The Market Lifts Fujian Wanchen Biotechnology Group Co., Ltd. (SZSE:300972) Shares 26% But It Can Do More

Despite an already strong run, Fujian Wanchen Biotechnology Group Co., Ltd. (SZSE:300972) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 163% following the latest surge, making investors sit up and take notice.

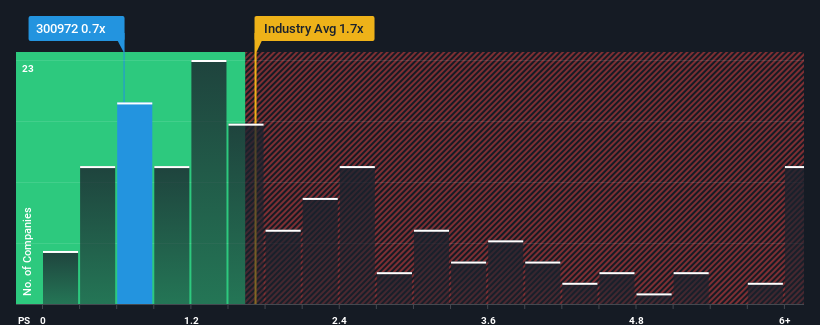

In spite of the firm bounce in price, Fujian Wanchen Biotechnology Group may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Food industry in China have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Fujian Wanchen Biotechnology Group

How Fujian Wanchen Biotechnology Group Has Been Performing

Recent times have been advantageous for Fujian Wanchen Biotechnology Group as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Fujian Wanchen Biotechnology Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Fujian Wanchen Biotechnology Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 72% over the next year. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

In light of this, it's peculiar that Fujian Wanchen Biotechnology Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Fujian Wanchen Biotechnology Group's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Fujian Wanchen Biotechnology Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 2 warning signs we've spotted with Fujian Wanchen Biotechnology Group.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300972

Fujian Wanchen Biotechnology Group

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives