- Taiwan

- /

- Semiconductors

- /

- TWSE:6515

Insider Picks For Growth In January 2025

Reviewed by Simply Wall St

As global markets continue to rally, with U.S. stocks nearing record highs fueled by optimism around potential trade deals and AI investments, growth stocks have notably outperformed their value counterparts for the first time this year. In this environment of heightened investor confidence and economic activity, companies with significant insider ownership often signal strong alignment between management and shareholder interests, making them compelling candidates for those seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's uncover some gems from our specialized screener.

Beijing Dabeinong Technology GroupLtd (SZSE:002385)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Dabeinong Technology Group Co., Ltd. operates in the agricultural technology sector and has a market cap of approximately CN¥17.50 billion.

Operations: Beijing Dabeinong Technology Group Co., Ltd. generates its revenue from various segments within the agricultural technology sector.

Insider Ownership: 27.4%

Earnings Growth Forecast: 93% p.a.

Beijing Dabeinong Technology Group Ltd. is trading at a significant discount, 62.4% below its estimated fair value, and is expected to achieve above-average market profit growth within three years. However, earnings currently do not cover interest payments or dividends effectively. Revenue growth is projected at 13.6% annually, slightly outpacing the Chinese market's average of 13.4%. Recent shareholder meetings focused on connected transactions and dividend affirmations indicate active insider engagement but no substantial insider trading activity was noted in the past three months.

- Get an in-depth perspective on Beijing Dabeinong Technology GroupLtd's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Beijing Dabeinong Technology GroupLtd is priced lower than what may be justified by its financials.

Relo Group (TSE:8876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Relo Group, Inc. provides property management services in Japan and has a market cap of ¥275.20 billion.

Operations: The company's revenue is primarily derived from its Relocation Business at ¥97.34 billion, followed by the Welfare Program at ¥26.52 billion and the Tourism Business at ¥15.17 billion.

Insider Ownership: 29.0%

Earnings Growth Forecast: 18.7% p.a.

Relo Group is trading at 36.2% below its estimated fair value, with revenue expected to grow at 5.6% annually, surpassing the Japanese market's average of 4.3%. The company forecasts robust earnings growth of 18.69% per year and high return on equity in three years (26.1%). Recently completing a buyback of over ¥5 billion worth of shares, Relo Group demonstrates strong insider confidence despite dividends not being well covered by earnings currently.

- Take a closer look at Relo Group's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Relo Group's current price could be quite moderate.

WinWay Technology (TWSE:6515)

Simply Wall St Growth Rating: ★★★★★★

Overview: WinWay Technology Co., Ltd. designs, processes, and sells optoelectronic product test fixtures and integrated circuit test interfaces globally, with a market cap of NT$42.89 billion.

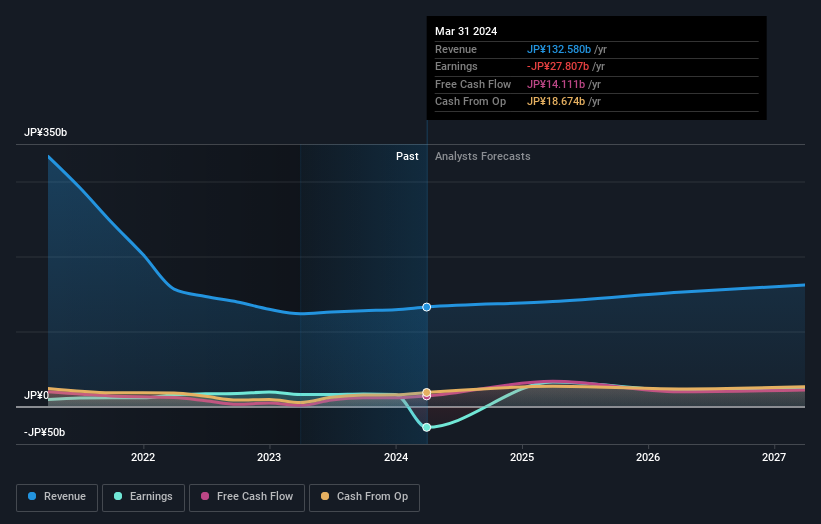

Operations: The company generates revenue of NT$4.93 billion from the manufacture and sales of photoelectric product testing tools.

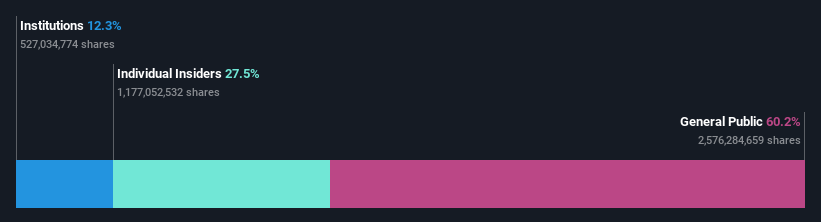

Insider Ownership: 22.6%

Earnings Growth Forecast: 28.1% p.a.

WinWay Technology's recent acquittal in a trade secrets case removes a potential legal overhang, enhancing its growth outlook. The company is trading significantly below its estimated fair value, with revenue and earnings expected to grow at 20.8% and 28.1% annually, respectively, outpacing the Taiwan market averages. Despite high share price volatility recently and no substantial insider transactions reported in the past three months, analysts anticipate a stock price increase of 22.6%.

- Click here and access our complete growth analysis report to understand the dynamics of WinWay Technology.

- Insights from our recent valuation report point to the potential undervaluation of WinWay Technology shares in the market.

Next Steps

- Discover the full array of 1465 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if WinWay Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6515

WinWay Technology

Designs, processes, and sells optoelectronic product test fixtures, integrated circuit test interfaces, and fixtures and their components in Taiwan, the Americas, China, Asia, Europe, and Canada.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives