Market Cool On Fujian Aonong Biological Technology Group Incorporation Limited's (SHSE:603363) Revenues Pushing Shares 30% Lower

Fujian Aonong Biological Technology Group Incorporation Limited (SHSE:603363) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 63% share price decline.

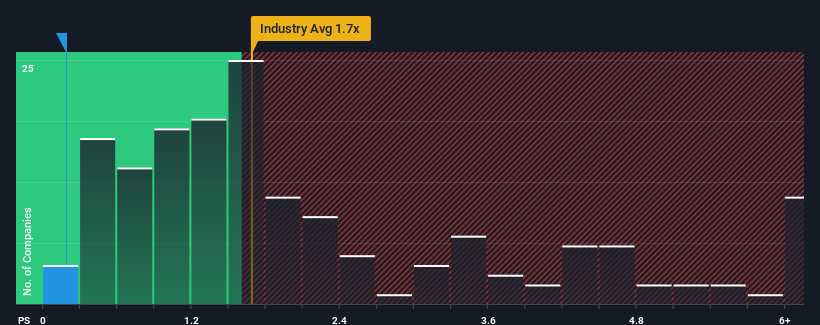

Since its price has dipped substantially, Fujian Aonong Biological Technology Group Incorporation may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Food industry in China have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Fujian Aonong Biological Technology Group Incorporation

What Does Fujian Aonong Biological Technology Group Incorporation's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Fujian Aonong Biological Technology Group Incorporation's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fujian Aonong Biological Technology Group Incorporation.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Fujian Aonong Biological Technology Group Incorporation's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 91% during the coming year according to the one analyst following the company. With the industry only predicted to deliver 11%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Fujian Aonong Biological Technology Group Incorporation is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Fujian Aonong Biological Technology Group Incorporation's P/S?

Fujian Aonong Biological Technology Group Incorporation's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Fujian Aonong Biological Technology Group Incorporation's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Fujian Aonong Biological Technology Group Incorporation that you should be aware of.

If you're unsure about the strength of Fujian Aonong Biological Technology Group Incorporation's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603363

Fujian Aonong Biological Technology Group Incorporation

Engages in the feed, pig raising, food, supply chain services, agricultural internet, bio-pharmaceutical, and other businesses in China and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives