Sentiment Still Eluding Fujian Wanchen Biotechnology Group Co., Ltd. (SZSE:300972)

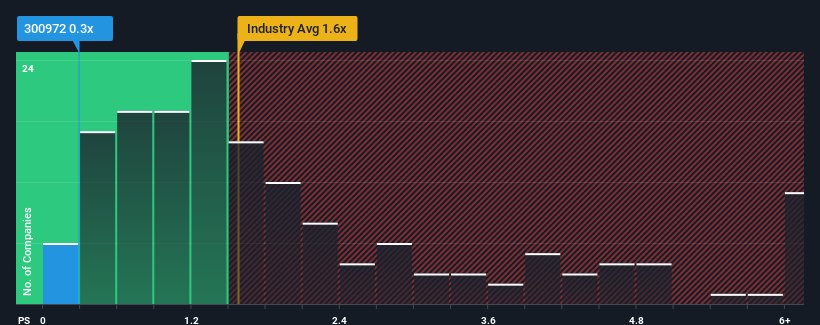

When you see that almost half of the companies in the Food industry in China have price-to-sales ratios (or "P/S") above 1.6x, Fujian Wanchen Biotechnology Group Co., Ltd. (SZSE:300972) looks to be giving off some buy signals with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Fujian Wanchen Biotechnology Group

What Does Fujian Wanchen Biotechnology Group's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Fujian Wanchen Biotechnology Group has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Fujian Wanchen Biotechnology Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Fujian Wanchen Biotechnology Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Fujian Wanchen Biotechnology Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to deliver huge revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 60% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 18%, which is noticeably less attractive.

In light of this, it's peculiar that Fujian Wanchen Biotechnology Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Fujian Wanchen Biotechnology Group's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Fujian Wanchen Biotechnology Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You always need to take note of risks, for example - Fujian Wanchen Biotechnology Group has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Fujian Wanchen Biotechnology Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300972

Fujian Wanchen Biotechnology GroupLtd

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives