- China

- /

- Medical Equipment

- /

- SZSE:300326

Investors five-year losses continue as Shanghai Kinetic Medical (SZSE:300326) dips a further 8.6% this week, earnings continue to decline

Shanghai Kinetic Medical Co., Ltd (SZSE:300326) shareholders should be happy to see the share price up 21% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. Indeed, the share price is down 56% in the period. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

Since Shanghai Kinetic Medical has shed CN¥437m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Shanghai Kinetic Medical

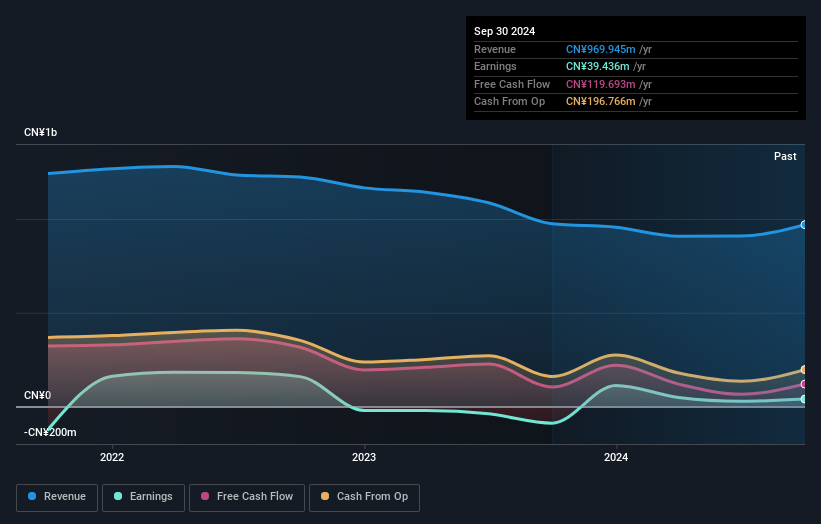

Given that Shanghai Kinetic Medical only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last five years Shanghai Kinetic Medical saw its revenue shrink by 4.0% per year. That's not what investors generally want to see. With neither profit nor revenue growth, the loss of 9% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Shanghai Kinetic Medical's financial health with this free report on its balance sheet.

A Different Perspective

Shanghai Kinetic Medical shareholders are up 3.8% for the year (even including dividends). Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Shanghai Kinetic Medical better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Shanghai Kinetic Medical (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

We will like Shanghai Kinetic Medical better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300326

Shanghai Kinetic Medical

Manufactures and sells medical devices in China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives