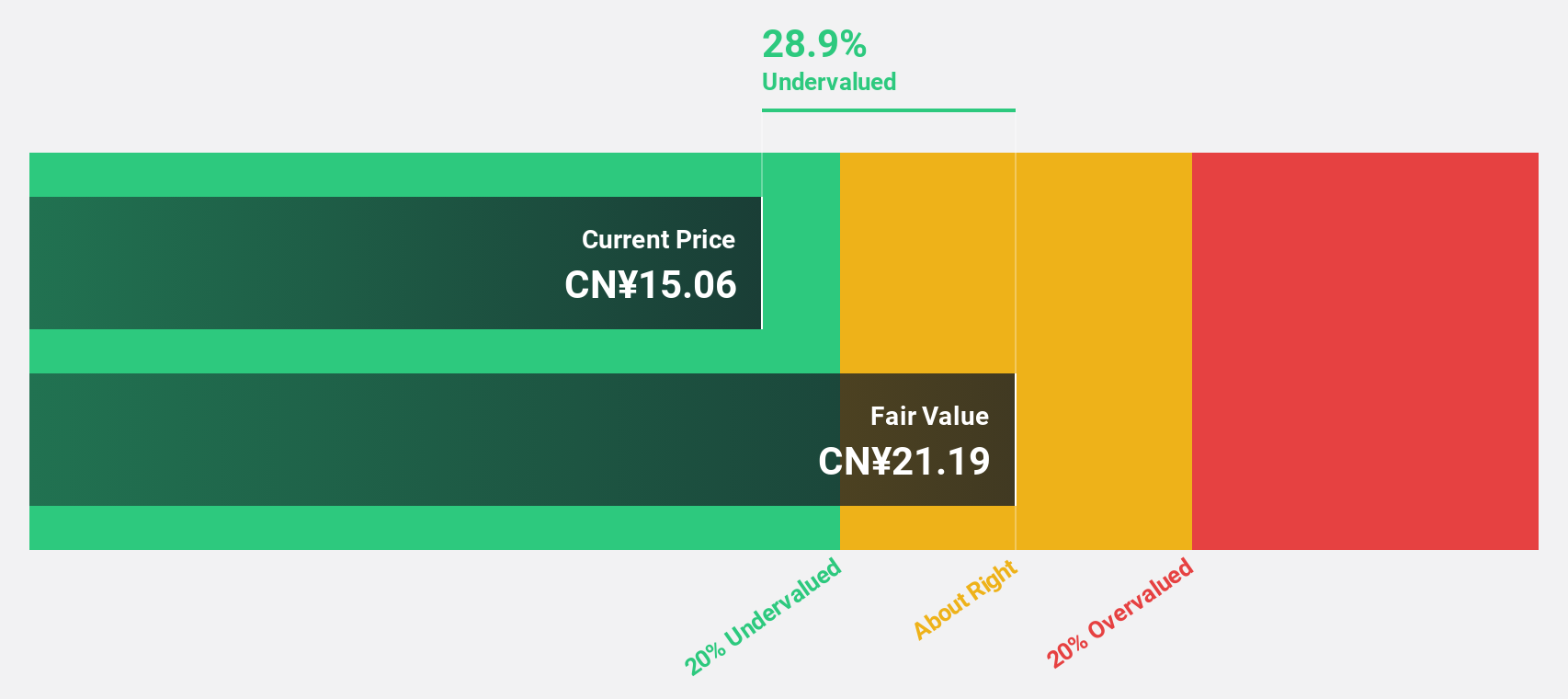

Anhui Anli Material Technology (SZSE:300218)

Overview: Anhui Anli Material Technology Co., Ltd. focuses on the R&D, production, sale, and servicing of ecological functional polyurethane synthetic leather products and other polymer composite materials in China with a market cap of CN¥3.57 billion.

Operations: The company generates revenue from its artificial leather synthetic leather industry segment, amounting to CN¥2.37 billion.

Estimated Discount To Fair Value: 22.5%

Anhui Anli Material Technology is trading at CN¥17.36, over 20% below its estimated fair value of CN¥22.39, suggesting potential undervaluation based on cash flows. The company reported a significant increase in net income to CNY 150.26 million for the first nine months of 2024, compared to CNY 41.63 million the previous year. Despite an unstable dividend track record and low forecasted return on equity of 17.3%, earnings are expected to grow significantly by 25.8% annually, outpacing the Chinese market's growth rate.

- According our earnings growth report, there's an indication that Anhui Anli Material Technology might be ready to expand.

- Click to explore a detailed breakdown of our findings in Anhui Anli Material Technology's balance sheet health report.

Seize The Opportunity

- Discover the full array of 906 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A213420

Duk San NeoluxLtd

Develops and manufactures OLED materials for display industry in South Korea.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives