- Japan

- /

- Professional Services

- /

- TSE:6200

3 Stocks Possibly Trading Below Their Estimated Fair Value

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policy changes, many major indices are reaching record highs, driven by investor optimism over potential growth and tax reforms. Amidst this rally, some stocks may still be trading below their estimated fair value, offering potential opportunities for investors who focus on fundamentals such as earnings growth prospects and valuation metrics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| IMAGICA GROUP (TSE:6879) | ¥475.00 | ¥946.51 | 49.8% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.81 | 50% |

| Appier Group (TSE:4180) | ¥1700.00 | ¥3393.06 | 49.9% |

| Dynavox Group (OM:DYVOX) | SEK66.50 | SEK132.84 | 49.9% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| Proficient Auto Logistics (NasdaqGS:PAL) | US$10.00 | US$19.92 | 49.8% |

| Nayuki Holdings (SEHK:2150) | HK$1.59 | HK$3.17 | 49.9% |

| Dometic Group (OM:DOM) | SEK61.15 | SEK121.72 | 49.8% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3915.00 | ¥7790.88 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.14 | €16.25 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

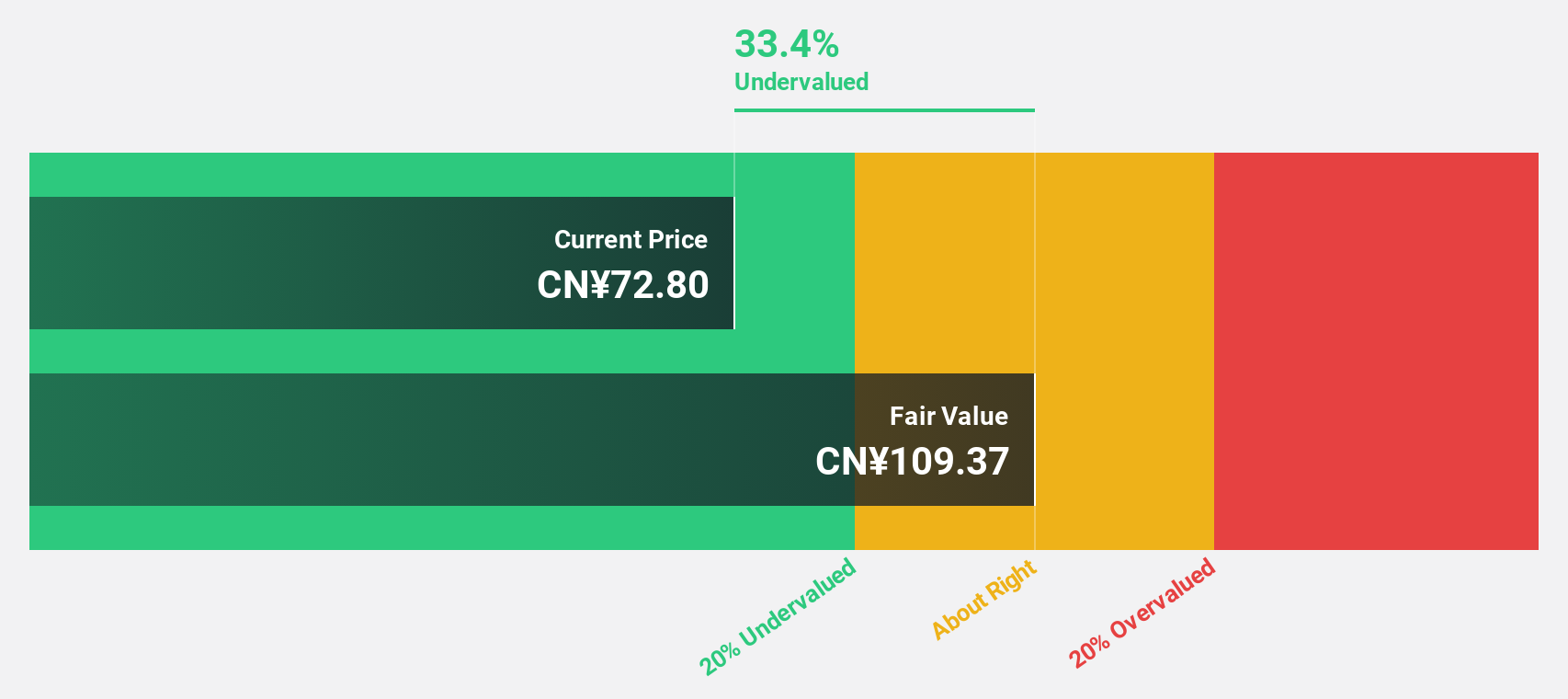

HangzhouS MedTech (SHSE:688581)

Overview: Hangzhou AGS MedTech Co., Ltd. specializes in the research, development, production, sale, and service of endoscopic surgery equipment and accessories in China with a market cap of CN¥4.97 billion.

Operations: Hangzhou AGS MedTech Co., Ltd. generates revenue through its involvement in the research, development, production, sale, and service of endoscopic surgery equipment and accessories within China.

Estimated Discount To Fair Value: 48.2%

Hangzhou S MedTech is trading at CN¥64.38, significantly below its estimated fair value of CN¥124.39, suggesting it is undervalued based on discounted cash flow analysis. The company's revenue and earnings are forecast to grow at 26.9% and 22.3% per year, respectively, with recent results showing increased sales and net income over the previous year. Despite slower earnings growth compared to the market, its strong revenue outlook supports potential value realization.

- The growth report we've compiled suggests that HangzhouS MedTech's future prospects could be on the up.

- Get an in-depth perspective on HangzhouS MedTech's balance sheet by reading our health report here.

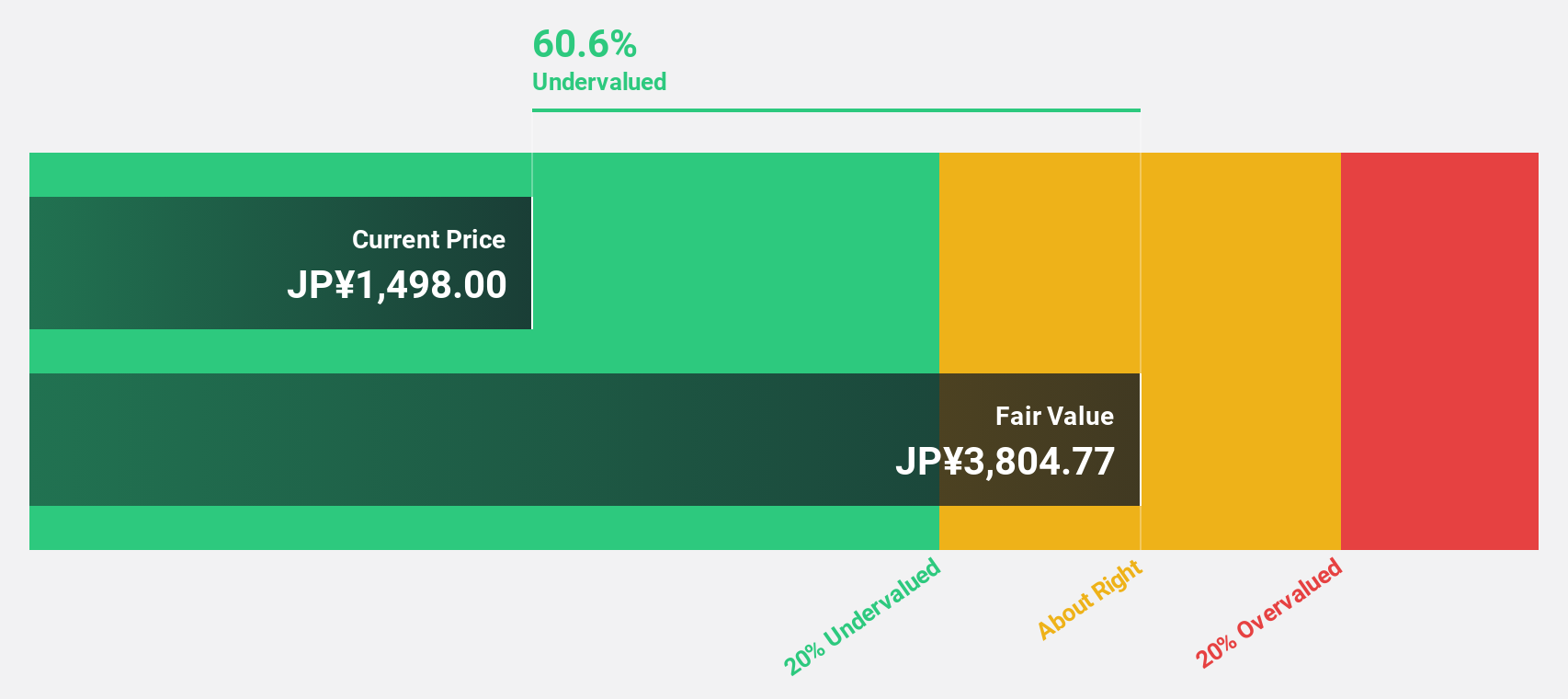

Appier Group (TSE:4180)

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market cap of approximately ¥172.89 billion.

Operations: The company's revenue primarily comes from its AI SaaS Business, generating ¥30.22 billion.

Estimated Discount To Fair Value: 49.9%

Appier Group, trading at ¥1700, is significantly undervalued with an estimated fair value of ¥3393.06 based on discounted cash flow analysis. Its earnings are projected to grow substantially at 38.3% annually, outpacing the market's growth rate. Despite high share price volatility and a lower return on equity forecast, Appier's recent inclusion as an Apple Search Ads Partner highlights its innovative AI capabilities and potential for enhancing client ROI through advanced campaign management solutions.

- Our growth report here indicates Appier Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Appier Group stock in this financial health report.

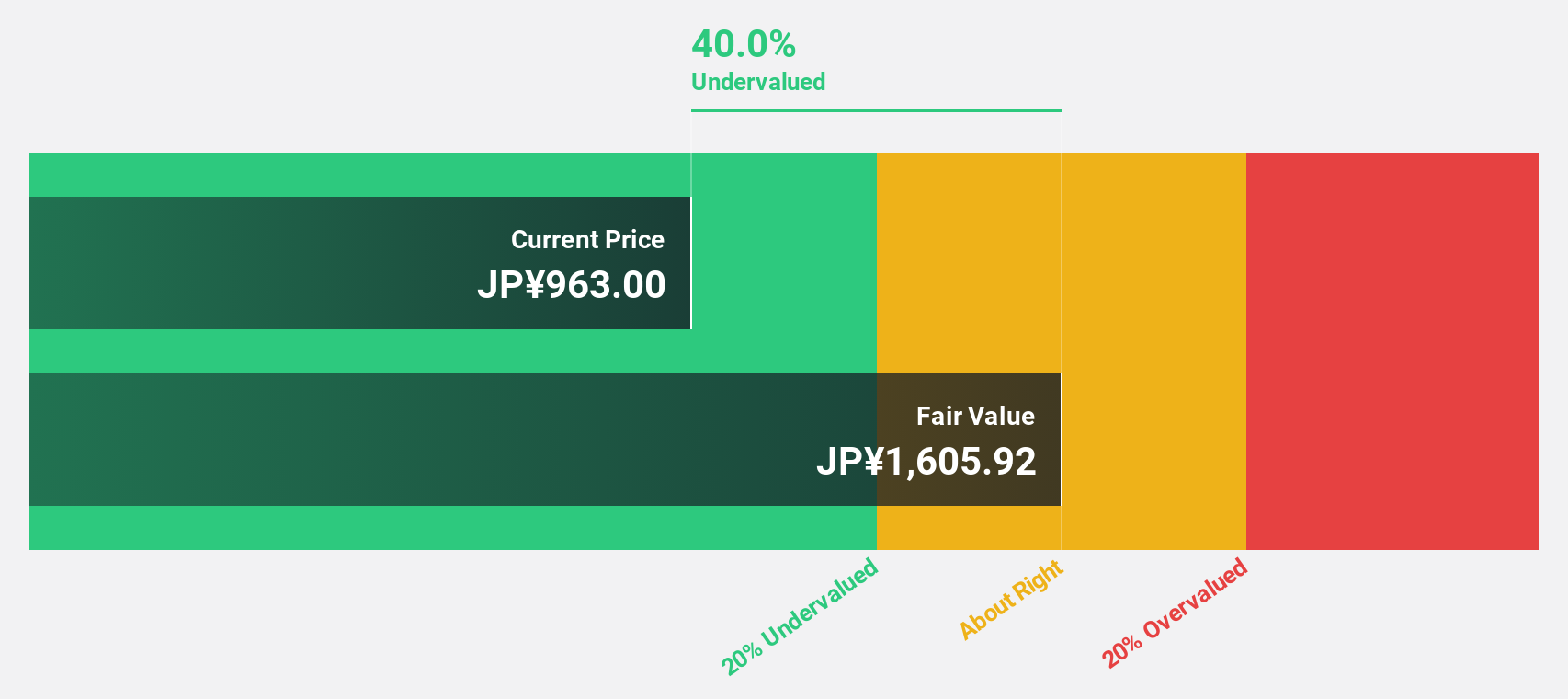

Insource (TSE:6200)

Overview: Insource Co., Ltd. operates in Japan, offering lecturer dispatch type training, open lectures, and other educational services with a market cap of ¥87.26 billion.

Operations: The company's revenue segments include ¥6.50 billion from lecturer dispatch type training, ¥3.20 billion from open lectures, and ¥1.80 billion from other educational services in Japan.

Estimated Discount To Fair Value: 32.4%

Insource Co., Ltd. is trading at ¥1080, notably undervalued compared to its estimated fair value of ¥1598.2 based on discounted cash flow analysis. The company anticipates revenue growth of 14.9% annually, surpassing the JP market's 4.2%. Earnings are expected to grow at 18% per year, outpacing the market's 9.1%, despite recent share price volatility. Upcoming dividends and strategic expansions, such as opening a new office in Gunma, support its growth trajectory.

- In light of our recent growth report, it seems possible that Insource's financial performance will exceed current levels.

- Dive into the specifics of Insource here with our thorough financial health report.

Seize The Opportunity

- Explore the 896 names from our Undervalued Stocks Based On Cash Flows screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6200

Insource

Provides various lecturer dispatch type training, open lecture, and other services in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives