Investors bid Lanzhou Huanghe Enterprise (SZSE:000929) up CN¥152m despite increasing losses YoY, taking five-year CAGR to 3.4%

It hasn't been the best quarter for Lanzhou Huanghe Enterprise Co., Ltd (SZSE:000929) shareholders, since the share price has fallen 21% in that time. But at least the stock is up over the last five years. Unfortunately its return of 18% is below the market return of 30%.

Since it's been a strong week for Lanzhou Huanghe Enterprise shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Lanzhou Huanghe Enterprise

Because Lanzhou Huanghe Enterprise made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Lanzhou Huanghe Enterprise saw its revenue shrink by 14% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 3% per year over that time. That's pretty decent given the top line decline, and lack of profits. Of course, a closer look at the bottom line - and any available analyst forecasts - could reveal an opportunity (if they point to future growth).

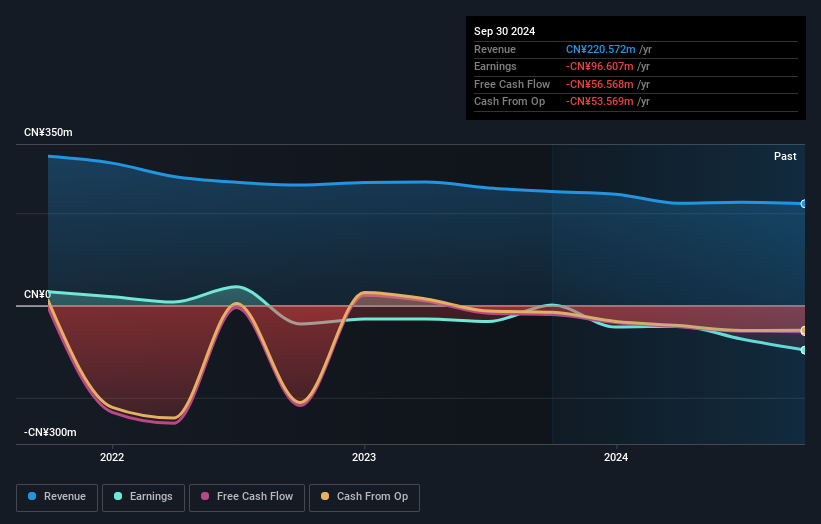

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Lanzhou Huanghe Enterprise's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Lanzhou Huanghe Enterprise had a tough year, with a total loss of 4.3%, against a market gain of about 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Lanzhou Huanghe Enterprise that you should be aware of.

Of course Lanzhou Huanghe Enterprise may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000929

Lanzhou Huanghe Enterprise

Engages in the production and sale of beer, malt, and beverages.

Flawless balance sheet minimal.

Market Insights

Community Narratives