Optimistic Investors Push Xinjiang Sayram Modern Agriculture Co., Ltd (SHSE:600540) Shares Up 32% But Growth Is Lacking

Xinjiang Sayram Modern Agriculture Co., Ltd (SHSE:600540) shares have continued their recent momentum with a 32% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

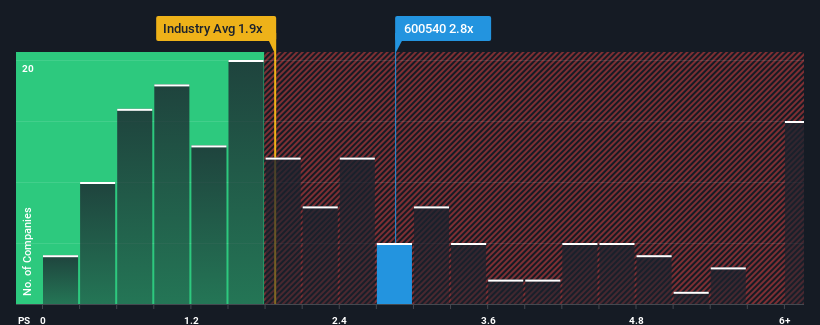

Since its price has surged higher, given close to half the companies operating in China's Food industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Xinjiang Sayram Modern Agriculture as a stock to potentially avoid with its 2.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Xinjiang Sayram Modern Agriculture

What Does Xinjiang Sayram Modern Agriculture's P/S Mean For Shareholders?

For example, consider that Xinjiang Sayram Modern Agriculture's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xinjiang Sayram Modern Agriculture will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Xinjiang Sayram Modern Agriculture's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 25% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 16% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Xinjiang Sayram Modern Agriculture is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Xinjiang Sayram Modern Agriculture's P/S?

Xinjiang Sayram Modern Agriculture's P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Xinjiang Sayram Modern Agriculture currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Xinjiang Sayram Modern Agriculture you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600540

Xinjiang Sayram Modern Agriculture

Engages in the research and development of agricultural high-tech products in China.

Low and slightly overvalued.

Market Insights

Community Narratives