- South Korea

- /

- Hospitality

- /

- KOSE:A039130

3 Prominent Stocks Estimated To Be Valued Up To 48.7% Below Intrinsic Worth

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices like the Nasdaq Composite reaching record highs while others decline, investors are closely watching central bank actions and economic indicators. Amidst this landscape of fluctuating growth stocks and rate cuts by institutions such as the ECB and SNB, identifying undervalued stocks becomes crucial for those seeking potential opportunities in a volatile environment. Recognizing stocks that may be trading below their intrinsic value can offer strategic entry points for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.14 | 49.9% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.68 | CN¥11.35 | 50% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.18 | HK$18.27 | 49.8% |

| Management SolutionsLtd (TSE:7033) | ¥1701.00 | ¥3400.08 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK254.00 | SEK506.18 | 49.8% |

| BYD Electronic (International) (SEHK:285) | HK$39.85 | HK$79.45 | 49.8% |

| Wetteri Oyj (HLSE:WETTERI) | €0.297 | €0.59 | 49.9% |

| ReadyTech Holdings (ASX:RDY) | A$3.13 | A$6.26 | 50% |

| ASMPT (SEHK:522) | HK$75.95 | HK$150.94 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

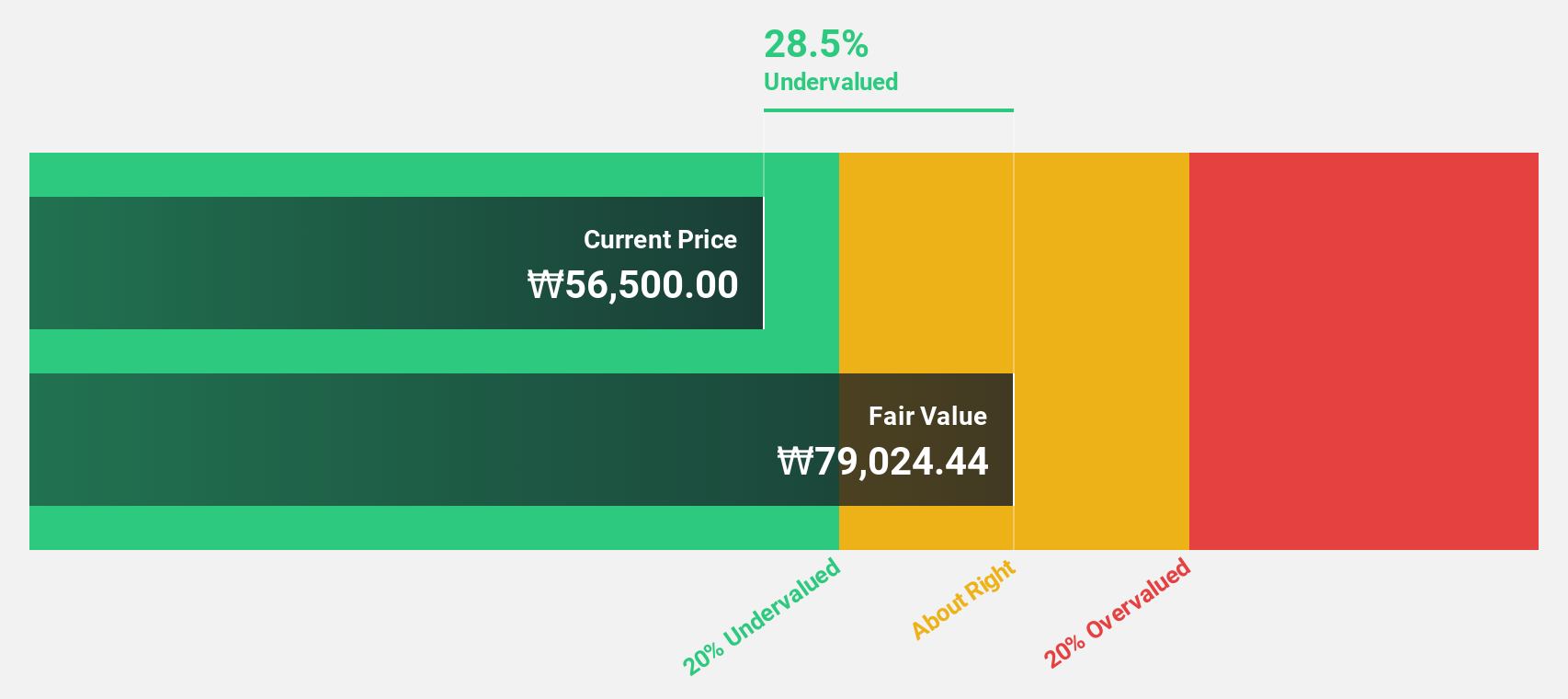

Hankuk Carbon (KOSE:A017960)

Overview: Hankuk Carbon Co., Ltd. is a South Korean company that produces and sells carbon fiber, synthetic resin, and glass paper related products, with a market cap of ₩510.88 billion.

Operations: The company's revenue is primarily derived from its Industrial Materials Division, which accounts for ₩703.72 billion, followed by the General Business Division at ₩45.23 billion.

Estimated Discount To Fair Value: 33.1%

Hankuk Carbon is trading 33.1% below its estimated fair value of ₩15,913.2, with a current price of ₩10,640. Despite revenue growth forecasts being modest at 8.1% annually, earnings are expected to grow significantly at 66.9%, surpassing the KR market average of 12.3%. Recent earnings reports show a turnaround from a net loss to a net income of KRW 12,269 million for Q3 2024, although profit margins have decreased compared to last year due to large one-off items affecting results.

- The growth report we've compiled suggests that Hankuk Carbon's future prospects could be on the up.

- Take a closer look at Hankuk Carbon's balance sheet health here in our report.

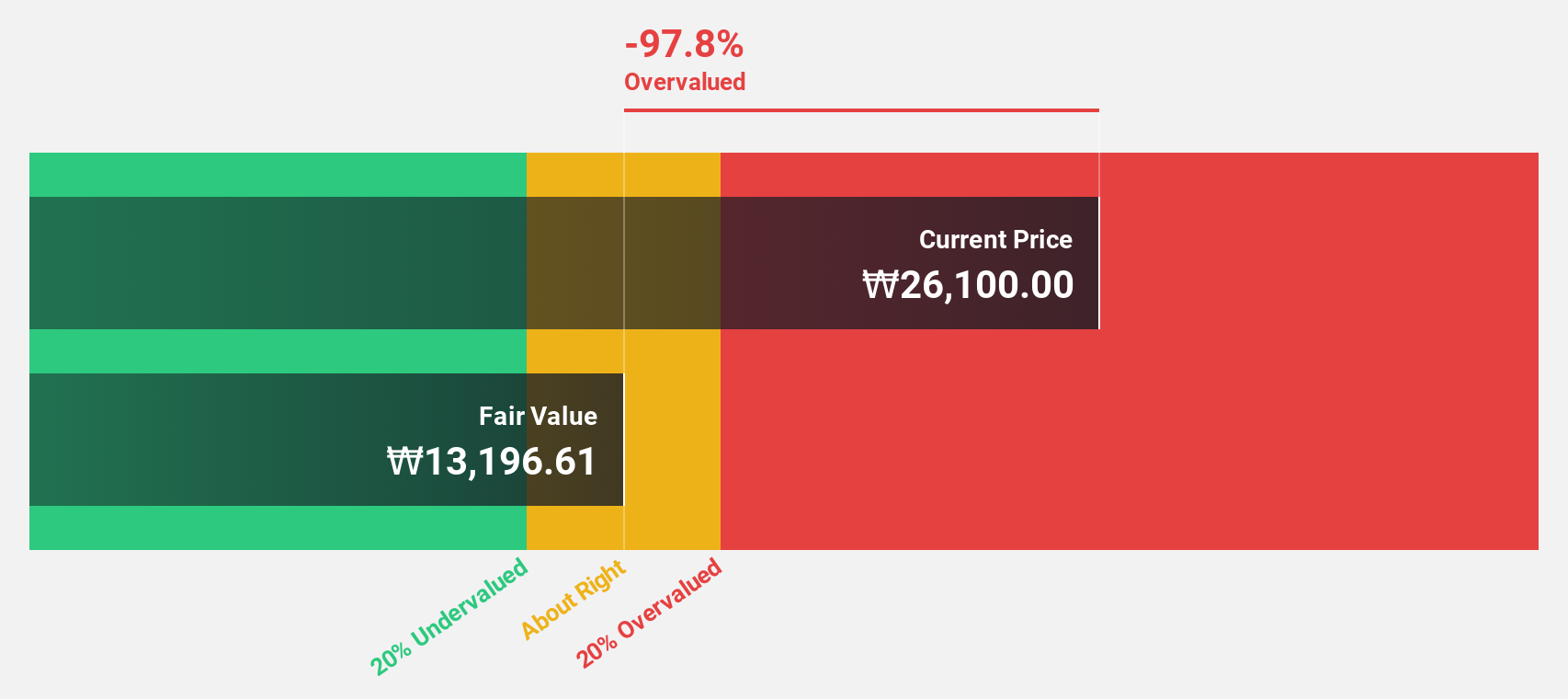

Hanatour Service (KOSE:A039130)

Overview: Hanatour Service Inc. is a travel service provider operating in South Korea, Northeast and Southeast Asia, the United States, and Europe with a market cap of ₩886.02 billion.

Operations: The company generates revenue primarily from its Trip segment at ₩582.45 billion and its Hotel segment at ₩24.71 billion.

Estimated Discount To Fair Value: 40.4%

Hanatour Service is trading at ₩57,000, significantly below its estimated fair value of ₩95,715.96. Earnings are projected to grow 17.08% annually, outpacing the KR market's 12.3%, although profit margins have declined from last year’s 13.1% to 8.8%. Recent earnings reports for Q3 show a decrease in net income and sales compared to the previous year but an overall increase over nine months, supporting its undervaluation based on cash flows.

- The analysis detailed in our Hanatour Service growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Hanatour Service's balance sheet health report.

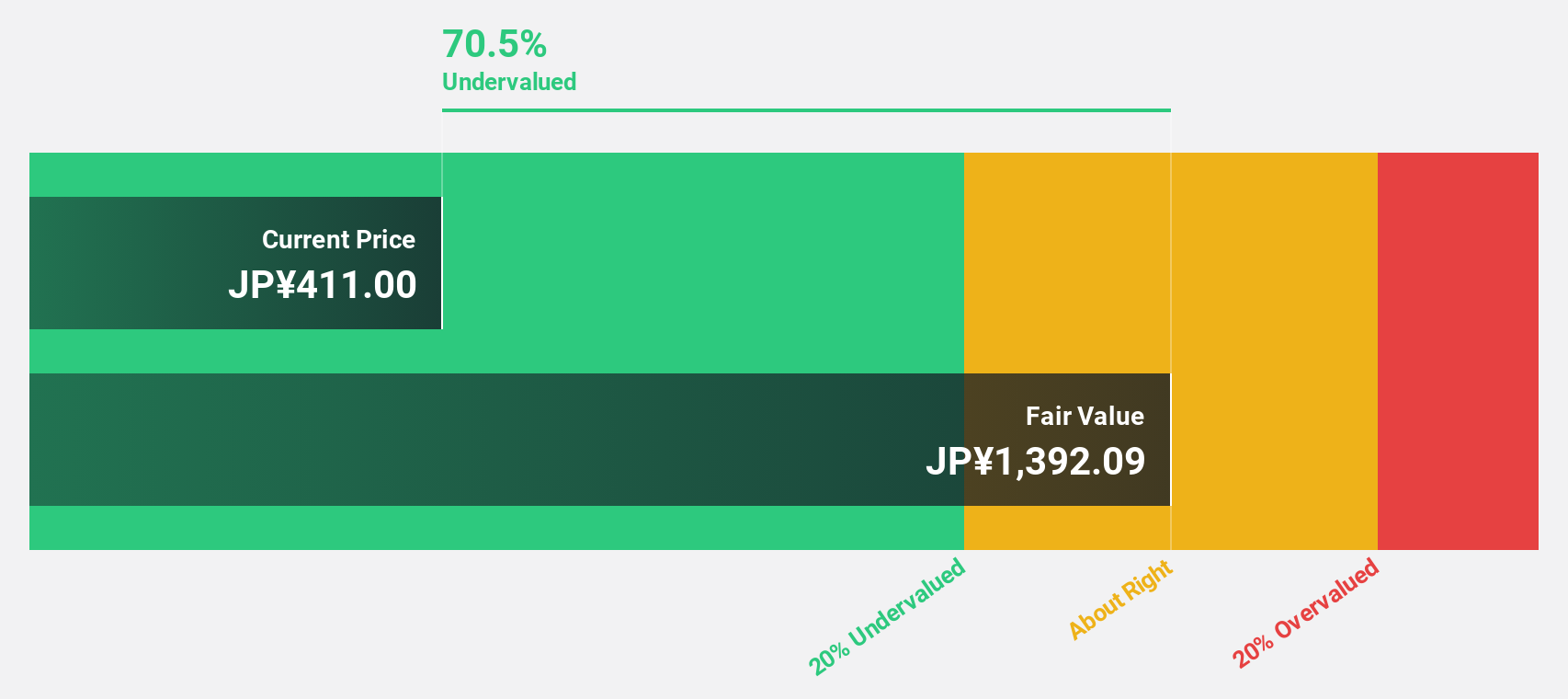

Infomart (TSE:2492)

Overview: Infomart Corporation operates an online BtoB e-commerce trading platform for the food industry in Japan, with a market cap of ¥64.27 billion.

Operations: The company generates revenue through its B2B-PFES segment, amounting to ¥5.62 billion, and the B to B-PF FOOD segment, which brings in ¥9.27 billion.

Estimated Discount To Fair Value: 48.7%

Infomart is trading at ¥294, well below its fair value estimate of ¥572.62, highlighting significant undervaluation based on cash flows. Earnings are expected to grow 40.86% annually, surpassing the JP market's 7.9% growth forecast. Despite high share price volatility recently, analysts predict a 39.5% increase in stock price. The company anticipates net sales of ¥16 billion and operating profit of ¥1 billion for 2024, alongside increased dividends per share from last year’s figures.

- In light of our recent growth report, it seems possible that Infomart's financial performance will exceed current levels.

- Get an in-depth perspective on Infomart's balance sheet by reading our health report here.

Next Steps

- Reveal the 906 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanatour Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A039130

Hanatour Service

Provides travel and related services in South Korea, Northeast and Southeast Asia, the United States, and Europe.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives