- China

- /

- Medical Equipment

- /

- SHSE:688338

Investors Still Aren't Entirely Convinced By Beijing Succeeder Technology Inc.'s (SHSE:688338) Earnings Despite 36% Price Jump

The Beijing Succeeder Technology Inc. (SHSE:688338) share price has done very well over the last month, posting an excellent gain of 36%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

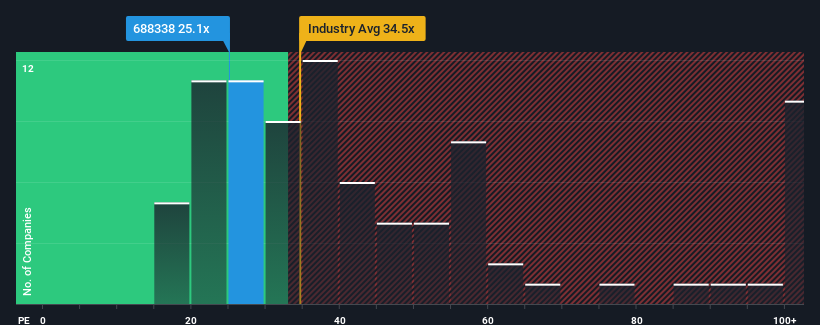

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Beijing Succeeder Technology as an attractive investment with its 25.1x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Beijing Succeeder Technology has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Beijing Succeeder Technology

Is There Any Growth For Beijing Succeeder Technology?

Beijing Succeeder Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 37% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the lone analyst watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Beijing Succeeder Technology's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Beijing Succeeder Technology's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Beijing Succeeder Technology's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Beijing Succeeder Technology (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on Beijing Succeeder Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Beijing Succeeder Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Succeeder Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688338

Beijing Succeeder Technology

Engages in the research and development, manufacture, and sale of in-vitro diagnostic products in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives