As global trade tensions show signs of easing, Asian markets are experiencing a cautious optimism, with countries like China preparing to bolster their economies through strategic stimulus measures. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| BIWIN Storage Technology (SHSE:688525) | 17.7% | 59.6% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's uncover some gems from our specialized screener.

DigiPlus Interactive (PSE:PLUS)

Simply Wall St Growth Rating: ★★★★★★

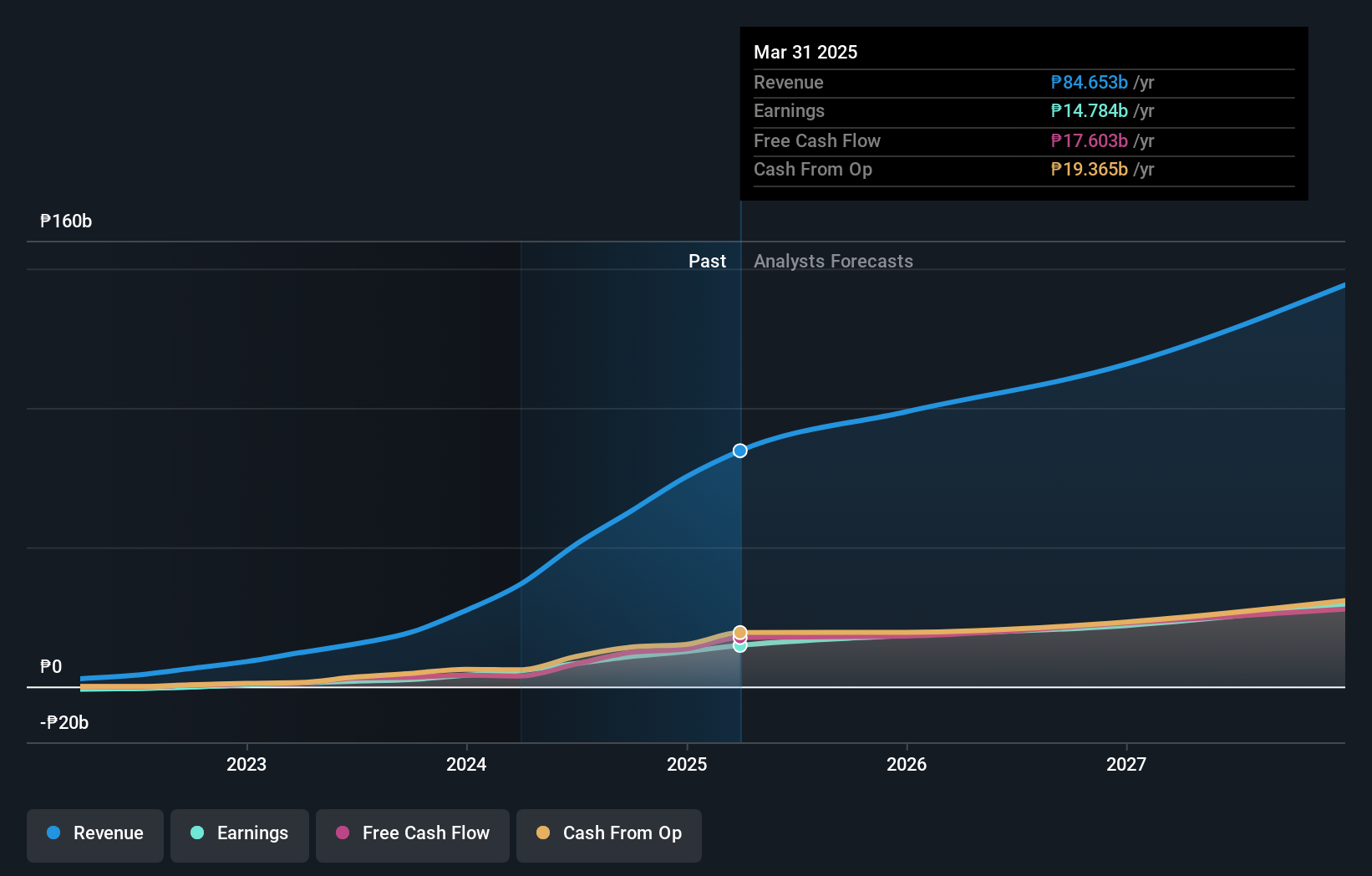

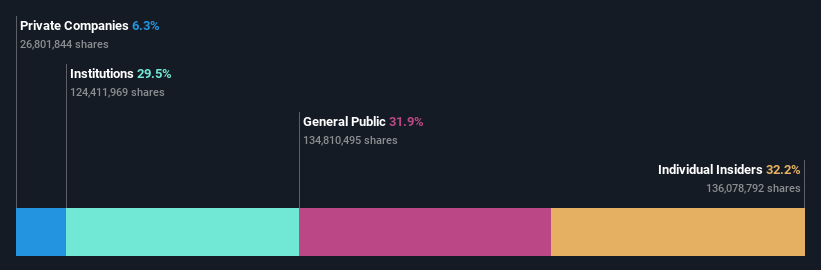

Overview: DigiPlus Interactive Corp., with a market cap of ₱177.32 billion, operates as a digital entertainment company in the Philippines through its subsidiaries.

Operations: The company's revenue is derived from its Casino Group with ₱497.10 million, Retail Group contributing ₱74.26 billion, and Network and License Group generating ₱424.15 million, alongside Property and Other Investments at ₱45.52 million.

Insider Ownership: 11.3%

Earnings Growth Forecast: 24.1% p.a.

DigiPlus Interactive, a key player in the Philippines' digital entertainment sector, has demonstrated significant growth with net income rising to PHP 12.58 billion for 2024. The company is expanding internationally by establishing DigiPlus Global in Singapore, aiming to drive strategic partnerships and talent acquisition. Despite substantial insider selling recently, forecasts suggest revenue and earnings will grow faster than the Philippine market at over 20% annually, indicating strong growth potential amidst competitive valuation.

- Unlock comprehensive insights into our analysis of DigiPlus Interactive stock in this growth report.

- In light of our recent valuation report, it seems possible that DigiPlus Interactive is trading behind its estimated value.

BrightGene Bio-Medical Technology (SHSE:688166)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BrightGene Bio-Medical Technology Co., Ltd. is a pharmaceutical company involved in the research, development, manufacture, and commercialization of pharmaceutical products in China, with a market cap of approximately CN¥20.50 billion.

Operations: BrightGene Bio-Medical Technology Co., Ltd. generates revenue through its core activities in the pharmaceutical sector, focusing on the research, development, production, and sale of pharmaceutical products within China.

Insider Ownership: 26.9%

Earnings Growth Forecast: 45.1% p.a.

BrightGene Bio-Medical Technology is experiencing a challenging period with Q1 2025 earnings showing a decline in revenue to CNY 248.96 million from CNY 340.13 million year-on-year, and net income dropping significantly. Despite this, the company is trading at a substantial discount to its estimated fair value, and forecasts predict its revenue will grow over 35% annually, outpacing the Chinese market's growth rate. Earnings are also expected to increase significantly over the next three years.

- Click to explore a detailed breakdown of our findings in BrightGene Bio-Medical Technology's earnings growth report.

- In light of our recent valuation report, it seems possible that BrightGene Bio-Medical Technology is trading beyond its estimated value.

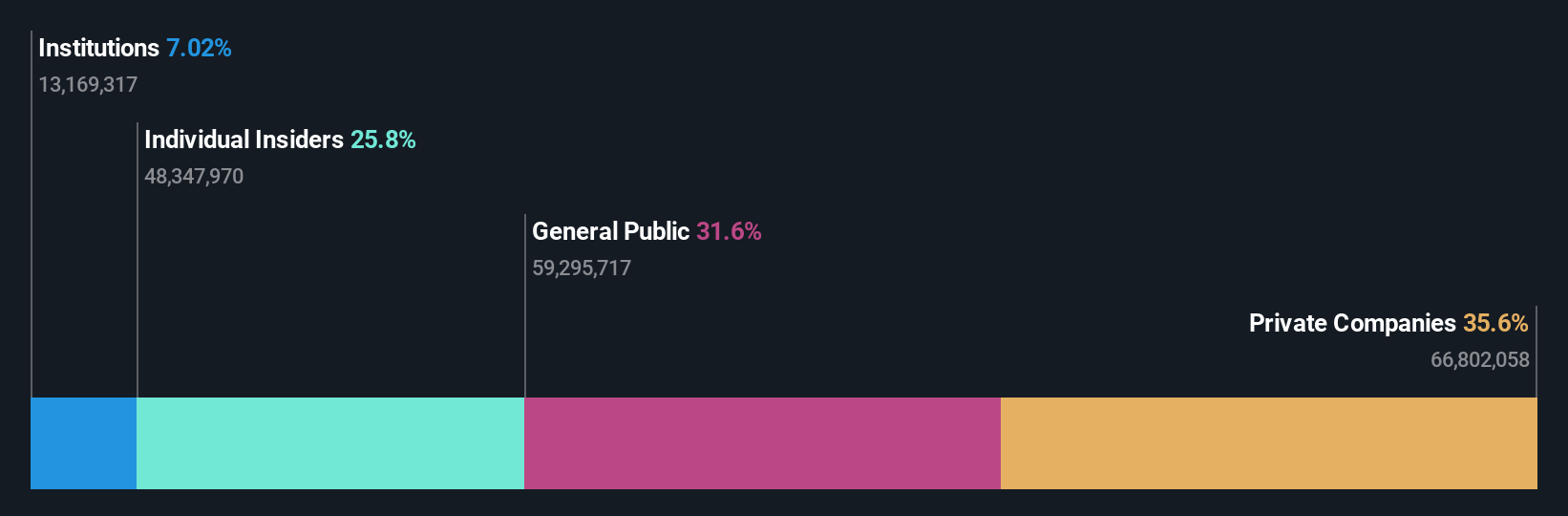

Fujian Wanchen Biotechnology Group (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fujian Wanchen Biotechnology Co., Ltd focuses on the R&D, cultivation, production, and sale of edible fungi in China with a market cap of CN¥29.65 billion.

Operations: The company's revenue segments consist of CN¥0.54 billion from edible fungi and CN¥31.79 billion from mass selling snacks.

Insider Ownership: 14.7%

Earnings Growth Forecast: 34.2% p.a.

Fujian Wanchen Biotechnology Group has demonstrated impressive financial performance with 2024 revenue reaching CNY 32.33 billion, a substantial increase from the previous year. The company became profitable, reporting a net income of CNY 293.52 million compared to a loss previously. Revenue and earnings are forecasted to grow significantly faster than the market, at rates of 23.4% and 34.2% per year respectively, although its share price remains highly volatile recently.

- Get an in-depth perspective on Fujian Wanchen Biotechnology Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Fujian Wanchen Biotechnology Group's share price might be too optimistic.

Key Takeaways

- Navigate through the entire inventory of 627 Fast Growing Asian Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300972

Fujian Wanchen Biotechnology Group

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives