- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A025320

Exploring High Growth Tech Stocks In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, with the Nasdaq Composite reaching new heights and growth stocks continuing to outperform value stocks, investors are closely monitoring the Federal Reserve's anticipated rate cut and its implications for market dynamics. In this environment, selecting high-growth tech stocks requires careful consideration of their potential to thrive amidst evolving monetary policies and fluctuating economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Synopex (KOSDAQ:A025320)

Simply Wall St Growth Rating: ★★★★☆☆

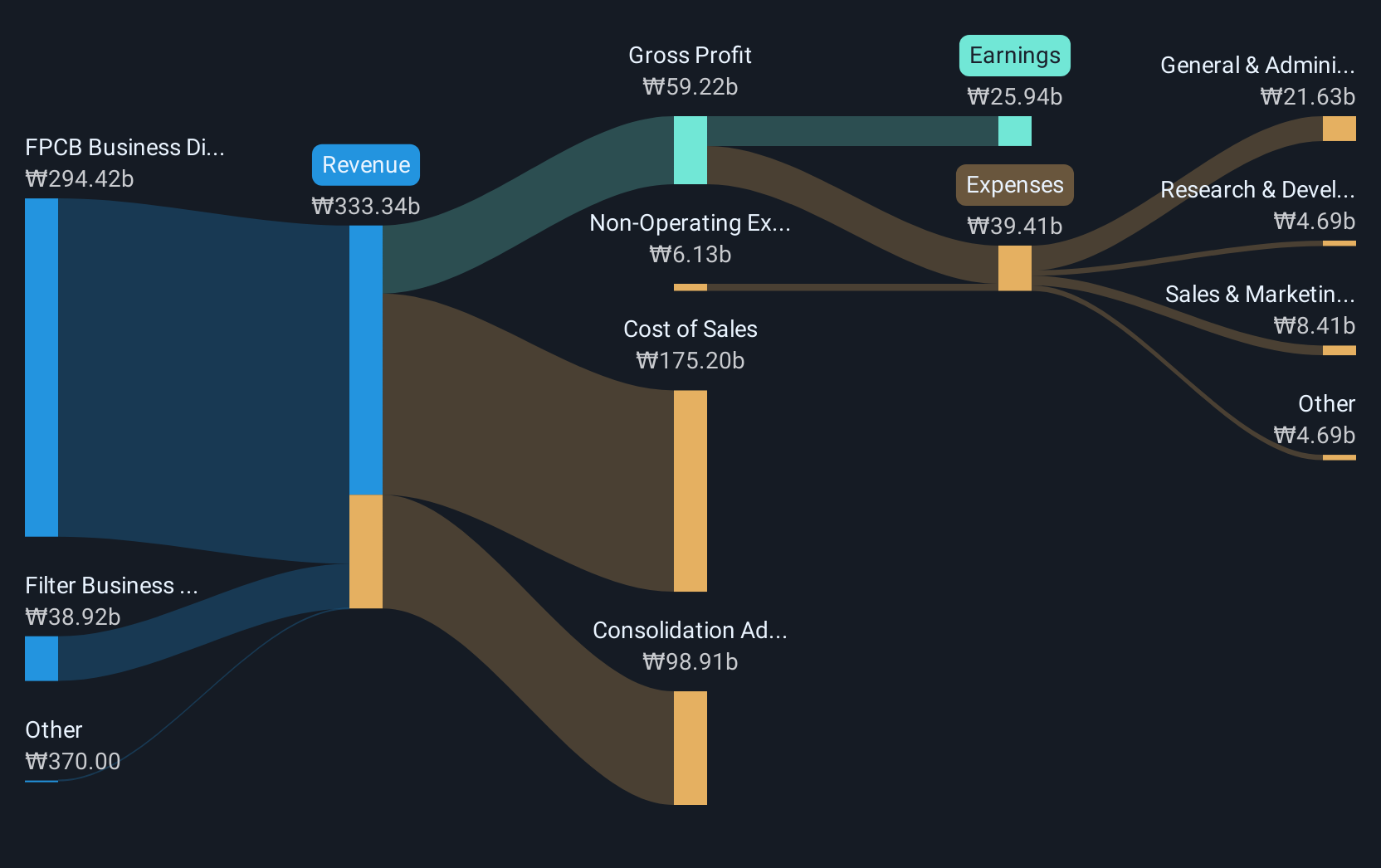

Overview: Synopex Inc. is a company that manufactures and sells flexible printed circuit board (FPCB) products and electronic components both in South Korea and internationally, with a market capitalization of approximately ₩556.09 billion.

Operations: The company's primary revenue stream is derived from its FPCB Business Division, generating ₩316.16 billion. Additionally, the Filter Business Division contributes ₩38.32 billion to the overall revenue.

Synopex, amidst a challenging market, reported an impressive 212.9% surge in earnings over the past year, significantly outpacing its industry's growth rate. This performance is underpinned by a robust annual revenue increase of 16.3%, which continues to exceed the broader Korean market's growth of 5.3%. Despite a recent dip in quarterly sales and net income as per the latest financial reports, Synopex maintains strong future prospects with expected earnings growth of 27.5% annually over the next three years. The company’s commitment to innovation is evident from its substantial R&D investments, aligning with industry shifts towards more sustainable and advanced tech solutions.

- Click here to discover the nuances of Synopex with our detailed analytical health report.

Review our historical performance report to gain insights into Synopex's's past performance.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★★☆

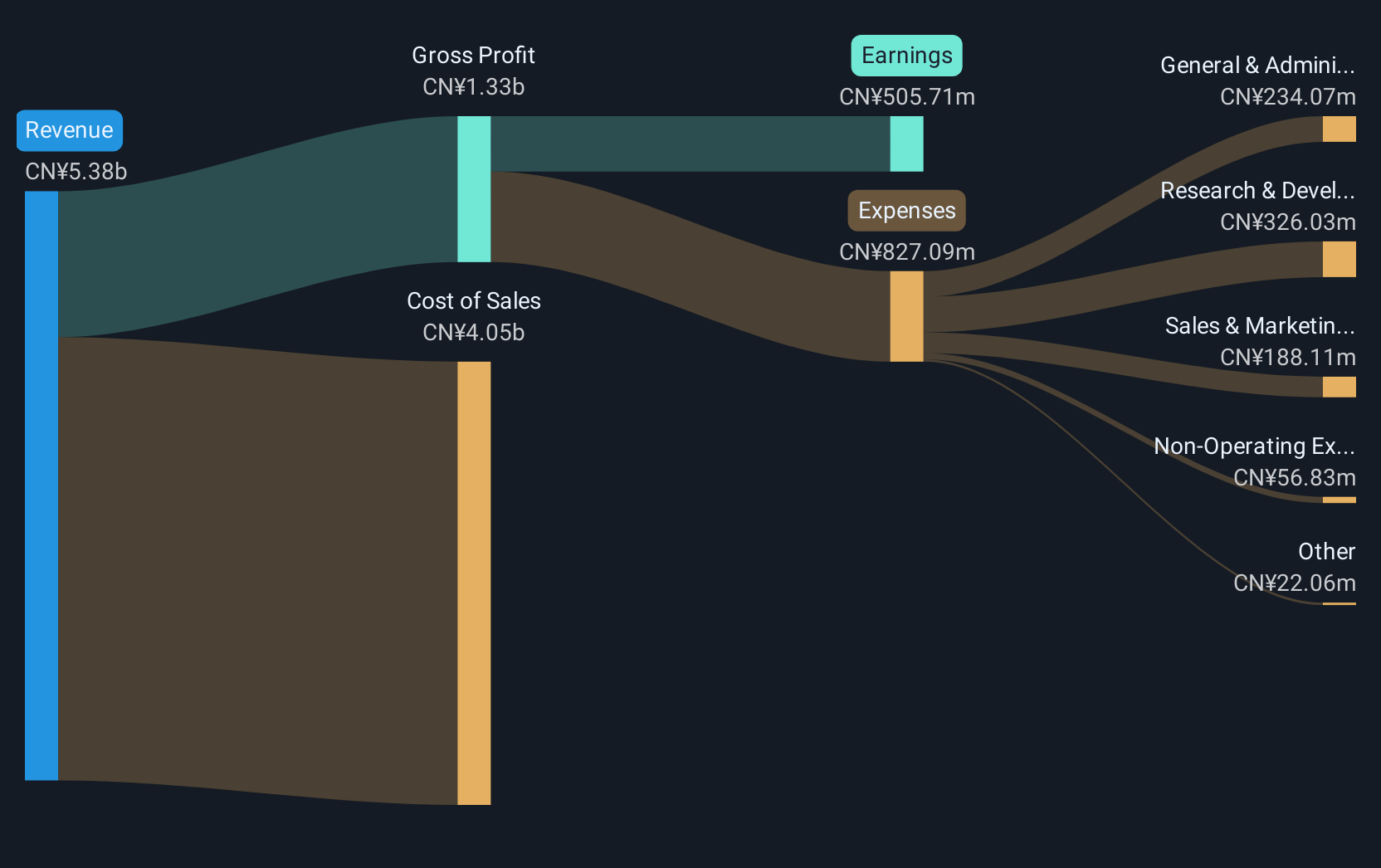

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of printed circuit boards in China with a market capitalization of CN¥31.49 billion.

Operations: Shengyi Electronics specializes in the production and sales of printed circuit boards, with a significant presence in the Chinese market. The company derives its revenue primarily from these activities, contributing to its market capitalization of CN¥31.49 billion.

Shengyi Electronics has demonstrated a remarkable turnaround, with its earnings skyrocketing from a net loss to CNY 186.52 million in just nine months. This resurgence is underscored by a robust annual revenue growth of 33%, significantly outstripping the broader Chinese market's expansion rate of 13.7%. The company's aggressive investment in R&D, which aligns with its strategic focus on innovative electronic solutions, positions it well for sustained growth amidst evolving technological demands.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★☆☆

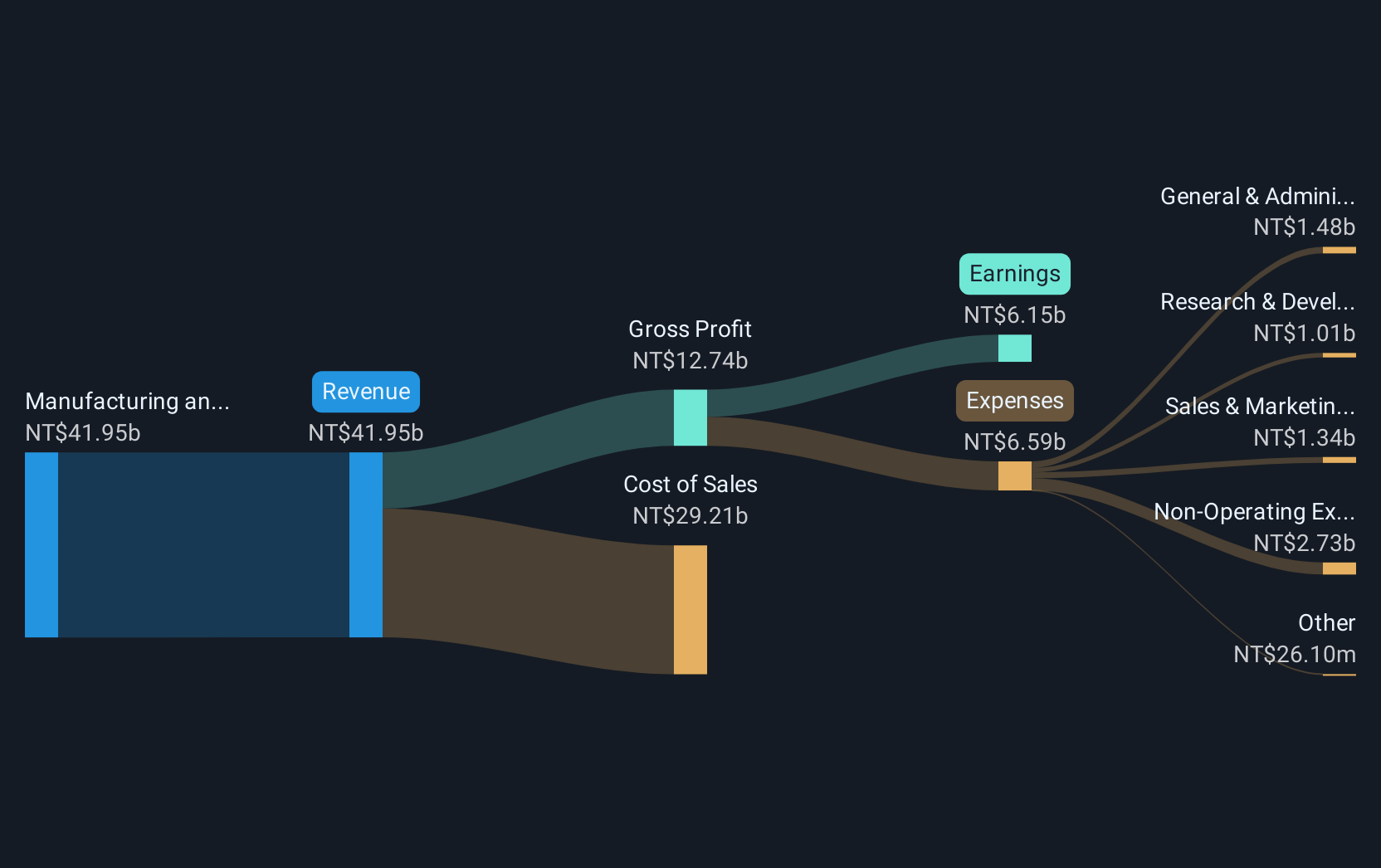

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that specializes in the design, manufacturing, processing, and distribution of multilayer printed circuit boards with a market capitalization of NT$117.05 billion.

Operations: The core revenue stream for Gold Circuit Electronics Ltd. is the manufacturing and sales of printed circuit boards, generating NT$37.63 billion. The company's operations focus on multilayer circuit board production within Taiwan's electronics sector.

Gold Circuit Electronics has shown a robust performance with a significant uptick in quarterly and nine-month financials, reflecting a 27% increase in recent quarterly sales to TWD 10.46 billion and an impressive annual net income rise to TWD 4.33 billion. This growth trajectory is underscored by an earnings forecast predicting an annual increase of nearly 19%, outpacing the broader Taiwanese market's average of just over 6%. The firm's commitment to innovation is evident from its R&D investments, aligning with industry trends towards enhanced electronic capabilities which may continue to drive its market position forward amidst competitive pressures.

- Delve into the full analysis health report here for a deeper understanding of Gold Circuit Electronics.

Evaluate Gold Circuit Electronics' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Gain an insight into the universe of 1269 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A025320

Synopex

Manufactures and sells FPCB products and electronic components in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives