3 Asian Growth Companies With High Insider Ownership And Up To 81% Earnings Growth

Reviewed by Simply Wall St

As global markets face challenges from policy risks, inflation concerns, and geopolitical tensions, investors in Asia are navigating a landscape marked by volatility and opportunity. Amid these conditions, growth companies with high insider ownership can be particularly appealing due to the potential alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Jiayou International LogisticsLtd (SHSE:603871) | 19.3% | 27.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Sineng ElectricLtd (SZSE:300827) | 36.3% | 41.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.4% |

| Oscotec (KOSDAQ:A039200) | 21.2% | 148.5% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 93.3% |

Let's review some notable picks from our screened stocks.

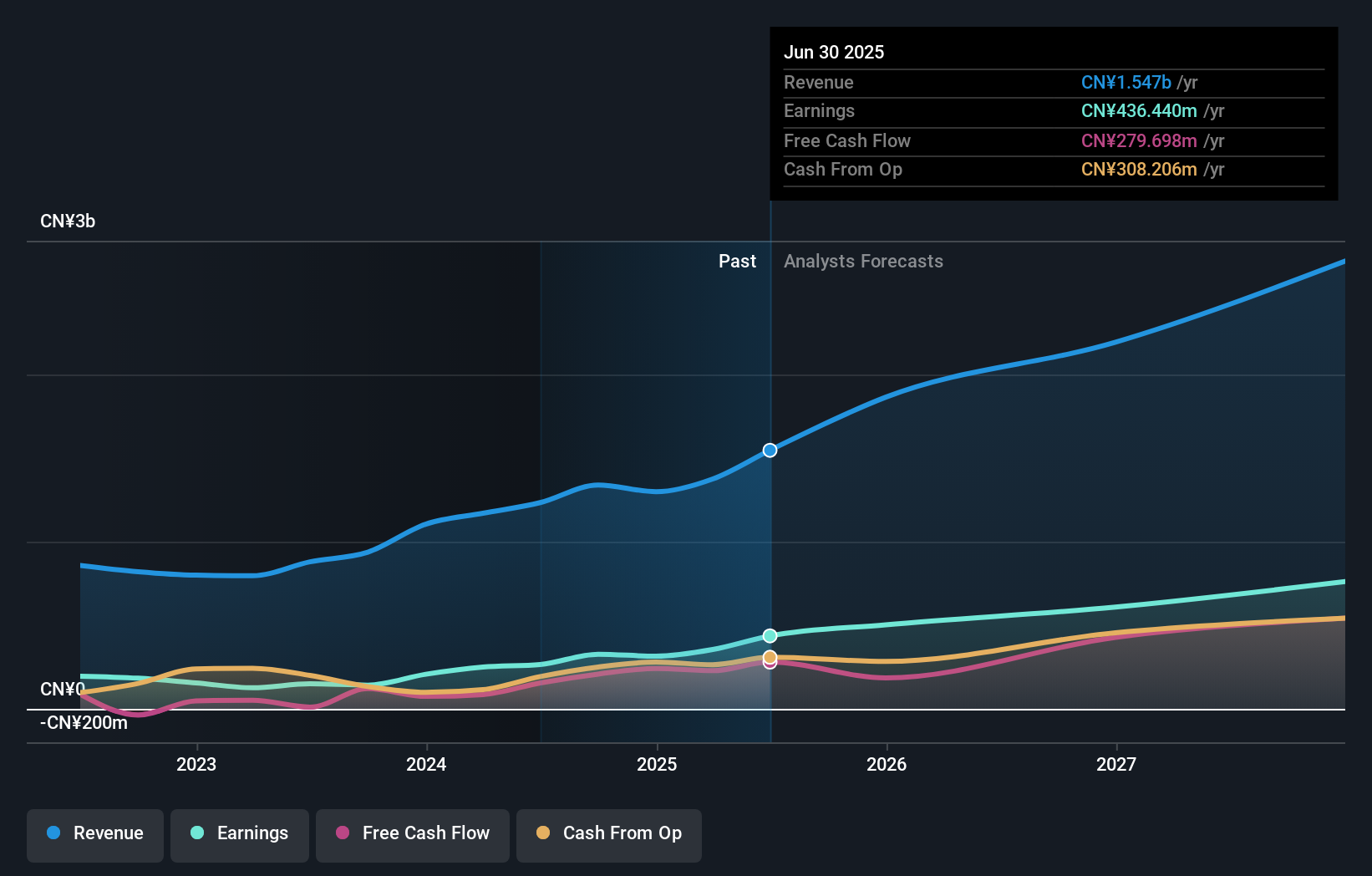

Ficont Industry (Beijing) (SHSE:605305)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ficont Industry (Beijing) Co., Ltd. operates in the wind energy, construction, and safety protection equipment sectors both in China and internationally, with a market capitalization of CN¥5.97 billion.

Operations: The company's revenue from construction machinery and equipment amounts to CN¥1.34 billion.

Insider Ownership: 33.6%

Earnings Growth Forecast: 24.9% p.a.

Ficont Industry (Beijing) is experiencing substantial growth, with its revenue forecasted to increase at 24.8% annually, outpacing the broader Chinese market. Despite earnings growth slightly trailing the market, they are still expected to rise significantly at 24.86% per year over the next three years. The stock is trading well below its estimated fair value and offers good relative value compared to peers. However, a low return on equity forecast and an unstable dividend track record present potential concerns.

- Dive into the specifics of Ficont Industry (Beijing) here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Ficont Industry (Beijing) is priced lower than what may be justified by its financials.

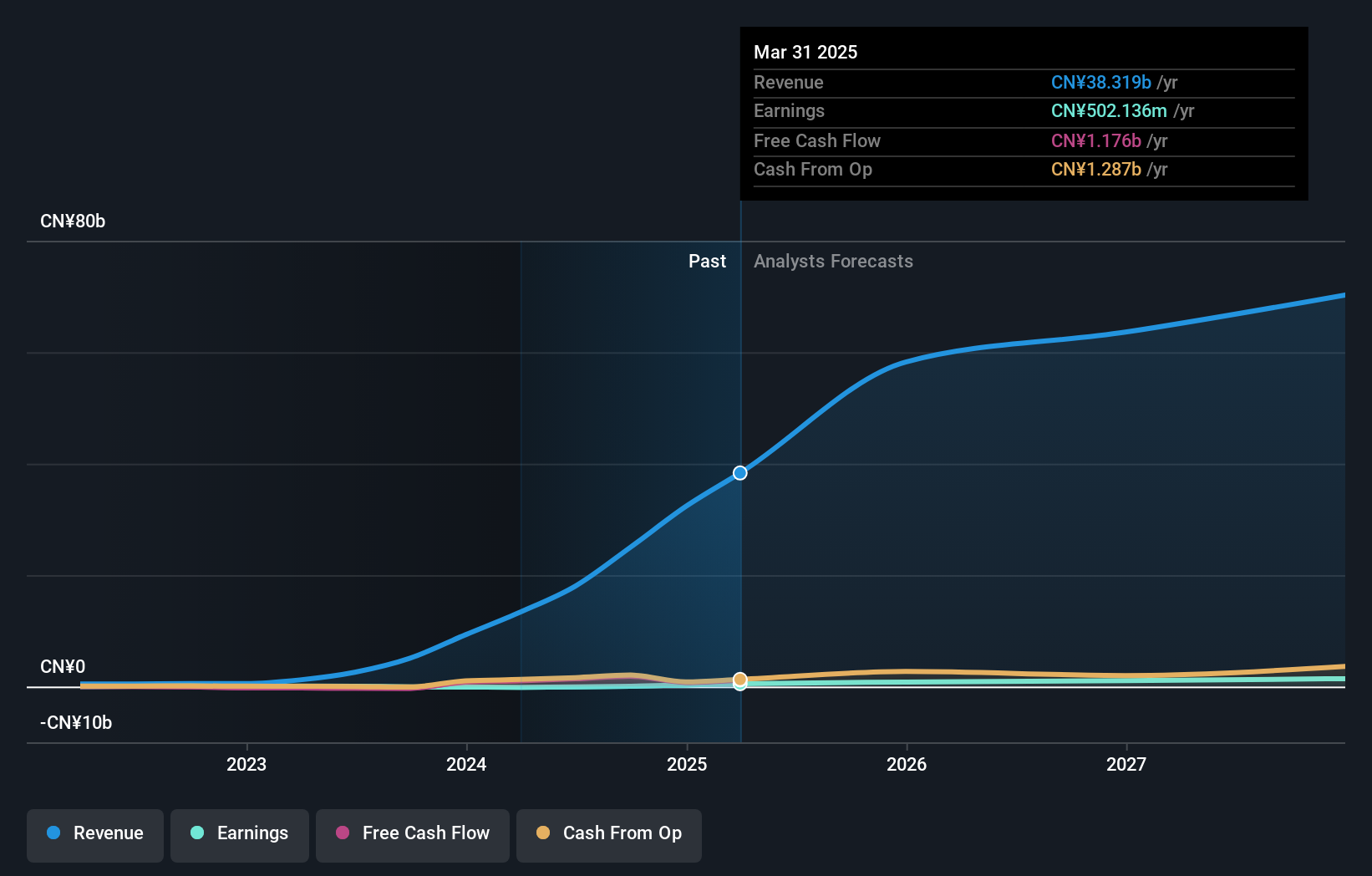

Fujian Wanchen Biotechnology Group (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fujian Wanchen Biotechnology Co., Ltd is involved in the research, development, cultivation, production, and sale of edible fungi in China with a market cap of CN¥17.25 billion.

Operations: The company generates revenue through its activities in the research, development, cultivation, production, and sale of edible fungi within China.

Insider Ownership: 14.7%

Earnings Growth Forecast: 81.8% p.a.

Fujian Wanchen Biotechnology Group is poised for significant growth, with earnings projected to rise 81.75% annually, far exceeding the Chinese market's average. The company's revenue is also expected to grow robustly at 38.2% per year. Despite recent shareholder dilution, it trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Recent dividend affirmations highlight a commitment to returning capital to shareholders amidst strong growth forecasts.

- Get an in-depth perspective on Fujian Wanchen Biotechnology Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Fujian Wanchen Biotechnology Group's share price might be too pessimistic.

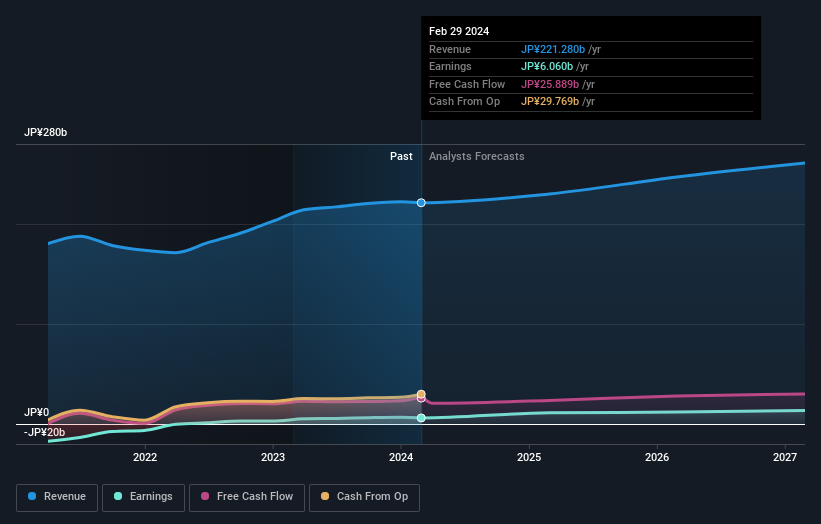

World (TSE:3612)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: World Co., Ltd. operates in the apparel and fashion industry, engaging in planning, manufacturing, retailing, selling, and importing/exporting products both within Japan and internationally; it has a market cap of approximately ¥84.05 billion.

Operations: The company generates revenue through the planning, manufacturing, retailing, selling, and importing/exporting of apparel and fashion products both domestically in Japan and on an international scale.

Insider Ownership: 13.9%

Earnings Growth Forecast: 21.6% p.a.

World Co., Ltd. shows potential for growth with earnings expected to increase significantly by 21.6% annually, outpacing the Japanese market average. Despite trading at a substantial discount to its estimated fair value, the company faces challenges with a high debt level and an unstable dividend history. Recent revisions in earnings forecasts and increased dividends suggest strategic adjustments, though recent sales figures indicate slight declines compared to last year across various channels.

- Delve into the full analysis future growth report here for a deeper understanding of World.

- Our valuation report unveils the possibility World's shares may be trading at a discount.

Make It Happen

- Click here to access our complete index of 644 Fast Growing Asian Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605305

Ficont Industry (Beijing)

Provides wind energy, construction, and safety protection equipment in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives