- China

- /

- Healthtech

- /

- SZSE:300253

Winning Health Technology Group Co., Ltd. (SZSE:300253) Held Back By Insufficient Growth Even After Shares Climb 25%

Winning Health Technology Group Co., Ltd. (SZSE:300253) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

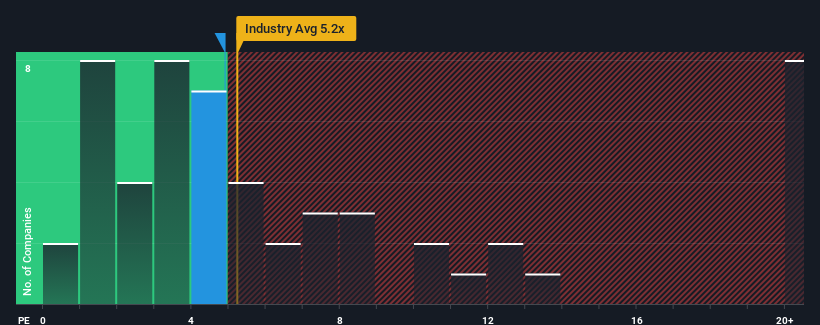

In spite of the firm bounce in price, given about half the companies operating in China's Healthcare Services industry have price-to-sales ratios (or "P/S") above 8.1x, you may still consider Winning Health Technology Group as an attractive investment with its 4.9x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Winning Health Technology Group

What Does Winning Health Technology Group's P/S Mean For Shareholders?

Recent times have been advantageous for Winning Health Technology Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Winning Health Technology Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Winning Health Technology Group?

The only time you'd be truly comfortable seeing a P/S as low as Winning Health Technology Group's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.3%. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 29% during the coming year according to the six analysts following the company. With the industry predicted to deliver 39% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Winning Health Technology Group's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Winning Health Technology Group's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Winning Health Technology Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Winning Health Technology Group you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Winning Health Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Winning Health Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300253

Winning Health Technology Group

Provides digital health services for medical and health institutions in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives