Ningxia Xiaoming Agriculture & Animal Husbandry Co.,Ltd's (SZSE:300967) 33% Price Boost Is Out Of Tune With Revenues

Ningxia Xiaoming Agriculture & Animal Husbandry Co.,Ltd (SZSE:300967) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

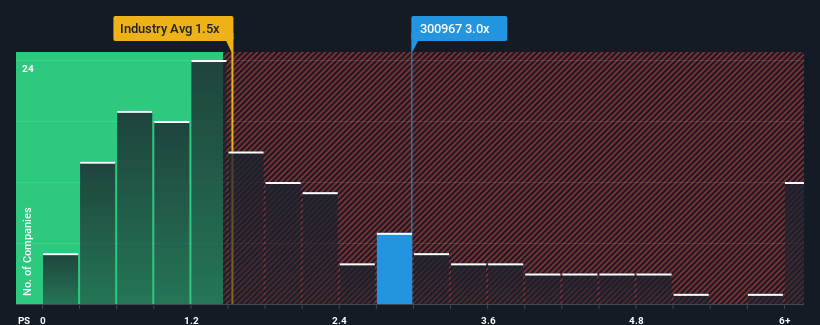

Following the firm bounce in price, when almost half of the companies in China's Food industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Ningxia Xiaoming Agriculture & Animal HusbandryLtd as a stock probably not worth researching with its 3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Ningxia Xiaoming Agriculture & Animal HusbandryLtd

How Ningxia Xiaoming Agriculture & Animal HusbandryLtd Has Been Performing

For instance, Ningxia Xiaoming Agriculture & Animal HusbandryLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Ningxia Xiaoming Agriculture & Animal HusbandryLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Ningxia Xiaoming Agriculture & Animal HusbandryLtd?

The only time you'd be truly comfortable seeing a P/S as high as Ningxia Xiaoming Agriculture & Animal HusbandryLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 16% shows it's noticeably less attractive.

With this information, we find it concerning that Ningxia Xiaoming Agriculture & Animal HusbandryLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Ningxia Xiaoming Agriculture & Animal HusbandryLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Ningxia Xiaoming Agriculture & Animal HusbandryLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Ningxia Xiaoming Agriculture & Animal HusbandryLtd (2 are a bit unpleasant!) that you need to be mindful of.

If you're unsure about the strength of Ningxia Xiaoming Agriculture & Animal HusbandryLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Xiaoming Agriculture & Animal HusbandryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300967

Ningxia Xiaoming Agriculture & Animal HusbandryLtd

Engages in the layer breeding business in China.

Good value slight.

Market Insights

Community Narratives