- Taiwan

- /

- Construction

- /

- TWSE:2404

Discovering November 2024's Undiscovered Gems with Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious earnings reports and mixed economic signals, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amid a busy earnings week. With the S&P MidCap 400 Index reaching record highs before retreating and labor market data sending divergent signals, investors are increasingly looking for potential opportunities in lesser-known stocks that may offer growth prospects despite broader uncertainties. In this context, identifying promising small-cap companies involves analyzing fundamentals such as financial health, management effectiveness, and industry positioning to uncover potential gems that might thrive even in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Changshu Fengfan Power Equipment | 91.61% | 6.89% | 31.92% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Kuaijishan Shaoxing Rice Wine (SHSE:601579)

Simply Wall St Value Rating: ★★★★★★

Overview: Kuaijishan Shaoxing Rice Wine Co., Ltd. is engaged in the research, development, production, and sale of rice wine both domestically and internationally, with a market capitalization of approximately CN¥5.10 billion.

Operations: Kuaijishan generates revenue primarily from the production and sale of rice wine, with a market capitalization of around CN¥5.10 billion. The company has experienced fluctuations in its net profit margin over recent periods, reflecting changes in operational efficiency and cost management.

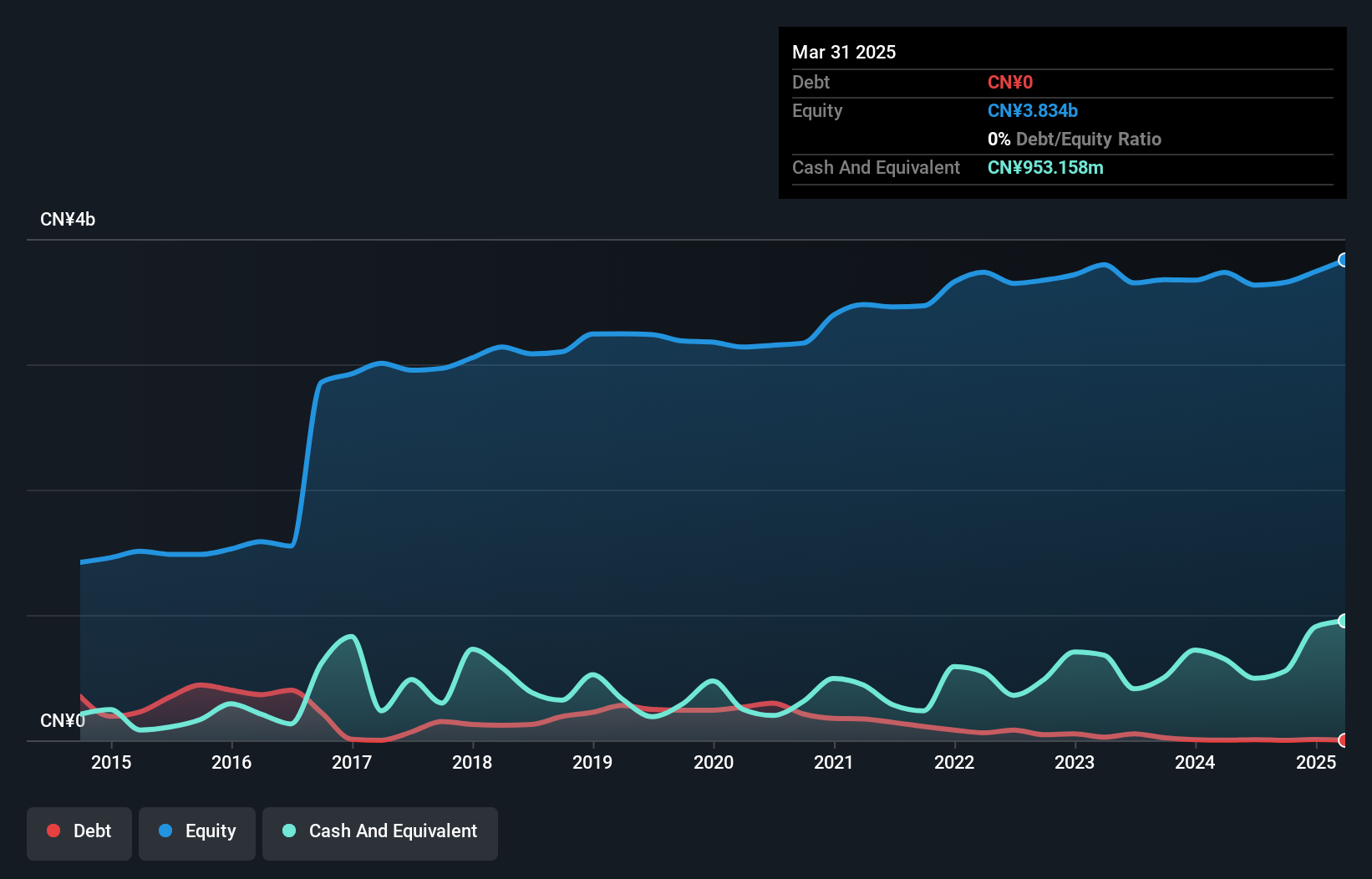

Kuaijishan Shaoxing Rice Wine, a smaller player in the beverage sector, has shown promising growth with earnings up 18% over the past year, outpacing the industry's 16%. The company is debt-free and boasts a favorable price-to-earnings ratio of 31x compared to the broader CN market's 36x. Recent financials reveal sales of CNY 1.06 billion for nine months ending September 2024, an increase from CNY 935 million last year. Net income also rose to CNY 113 million from CNY 103 million. Despite its size, Kuaijishan’s robust performance and lack of debt suggest potential for continued growth.

Kurabo Industries (TSE:3106)

Simply Wall St Value Rating: ★★★★★★

Overview: Kurabo Industries Ltd. operates in textile, chemical, technology, food and service, and real estate sectors both in Japan and internationally with a market capitalization of ¥82.37 billion.

Operations: Kurabo Industries Ltd. generates revenue primarily from its chemical products and textile business, contributing ¥63.27 billion and ¥51.89 billion respectively. The environmental mechatronics segment also adds a significant ¥25.61 billion to the revenue stream, while the food and services sector contributes ¥9.69 billion, followed by real estate at ¥4.23 billion.

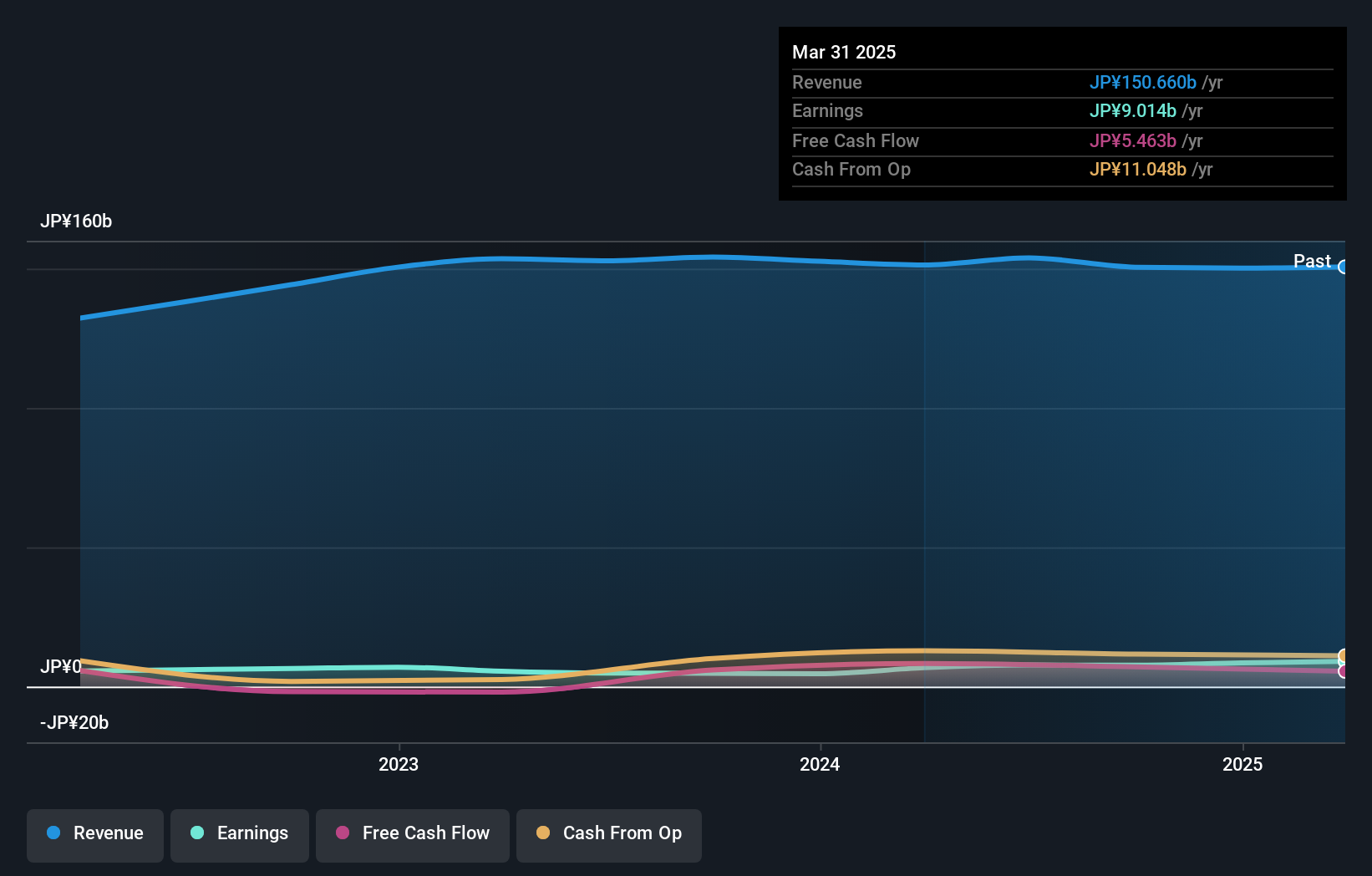

Kurabo Industries, a notable player in the textile and chemical sectors, has shown robust financial health with a 59% earnings growth over the past year, outpacing the luxury industry average of 16%. The company’s debt-to-equity ratio improved from 23.2% to 10.8% over five years, indicating prudent financial management. Trading at approximately 42.8% below its estimated fair value suggests potential undervaluation. Recent actions include a substantial share buyback program valued at ¥6 billion to enhance shareholder returns and optimize capital efficiency by repurchasing up to 1.3 million shares or about 7.34% of its issued capital by October 2025.

- Dive into the specifics of Kurabo Industries here with our thorough health report.

Evaluate Kurabo Industries' historical performance by accessing our past performance report.

United Integrated Services (TWSE:2404)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Integrated Services Co., Ltd. offers engineering construction services across Taiwan, Mainland China, Singapore, the United States, and Japan with a market capitalization of NT$64.25 billion.

Operations: United Integrated Services generates revenue primarily from its Engineering and Integration segment, which accounts for NT$59.72 billion. The company also earns from its Maintenance and Design services, contributing NT$69.60 million to the total revenue.

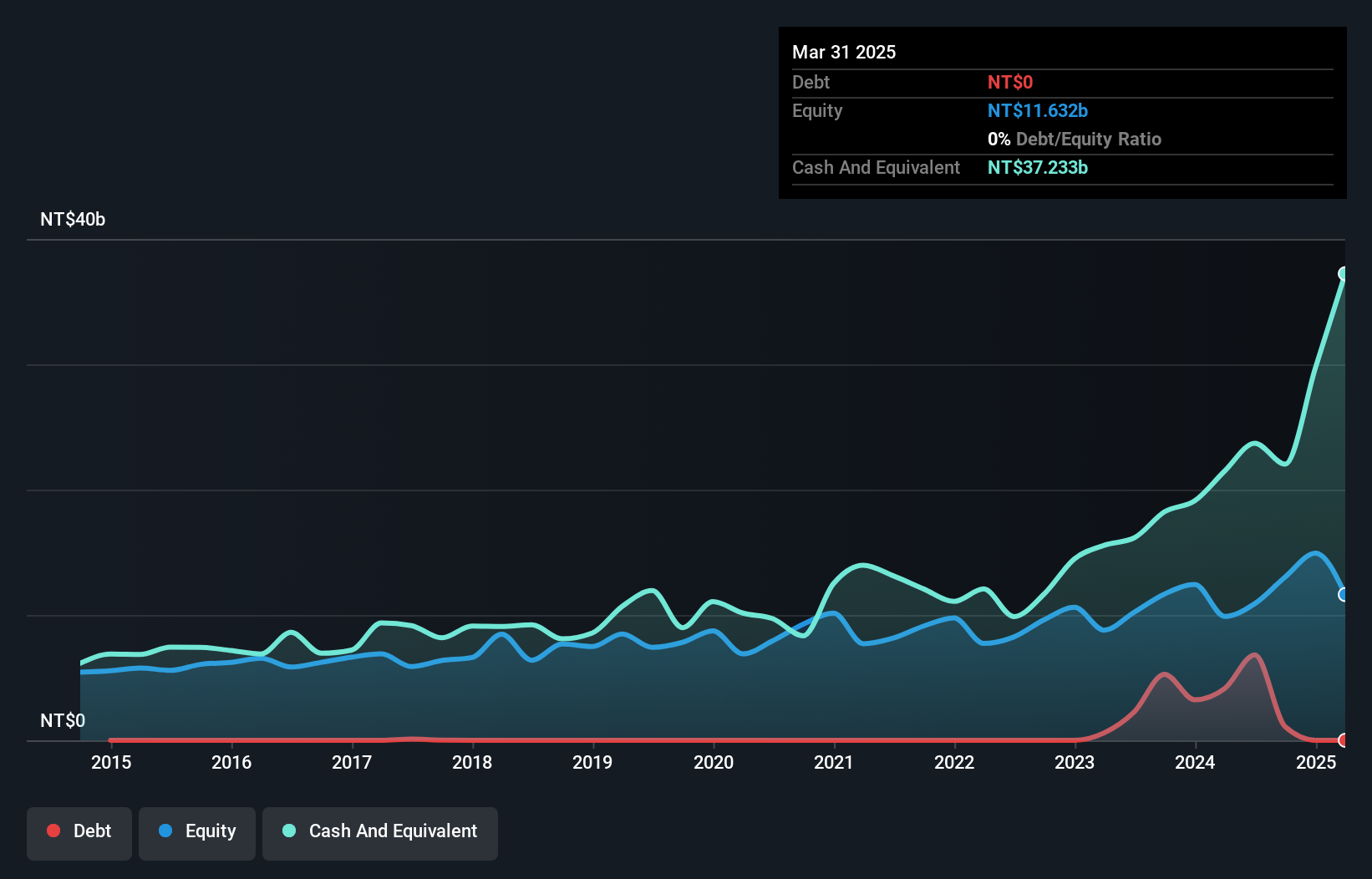

United Integrated Services, a player in the construction industry, has experienced some financial fluctuations. Over the past year, earnings growth was negative at 4.1%, contrasting with the industry's 7.6% average. Despite this, it trades at 15% below its estimated fair value and maintains high-quality earnings. The company reported TWD 11.3 billion in sales for Q2 2024 compared to TWD 17.6 billion the previous year, while net income was slightly lower at TWD 1.19 billion from TWD 1.24 billion a year ago; however, basic EPS improved to TWD 13.15 for six months from TWD 12.61 last year due to efficient cost management likely contributing positively despite revenue challenges.

Seize The Opportunity

- Get an in-depth perspective on all 4703 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2404

United Integrated Services

Provides engineering construction services in Taiwan, Mainland China, Singapore, the United states, and Japan.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives