Asian Market Gems Tibet Water Resources And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly looking for opportunities that can weather such volatility. Penny stocks, while often associated with smaller or newer companies, continue to capture interest due to their potential for significant growth when backed by solid financials. In this article, we explore several promising penny stocks in Asia that showcase financial strength and could offer hidden value to discerning investors.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.57 | HK$971.08M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.62 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.30 | SGD526.88M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.70 | THB2.82B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.10 | SGD52.35M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.20 | SGD12.59B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.07 | HK$3.09B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.40 | THB8.89B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 952 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Tibet Water Resources (SEHK:1115)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tibet Water Resources Ltd. is an investment holding company involved in producing and selling water and beer products in the People's Republic of China, with a market capitalization of HK$2.69 billion.

Operations: The company's revenue is derived from its beer segment, contributing CN¥104.01 million, and its water segment, contributing CN¥151.36 million.

Market Cap: HK$2.69B

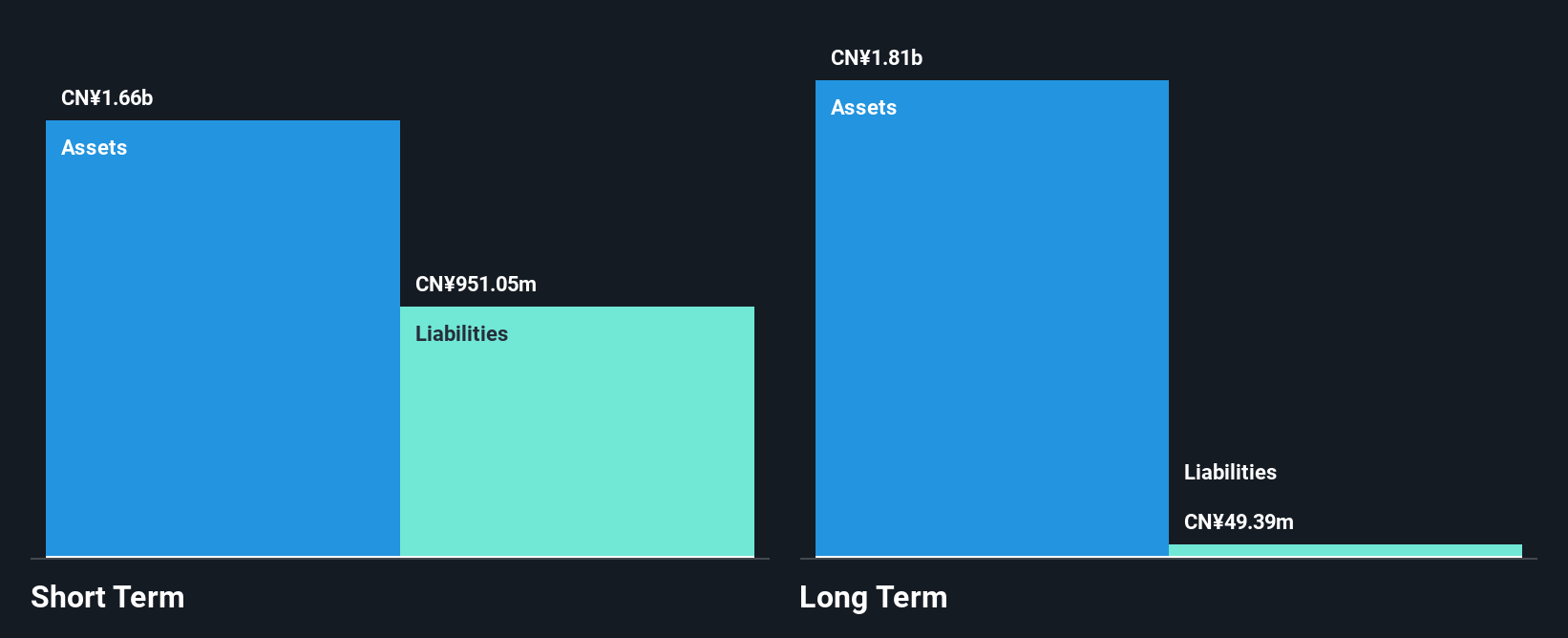

Tibet Water Resources Ltd. recently announced a private placement of convertible bonds totaling HK$297 million, with full conversion at an initial price of HK$0.55, providing the company with net proceeds of HK$295 million. Despite being unprofitable, the company reported significant revenue growth in its water segment and achieved a net income increase to CN¥36.19 million for the first half of 2025. The company's short-term assets significantly exceed its liabilities, ensuring financial stability despite high share price volatility and negative return on equity. Management and board members have relatively seasoned tenures, contributing to strategic oversight amidst market challenges.

- Take a closer look at Tibet Water Resources' potential here in our financial health report.

- Explore historical data to track Tibet Water Resources' performance over time in our past results report.

Fortune Ng Fung Food (Hebei)Ltd (SHSE:600965)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fortune Ng Fung Food (Hebei) Co., Ltd operates in the beef cattle breeding, slaughtering, and food processing sectors within China and internationally, with a market capitalization of CN¥4.09 billion.

Operations: Fortune Ng Fung Food (Hebei) Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥4.09B

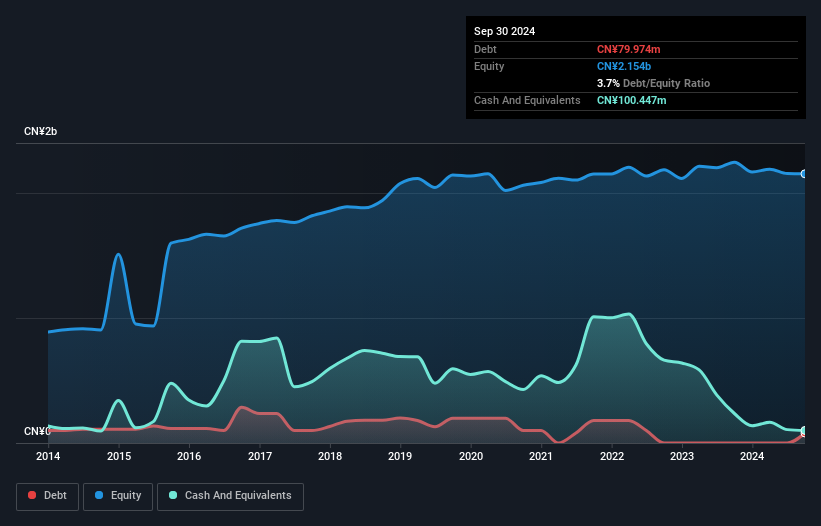

Fortune Ng Fung Food (Hebei) Co., Ltd has shown a notable improvement in financial health, with debt to equity reducing from 9.8% to 3.7% over five years and net debt to equity at a satisfactory 1%. The company's earnings surged by 54.4% last year, surpassing the industry average significantly, while profit margins improved from 3.9% to 5.2%. Despite low return on equity at 2.8%, interest payments are well covered by EBIT at a multiple of 28.2x, and short-term assets comfortably cover liabilities, indicating solid liquidity management amidst recent revenue growth and stable volatility levels.

- Get an in-depth perspective on Fortune Ng Fung Food (Hebei)Ltd's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Fortune Ng Fung Food (Hebei)Ltd's track record.

Beijing Jingyuntong Technology (SHSE:601908)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Jingyuntong Technology Co., Ltd. operates in the research, development, production, and sale of monocrystalline silicon products both in China and internationally, with a market cap of CN¥10.82 billion.

Operations: No specific revenue segments are reported for Beijing Jingyuntong Technology Co., Ltd.

Market Cap: CN¥10.82B

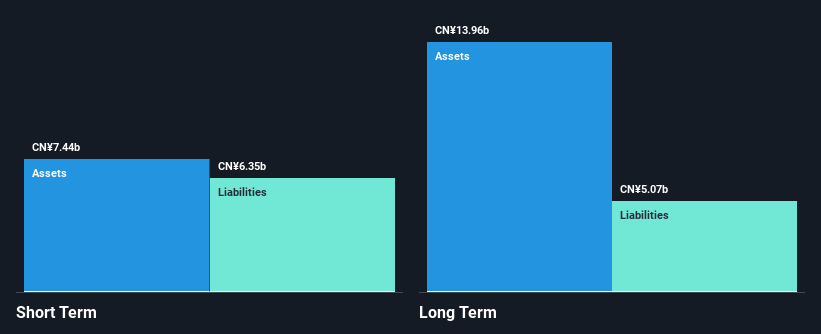

Beijing Jingyuntong Technology Co., Ltd. faces challenges with declining earnings, having reported a significant net loss of CN¥212.01 million for the first half of 2025, though this is an improvement from the previous year's larger loss. The company's debt management appears robust, with operating cash flow covering 22% of its debt and a satisfactory net debt to equity ratio of 32.2%. Despite high volatility and negative return on equity at -17.88%, it trades at a substantial discount to estimated fair value, suggesting potential for future valuation adjustments if profitability improves over time.

- Click to explore a detailed breakdown of our findings in Beijing Jingyuntong Technology's financial health report.

- Evaluate Beijing Jingyuntong Technology's historical performance by accessing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 949 Asian Penny Stocks now.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600965

Fortune Ng Fung Food (Hebei)Ltd

Engages in the beef cattle breeding and slaughtering, and food processing businesses in the People’s Republic of China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives