Wuliangye Yibin Co.,Ltd. (SZSE:000858) Stock Catapults 30% Though Its Price And Business Still Lag The Market

Wuliangye Yibin Co.,Ltd. (SZSE:000858) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.4% over the last year.

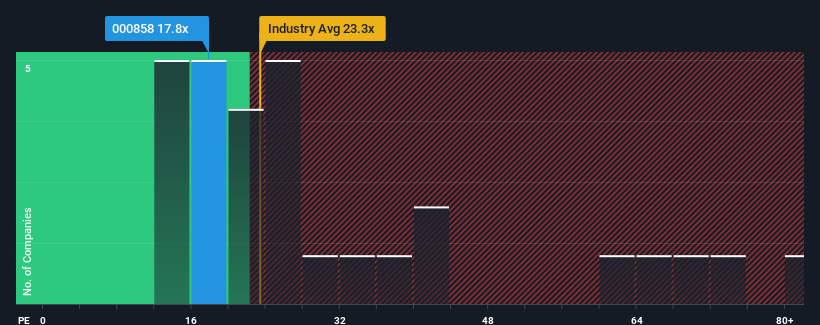

In spite of the firm bounce in price, Wuliangye YibinLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.8x, since almost half of all companies in China have P/E ratios greater than 29x and even P/E's higher than 54x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Wuliangye YibinLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Wuliangye YibinLtd

How Is Wuliangye YibinLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Wuliangye YibinLtd's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. The latest three year period has also seen an excellent 45% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 13% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% each year, which is noticeably more attractive.

In light of this, it's understandable that Wuliangye YibinLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Wuliangye YibinLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Wuliangye YibinLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Wuliangye YibinLtd with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Wuliangye YibinLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000858

Wuliangye YibinLtd

Manufactures and sells liquor and wine products under the Wuliangye brand in China.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives