- China

- /

- Medical Equipment

- /

- SZSE:300888

Further Upside For Winner Medical Co., Ltd. (SZSE:300888) Shares Could Introduce Price Risks After 26% Bounce

Winner Medical Co., Ltd. (SZSE:300888) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 29%.

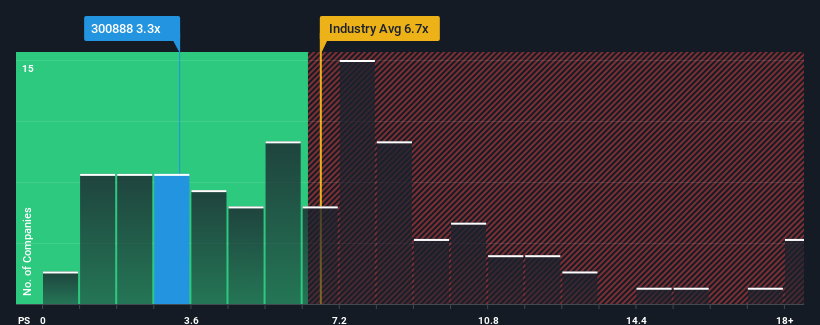

Although its price has surged higher, when around half the companies operating in China's Medical Equipment industry have price-to-sales ratios (or "P/S") above 6.7x, you may still consider Winner Medical as an incredibly enticing stock to check out with its 3.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Winner Medical

What Does Winner Medical's P/S Mean For Shareholders?

Winner Medical hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Winner Medical will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Winner Medical's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. As a result, revenue from three years ago have also fallen 6.6% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 22% over the next year. Meanwhile, the rest of the industry is forecast to expand by 24%, which is not materially different.

With this in consideration, we find it intriguing that Winner Medical's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Winner Medical's P/S?

Shares in Winner Medical have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Winner Medical's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Having said that, be aware Winner Medical is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Winner Medical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Winner Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300888

Winner Medical

Engages in the research and development, manufacture, and marketing of cotton-based medical dressings and medical disposables, and consumer products in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives